A Fresh Look at Air France-KLM (ENXTPA:AF) Valuation as Trading Patterns Stabilize

Reviewed by Kshitija Bhandaru

Air France-KLM (ENXTPA:AF) shares have moved modestly lately, prompting a closer look at recent trading patterns and fundamentals. Investors appear to be weighing current performance against longer-term trends, especially as travel demand continues to evolve.

See our latest analysis for Air France-KLM.

While Air France-KLM's latest share price return is little changed in the short term, its total shareholder return across one year has been slightly positive. However, the five-year figure remains well below water, reflecting persistent challenges. The stock's momentum appears to be stabilizing lately, which may indicate that the market is waiting for clearer signals before making its next move.

If you're keeping an eye on how travel stocks are unfolding this year, it could be the perfect time to check out See the full list for free..

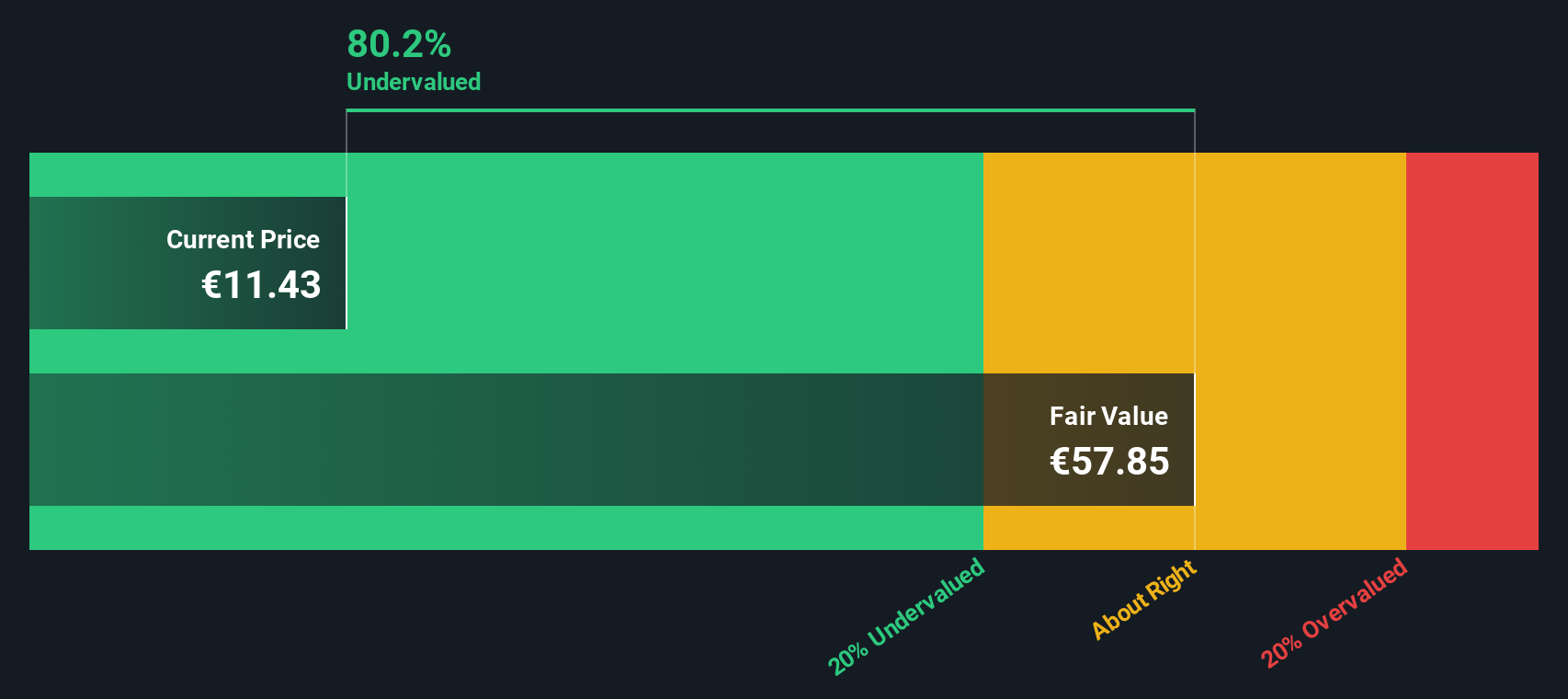

With returns turning positive over the past year but longer-term numbers still lagging, the question remains: is Air France-KLM undervalued at current levels, or is the market already pricing in all its future growth potential?

Price-to-Earnings of 3.2x: Is it Justified?

Air France-KLM's shares trade at a price-to-earnings (P/E) ratio of 3.2x, which is substantially lower than both the peer average and the industry standard. This makes the stock appear notably undervalued at its last close of €11.5.

The price-to-earnings ratio compares a company's market price per share to its earnings per share. It serves as a barometer for how much investors are willing to pay today for a euro of future earnings. For airlines, which often experience volatile earnings, a lower P/E could hint at either market caution or unrecognized value based on recent performance improvements.

This muted multiple is especially striking when compared to the global airlines industry average of 9.2x as well as a peer average of 53.7x. This suggests the market may be underestimating Air France-KLM's recent earnings momentum and future potential. The SWS fair P/E estimate of 14x provides a further benchmark, implying that the stock has meaningful upside if sentiment shifts.

Explore the SWS fair ratio for Air France-KLM

Result: Price-to-Earnings of 3.2x (UNDERVALUED)

However, slowing revenue growth and a lingering five-year loss remain risks that could challenge any swift revaluation of Air France-KLM shares.

Find out about the key risks to this Air France-KLM narrative.

Another View: What Does the SWS DCF Model Say?

Looking from a different angle, the SWS DCF model values Air France-KLM shares at €37.94, which is much higher than the recent trading price of €11.5. This suggests that the market might be overlooking substantial long-term value or is wary of underlying business risks. Which scenario do you believe is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air France-KLM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air France-KLM Narrative

If you think there’s more to the story or want to reach your own conclusion, it’s easy to dive into the numbers and shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Air France-KLM.

Looking for More Investment Ideas?

Make sure you don't miss out on what else the markets have to offer. Use these handpicked shortcuts to unlock powerful new opportunities and enhance your portfolio strategy:

- Snap up attractive yields by checking out these 19 dividend stocks with yields > 3%, which offers above-average income potential for any disciplined investor seeking reliable returns.

- Seize an edge in tech and innovation with these 26 quantum computing stocks, featuring the latest players advancing quantum computing breakthroughs and next-level industry disruption.

- Grab tomorrow’s growth stories early by evaluating these 896 undervalued stocks based on cash flows, packed with companies flying under the radar and loaded with value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives