- France

- /

- Infrastructure

- /

- ENXTPA:ADP

Aeroports de Paris (ENXTPA:ADP) Is Up 7.2% After Morgan Stanley Upgrade on Regulatory Reassessment Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, Morgan Stanley upgraded Aeroports de Paris from Equalweight to Overweight, highlighting that regulatory risks linked to the upcoming 2025 multi-year regulatory period may have been exaggerated and emphasizing the company’s actions, alongside regulator ART, to reduce related uncertainties.

- This upgrade draws attention to strong passenger traffic projections for Winter 2025/26 and the significant retail opportunity expected in the latter half of 2026, marking a positive shift in market sentiment toward Aeroports de Paris.

- Given Morgan Stanley's reassessment of regulatory risk, we’ll examine how reduced uncertainty could influence Aeroports de Paris's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aeroports de Paris Investment Narrative Recap

If you're considering Aeroports de Paris as an investment, the essential thesis hinges on long-term growth in passenger traffic and non-aeronautical revenue, balanced by regulatory certainty and manageable financial risk. The recent upgrade by Morgan Stanley points to reduced regulatory uncertainty, a factor that could positively influence short-term sentiment, but the biggest immediate catalyst, final clarity on the 2025-2030 regulatory agreement, remains pending, while significant earnings volatility due to non-operational items is still a risk for near-term stability. Among recent disclosures, the September traffic update showing group passenger growth of 2.4% stands out. Sustained and improving traffic trends underpin optimism for revenue growth and support the positive market sentiment highlighted by the Morgan Stanley upgrade, but also underscore that any setback in volume recovery remains a key sensitivity for future earnings. Yet, in contrast, investors should be aware that growing operating costs and rising debt loads could still threaten...

Read the full narrative on Aeroports de Paris (it's free!)

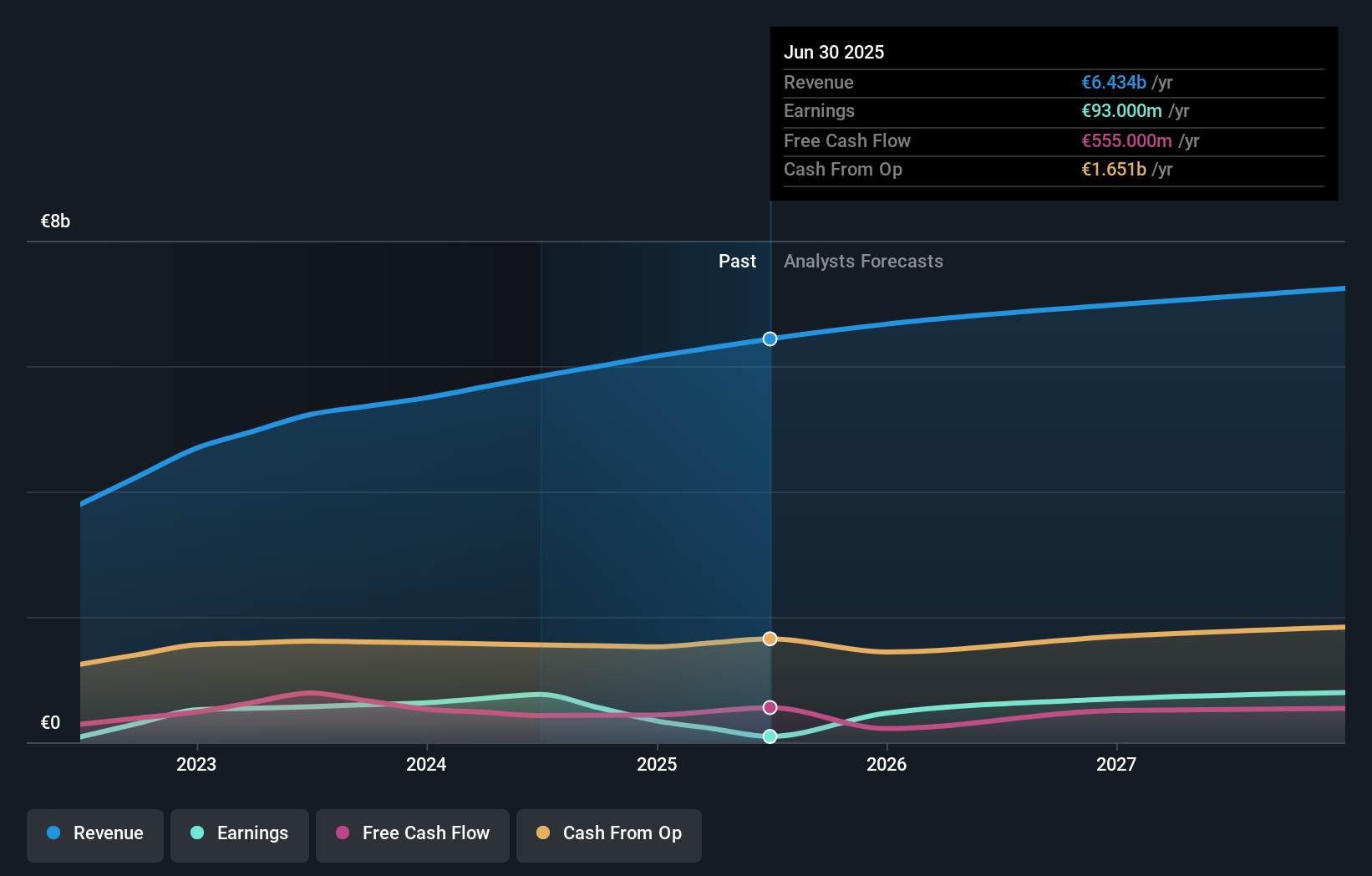

Aeroports de Paris is forecast to deliver €7.3 billion in revenue and €875.8 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 4.4% and projects a substantial increase in earnings, up €782.8 million from current earnings of €93.0 million.

Uncover how Aeroports de Paris' forecasts yield a €122.73 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members place fair value for Aeroports de Paris between €122.73 and €142.35, based on two individual estimates. While regulatory risks have recently eased, ongoing pressure from higher operating costs and debt highlights why opinions on future performance can differ so widely.

Explore 2 other fair value estimates on Aeroports de Paris - why the stock might be worth as much as 17% more than the current price!

Build Your Own Aeroports de Paris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeroports de Paris research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aeroports de Paris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeroports de Paris' overall financial health at a glance.

No Opportunity In Aeroports de Paris?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ADP

Aeroports de Paris

Operates and designs airports in France, Turkey, Kazakhstan, Jordan, Georgia, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives