- France

- /

- Telecom Services and Carriers

- /

- ENXTPA:ORA

Orange (ENXTPA:ORA): Examining Valuation After Strong Multi-Year Share Price Gains

Reviewed by Simply Wall St

Orange (ENXTPA:ORA) is back in the spotlight, and if you have been following European telecom stocks, you are probably wondering if now is the right time to make a move. There is no single headline event sparking the recent attention. Sometimes a quiet shift in market sentiment can be just as telling. When a large-cap company like Orange catches investors’ eye without a major news trigger, it is often a signal to dig deeper into what the market might be anticipating or missing entirely.

Looking at Orange’s journey over the past year, the share price has climbed around 34% with nearly 40% gains this year alone, showing that some real momentum has built behind the stock. The past month has seen a slight pullback, which contrasts with the strong performance of recent months and a gain of over 100% across five years. Despite limited headlines lately, those numbers mark an interesting divergence between short-term cooling and longer-term strength.

So, with Orange’s strong run and the recent dip, is there hidden value waiting to be unlocked, or is the market already factoring in expectations for future growth?

Price-to-Earnings of 39.5x: Is it justified?

Based on the most commonly used valuation multiple, Orange currently trades at a price-to-earnings (P/E) ratio of 39.5 times. This makes it significantly more expensive than both its European telecom industry peers and the wider market average. This suggests that investors are either optimistic about future growth prospects or willing to pay a premium for the company’s current earnings despite industry trends.

The price-to-earnings ratio compares a company’s share price to its earnings per share and is a popular indicator of whether a stock is over or undervalued relative to its profits. For telecom companies like Orange, which often operate in mature markets with stable cash flows, a high P/E can be seen as an indicator the market expects substantial earnings increases or unique business advantages in the years ahead.

Currently, the market is overpricing Orange’s expected earnings based on this elevated P/E multiple. Unless earnings growth dramatically outpaces both historical and industry averages, this valuation appears difficult to justify purely on fundamentals.

Result: Fair Value of $13.53 (OVERVALUED)

See our latest analysis for Orange.However, slower revenue growth and the risk of profit margin pressure could quickly dampen sentiment and challenge the current momentum in valuation.

Find out about the key risks to this Orange narrative.Another Perspective: Discounted Cash Flow Signals Undervaluation

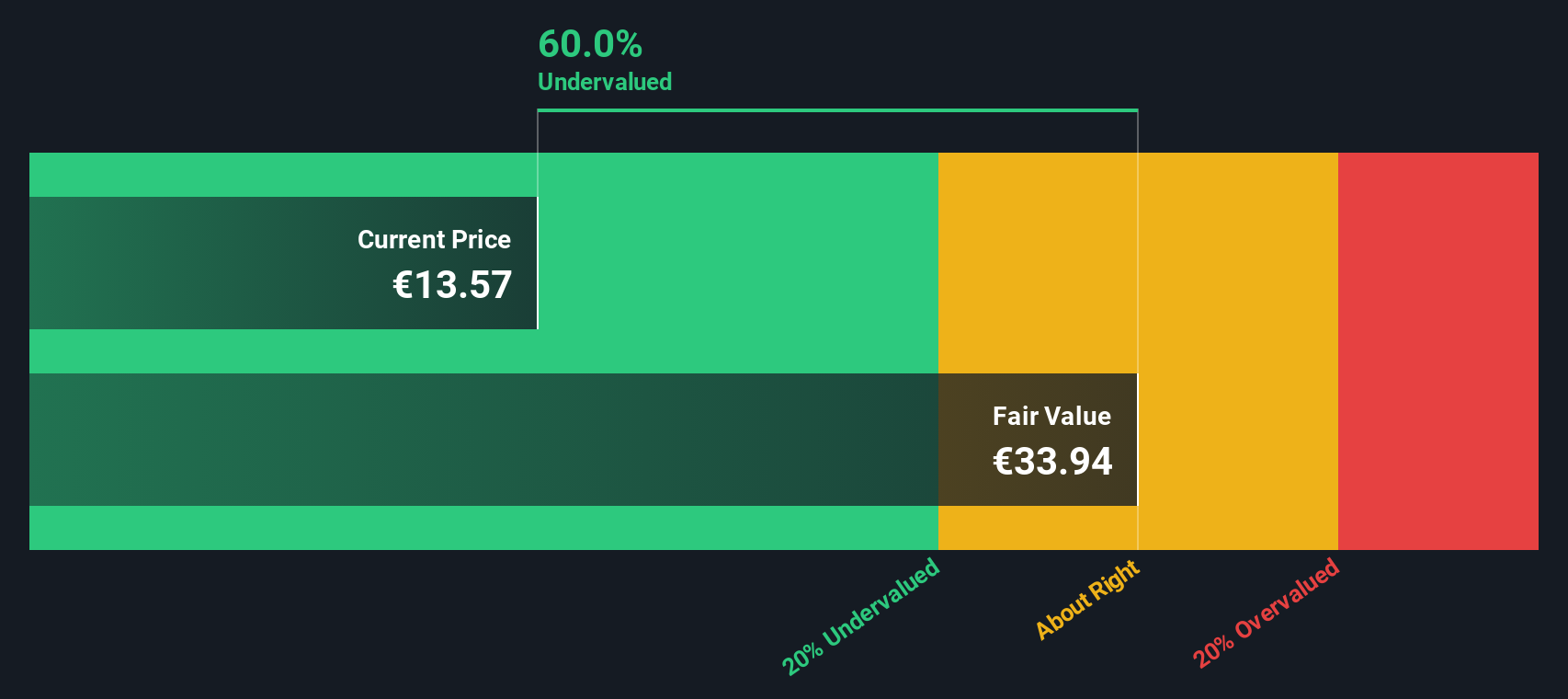

While the market appears to be valuing Orange at a premium based on current earnings, our DCF model indicates that the shares may be trading well below their actual worth. Could this method uncover hidden potential that the market has yet to recognize?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Orange Narrative

If you see things differently or would rather draw your own conclusions, the tools are available to help you do so in just a few minutes. Do it your way

A great starting point for your Orange research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

See how the right strategy can unlock new opportunities and help you find stocks you might otherwise overlook. Use Simply Wall Street’s screener to confidently spot your next move before everyone else.

- Uncover stocks delivering above-average yields by checking out our dividend stocks with yields > 3% for a reliable source of passive income.

- Position yourself at the forefront of technology advances and capitalise on innovation by exploring the brightest AI penny stocks available now.

- Seize opportunities hiding under the radar among undervalued stocks based on cash flows to give your portfolio a solid value advantage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:ORA

Orange

Operates as a telecommunications operator in France and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success