- France

- /

- Telecom Services and Carriers

- /

- ENXTPA:ORA

Cautious Investors Not Rewarding Orange S.A.'s (EPA:ORA) Performance Completely

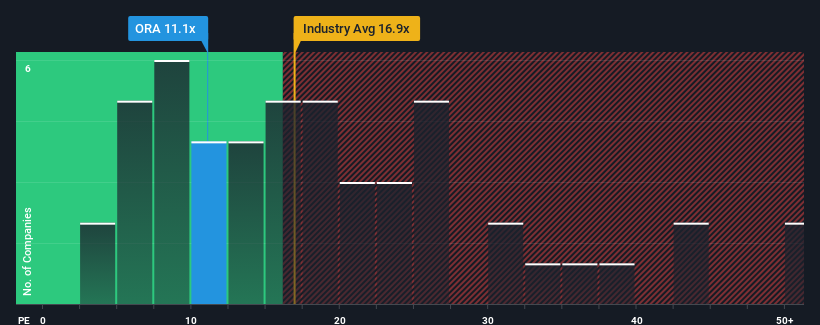

With a price-to-earnings (or "P/E") ratio of 11.1x Orange S.A. (EPA:ORA) may be sending bullish signals at the moment, given that almost half of all companies in France have P/E ratios greater than 16x and even P/E's higher than 28x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Orange as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Orange

How Is Orange's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Orange's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 50% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 14% each year over the next three years. That's shaping up to be similar to the 13% per year growth forecast for the broader market.

With this information, we find it odd that Orange is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Orange's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Orange's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Orange has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Orange, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ORA

Orange

Operates as a telecommunications operator in France and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives