In recent weeks, the European market has shown signs of recovery with the pan-European STOXX Europe 600 Index climbing 3.93%, buoyed by the European Central Bank's decision to cut rates amid trade uncertainties and President Trump's delay in imposing higher tariffs. As investors navigate this evolving landscape, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and innovation in response to shifting economic conditions and policy changes.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG specializes in providing high-performance computing and artificial intelligence solutions to businesses and research institutions globally, with a market capitalization of approximately €1.61 billion.

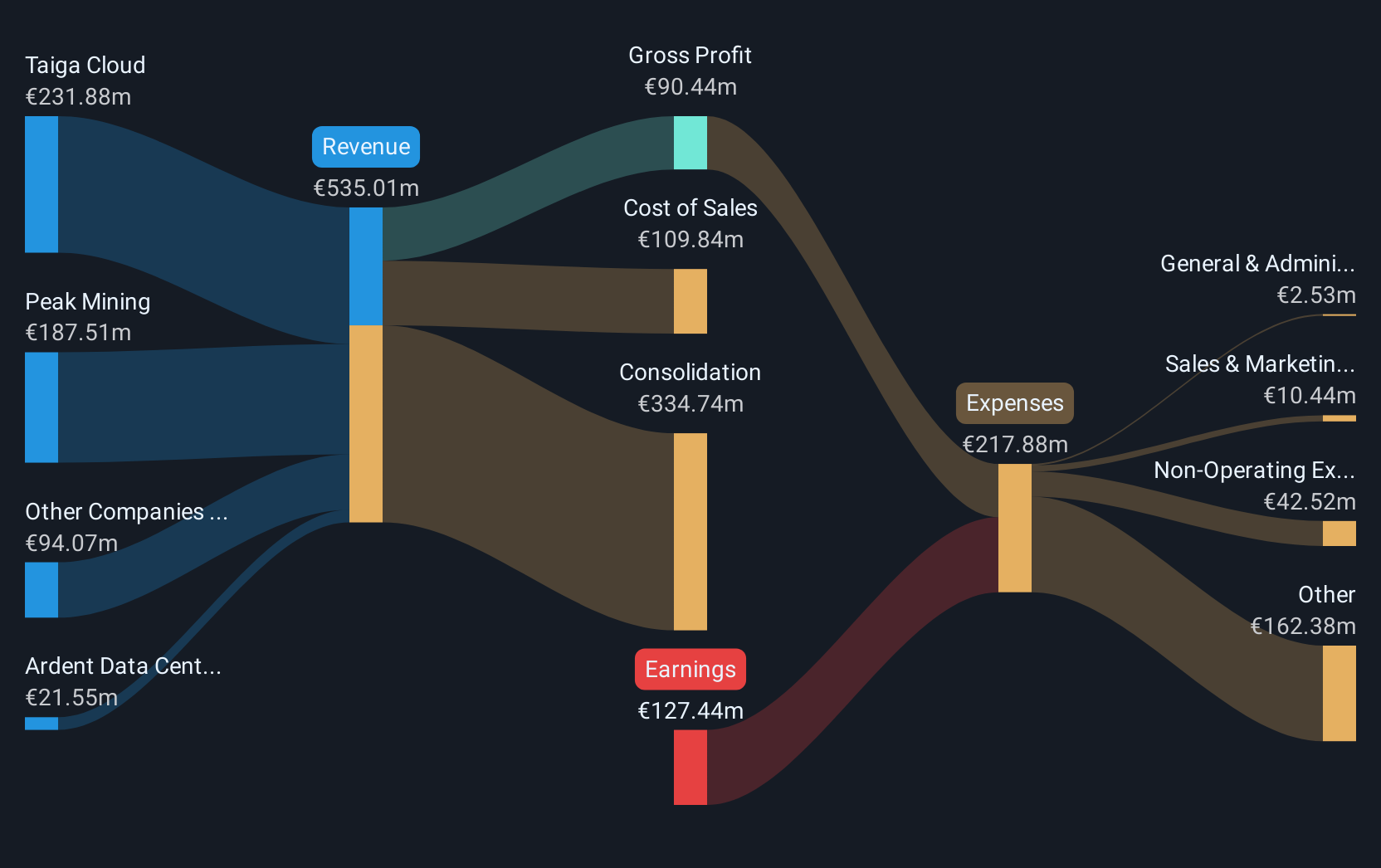

Operations: The company generates revenue primarily from its Taiga Cloud and Peak Mining segments, contributing €231.88 million and €187.51 million respectively. Ardent Data Centers adds another €21.55 million to the revenue stream.

Northern Data's recent partnership with Gcore marks a strategic advance in AI services, positioning it to capitalize on the burgeoning AI inferencing market, projected to reach USD 169 billion by 2032. This collaboration leverages Northern Data’s robust GPU infrastructure and Gcore’s innovative software, creating a comprehensive AI delivery network designed for low-latency at the edge—crucial for expanding AI application adoption. Financially, Northern Data anticipates revenues between EUR 520 million and EUR 570 million for FY2025, reflecting its focus on enhancing its AI cloud platform post-divestment of Peak Mining. Despite a challenging past with significant losses (EUR 127.44 million in FY2024), the company's strategic pivot towards high-growth tech sectors like AI could reshape its financial landscape, supported by an expected annual revenue growth rate of 20.3% and an earnings growth forecast of 116.6%.

- Navigate through the intricacies of Northern Data with our comprehensive health report here.

Review our historical performance report to gain insights into Northern Data's's past performance.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €2 billion.

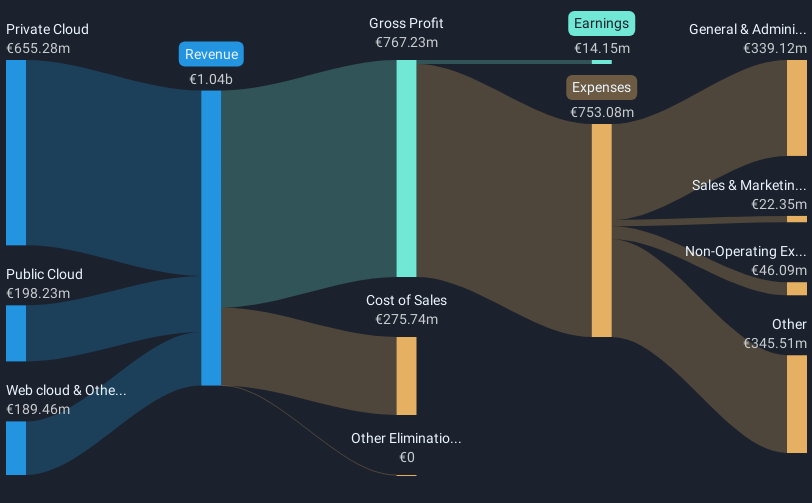

Operations: The company's revenue streams are primarily driven by its Private Cloud services, generating €655.28 million, followed by Public Cloud at €198.23 million and Web Cloud & Other at €189.46 million.

OVH Groupe's recent earnings announcement showcased a significant turnaround, with sales rising to €536 million from €486.09 million year-over-year and net income reaching €7.21 million, reversing a previous loss of €17.24 million. This performance underscores OVH's recovery trajectory, augmented by strategic partnerships like the one with HYCU Inc., enhancing its cloud services portfolio for diverse virtual environments. The company's R&D commitment is evident in its expanded server range and tailored cloud solutions across multiple data centers, positioning it well within Europe’s tech landscape despite a volatile share price and earnings coverage concerns. With an anticipated annual profit growth of 81.4% and revenue growth outpacing the French market at 9.9%, OVH is aligning itself with broader industry trends towards specialized cloud services and infrastructure resilience.

- Take a closer look at OVH Groupe's potential here in our health report.

Gain insights into OVH Groupe's past trends and performance with our Past report.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

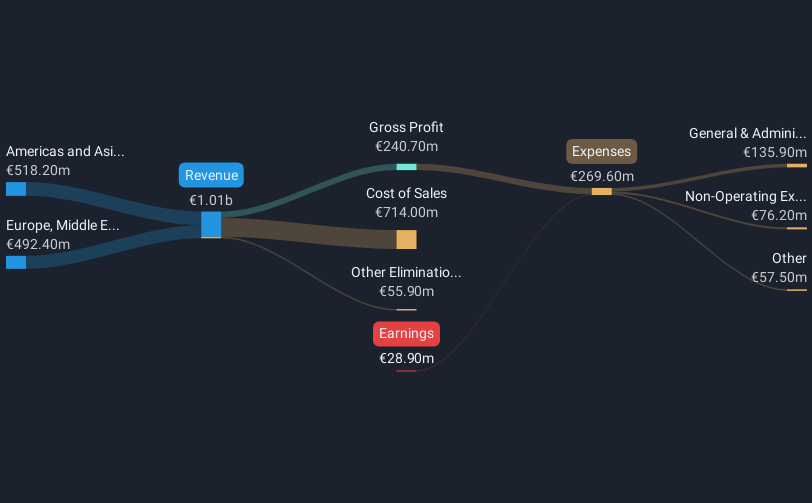

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €3.26 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €954.70 million.

VusionGroup S.A. is setting a brisk pace in Europe's tech sector with its projected annual revenue growth at 19.4%, significantly outstripping the French market's 5.4%. This growth trajectory is complemented by an aggressive R&D stance, as evidenced in their latest earnings call, although specific figures were not disclosed. The company has also doubled its dividend to EUR 0.60, signaling confidence in future cash flows and profitability which is expected to materialize within three years with an anticipated profit surge of 68.85% annually. Despite current unprofitability and a highly volatile share price, these moves could position VusionGroup as a more influential player in the tech landscape, especially if it can stabilize earnings and continue to innovate effectively.

- Click here to discover the nuances of VusionGroup with our detailed analytical health report.

Examine VusionGroup's past performance report to understand how it has performed in the past.

Make It Happen

- Embark on your investment journey to our 231 European High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion