As the European Central Bank's recent interest rate cuts have buoyed major stock indexes, France's CAC 40 Index has seen a modest increase, reflecting a cautiously optimistic market sentiment amid ongoing monetary easing. In this environment, investors may find it beneficial to focus on high-growth tech stocks that demonstrate strong fundamentals and adaptability in a rapidly evolving economic landscape.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 24.36% | 78.41% | ★★★★★☆ |

| Valneva | 22.84% | 18.29% | ★★★★★☆ |

| Valbiotis | 43.33% | 42.78% | ★★★★★☆ |

| beaconsmind | 25.00% | 85.04% | ★★★★★★ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.66 billion.

Operations: The company generates revenue primarily through its private cloud services (€589.61 million), followed by web cloud & other services (€185.43 million), and public cloud offerings (€169.01 million).

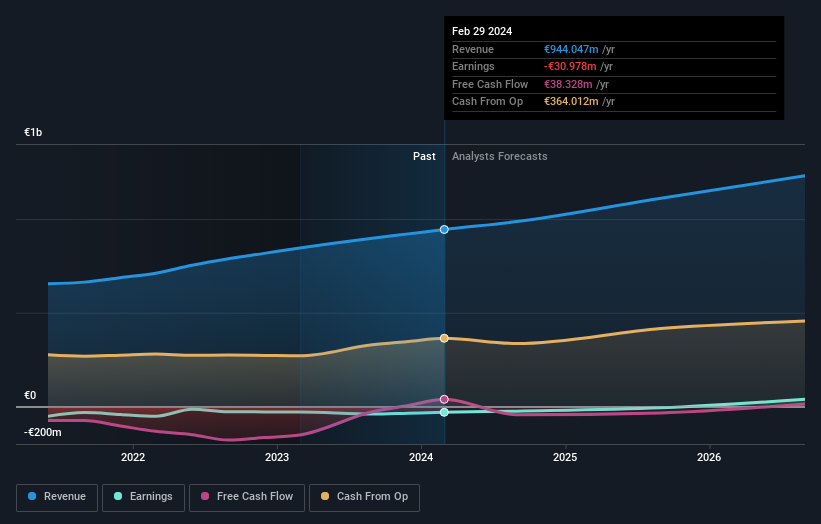

Amidst a challenging landscape, OVH Groupe stands out with its strategic focus on R&D, investing significantly to innovate within the cloud services sector. This dedication is reflected in their R&D expense ratio which has consistently aligned with industry growth demands. Recently, they presented at the 2024 OCP Global Summit, highlighting new advancements that promise to enhance their service offerings. Despite a volatile share price and current unprofitability, OVH's revenue is expected to grow at 9.6% annually, outpacing the French market's 5.5%. Moreover, earnings are projected to surge by an impressive 101.37% annually over the next three years as they move towards profitability—signaling potential for future stability and growth in an increasingly competitive field.

- Navigate through the intricacies of OVH Groupe with our comprehensive health report here.

Gain insights into OVH Groupe's past trends and performance with our Past report.

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Valneva SE is a specialty vaccine company focused on developing, manufacturing, and commercializing vaccines for infectious diseases with unmet needs, with a market cap of approximately €436.45 million.

Operations: The company generates revenue primarily through the development and commercialization of prophylactic vaccines, totaling €156.47 million.

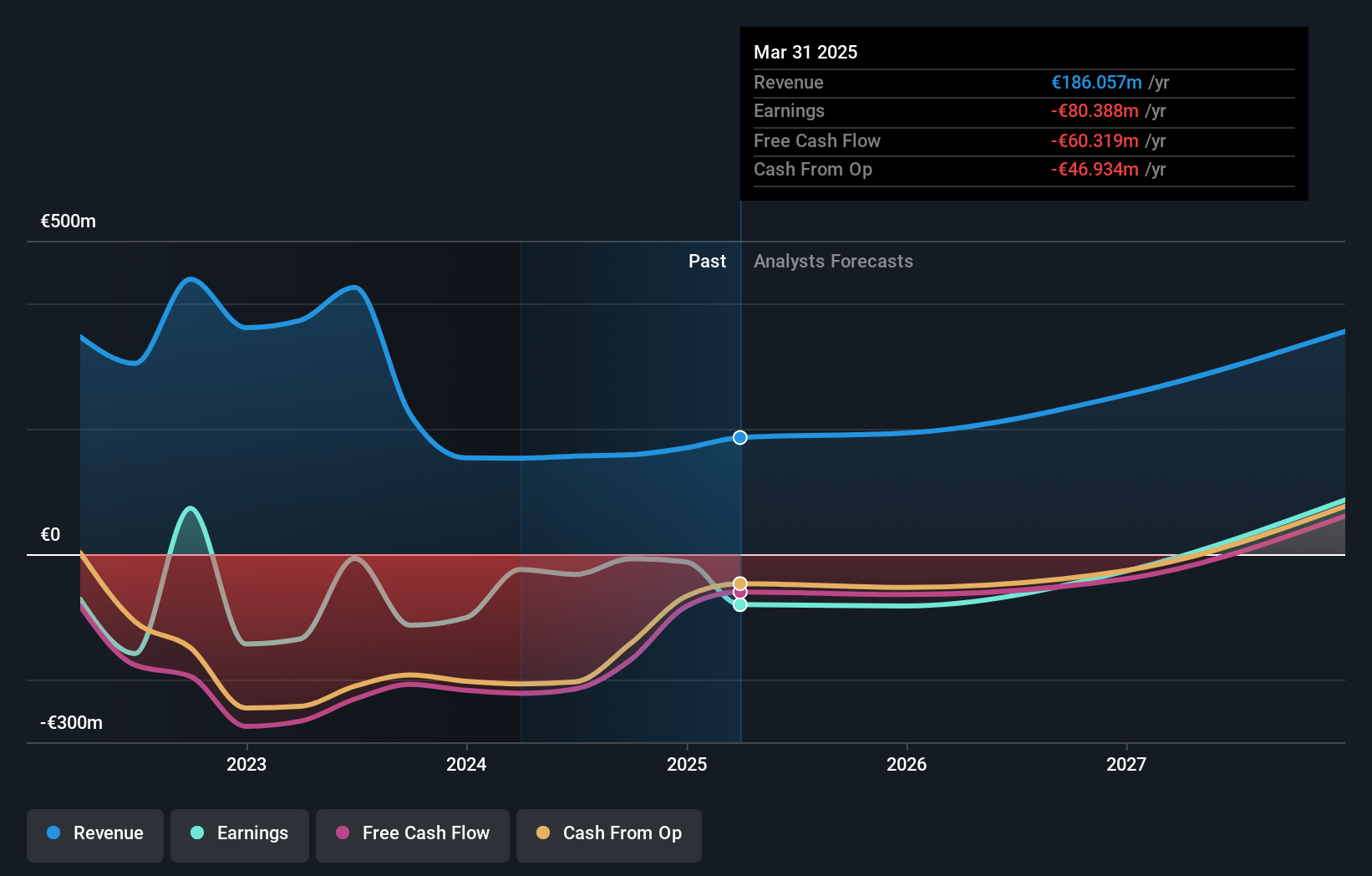

Valneva's strategic maneuvers, particularly in R&D, are setting a brisk pace in the biotech sector with a notable 22.8% annual revenue growth forecast, outstripping the French market average of 5.5%. This growth is underpinned by innovative vaccine developments like Shigella4V, which recently secured FDA Fast Track designation—a testament to its potential in addressing significant unmet medical needs. With R&D expenses reflecting an assertive reinvestment back into their pipeline, Valneva is not just chasing but potentially setting new benchmarks for industry innovation and public health impact.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of approximately €2.22 billion.

Operations: VusionGroup S.A. generates revenue primarily through installing and maintaining electronic shelf labels, amounting to approximately €830.16 million.

VusionGroup's recent pivot towards digital shelf label (DSL) technology, as evidenced by their partnership with Ace Hardware, marks a significant stride in retail innovation. This collaboration aims to revolutionize customer experience and operational efficiency across over 5,000 Ace locations in the U.S., integrating VusionGroup's advanced VusionOX and VusionCloud platforms. Despite a challenging financial period with a net loss reported at EUR 24.4 million for the first half of 2024, compared to a net income of EUR 91.5 million in the previous year, VusionGroup is poised for recovery. Analysts forecast robust revenue growth at 28.4% annually, significantly outpacing the French market's average of 5.5%, with earnings expected to surge by approximately 81.7% per year over the next three years as they transition towards profitability and expand their technological footprint in the DIY sector.

- Dive into the specifics of VusionGroup here with our thorough health report.

Review our historical performance report to gain insights into VusionGroup's's past performance.

Make It Happen

- Discover the full array of 39 Euronext Paris High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLA

Valneva

A specialty vaccine company, develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs.

High growth potential and good value.