- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

High Growth Tech Stocks In France To Watch October 2024

Reviewed by Simply Wall St

As the European Central Bank continues its monetary easing with a second consecutive interest rate cut, the French market is seeing a modest rise in major stock indexes, including the CAC 40 Index. In this environment of potential economic support and lower inflationary pressures, investors might consider focusing on high-growth tech stocks that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 24.36% | 78.41% | ★★★★★☆ |

| Valneva | 22.84% | 18.29% | ★★★★★☆ |

| Valbiotis | 43.33% | 42.78% | ★★★★★☆ |

| beaconsmind | 25.00% | 81.09% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.48 billion.

Operations: OVH Groupe generates revenue primarily through its public cloud, private cloud, and web cloud services, with private cloud being the largest segment at €589.61 million. The company's focus on diverse cloud solutions positions it as a significant player in the global market.

OVH Groupe, amidst a challenging landscape for unprofitable tech firms, shows promising signs with its strategic focus on R&D, investing significantly to spur future growth. Despite current unprofitability and a volatile share price, the company's revenue is expected to expand by 9.7% annually, outpacing the French market's 5.5%. Notably, earnings are projected to surge by an impressive 101.4% per year as OVH transitions towards profitability within three years. This growth trajectory is bolstered by recent presentations at global tech summits, underscoring its commitment to innovation and market expansion.

- Click here and access our complete health analysis report to understand the dynamics of OVH Groupe.

Gain insights into OVH Groupe's historical performance by reviewing our past performance report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is a global entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa, and it has a market capitalization of approximately €10.51 billion.

Operations: Vivendi SE generates revenue primarily from its Canal+ Group and Havas Group segments, contributing €6.20 billion and €2.92 billion respectively. The company also derives income from Gameloft, Prisma Media, Vivendi Village, New Initiatives, and Generosity and Solidarity.

Vivendi SE, navigating through a transformative phase in the media sector, has shown resilience with a 9.4% annual revenue growth projection, outpacing the French market's average of 5.5%. This growth is complemented by an aggressive R&D investment strategy, reflecting in their recent earnings where sales doubled to €9.05 billion from last year's €4.7 billion. With earnings expected to surge by 30.6% annually, Vivendi is not just recovering but strategically positioning itself amidst evolving digital consumption trends and competitive media landscapes. The company also repurchased shares worth €184 million this year, underscoring confidence in its financial health and future prospects.

- Take a closer look at Vivendi's potential here in our health report.

Examine Vivendi's past performance report to understand how it has performed in the past.

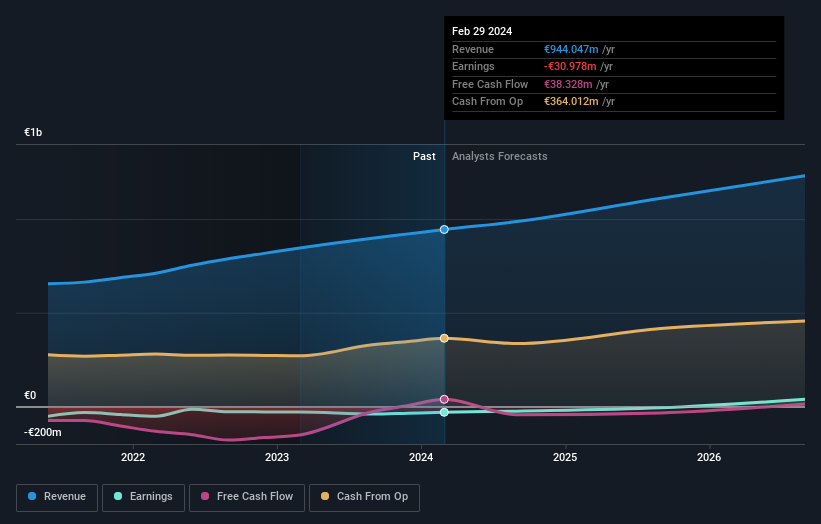

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.28 billion.

Operations: VusionGroup S.A. generates revenue primarily through its Installing and Maintaining Electronic Shelf Labels segment, which accounts for €830.16 million.

VusionGroup, amidst a challenging fiscal period with a reported net loss of EUR 24.4 million for the first half of 2024, contrasts sharply against last year's net income of EUR 91.5 million. Despite these hurdles, the company is forging significant partnerships, notably with Ace Hardware to deploy innovative digital shelf label technology across over 5,000 stores. This move not only enhances customer interaction but also streamlines operational efficiencies through VusionGroup’s VusionCloud platform. With revenue growth projected at an impressive 28.4% annually and earnings expected to surge by approximately 81.7% per year, VusionGroup is strategically positioning itself to leverage its technological advancements in retail solutions despite current profitability challenges.

- Delve into the full analysis health report here for a deeper understanding of VusionGroup.

Gain insights into VusionGroup's past trends and performance with our Past report.

Turning Ideas Into Actions

- Investigate our full lineup of 38 Euronext Paris High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VusionGroup, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.