In recent weeks, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising 3.93% as investor sentiment was buoyed by the European Central Bank's rate cuts and a delay in U.S. tariff increases. Amidst this backdrop of cautious optimism, growth companies with high insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests, making them appealing in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Bonesupport Holding (OM:BONEX) | 10.1% | 48.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elicera Therapeutics (OM:ELIC) | 20.5% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Let's review some notable picks from our screened stocks.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various countries including Spain and the United States, with a market cap of €1.43 billion.

Operations: Pharma Mar's revenue is primarily derived from its oncology segment, which generated €174.59 million, with an additional contribution of €0.26 million from RNA Interference (RNAi).

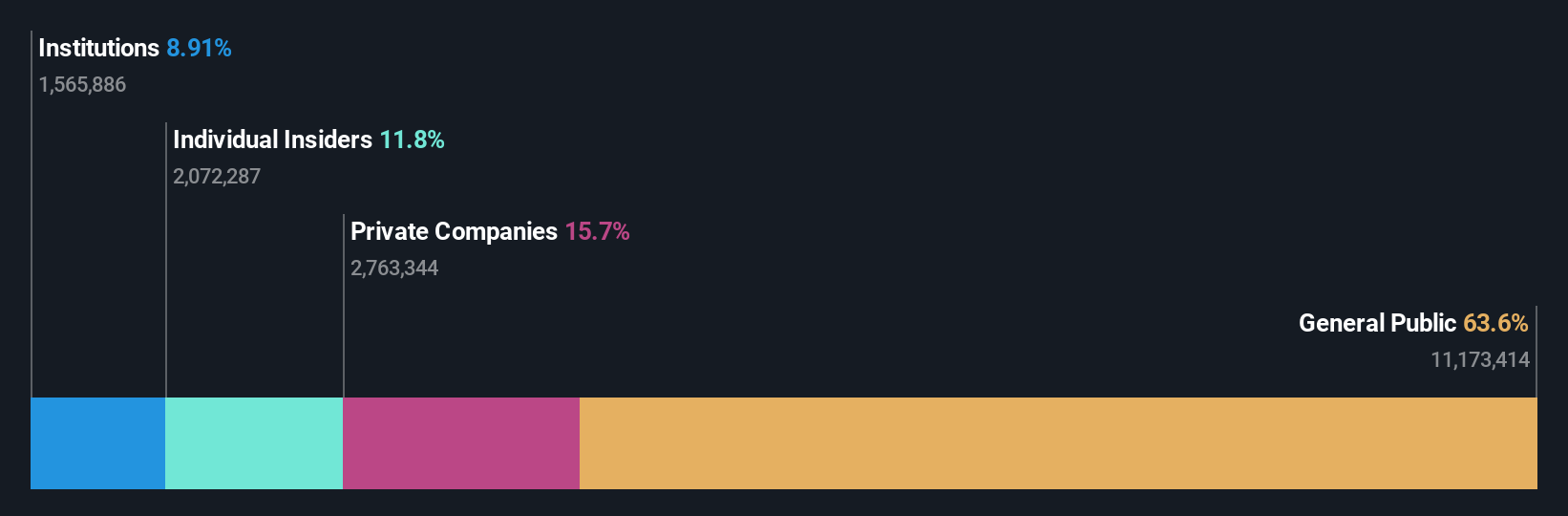

Insider Ownership: 11.8%

Return On Equity Forecast: 35% (2027 estimate)

Pharma Mar has demonstrated substantial growth, with earnings increasing significantly by a very large percentage over the past year. Forecasts indicate continued strong revenue growth at 23.7% annually, outpacing the Spanish market's 5.1%. The company's earnings are also expected to grow significantly faster than the market average, at 40.1% per year. Despite high volatility in its share price, Pharma Mar is trading well below its estimated fair value and maintains high-quality earnings with no recent insider selling activity reported.

- Click here and access our complete growth analysis report to understand the dynamics of Pharma Mar.

- Our valuation report here indicates Pharma Mar may be undervalued.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of €3.19 billion.

Operations: The company's revenue is primarily derived from installing and maintaining electronic shelf labels, amounting to €954.70 million.

Insider Ownership: 13.4%

Return On Equity Forecast: 31% (2027 estimate)

VusionGroup exhibits significant growth potential, with earnings projected to rise 69.58% annually and revenue expected to grow at 19.3% per year, surpassing the French market's average. Despite a highly volatile share price recently, insider ownership remains high without substantial insider selling over the past three months. The company is forecasted to achieve profitability within three years, alongside a proposed dividend increase to €0.60 for 2025, reflecting confidence in its financial trajectory.

- Click to explore a detailed breakdown of our findings in VusionGroup's earnings growth report.

- The analysis detailed in our VusionGroup valuation report hints at an inflated share price compared to its estimated value.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

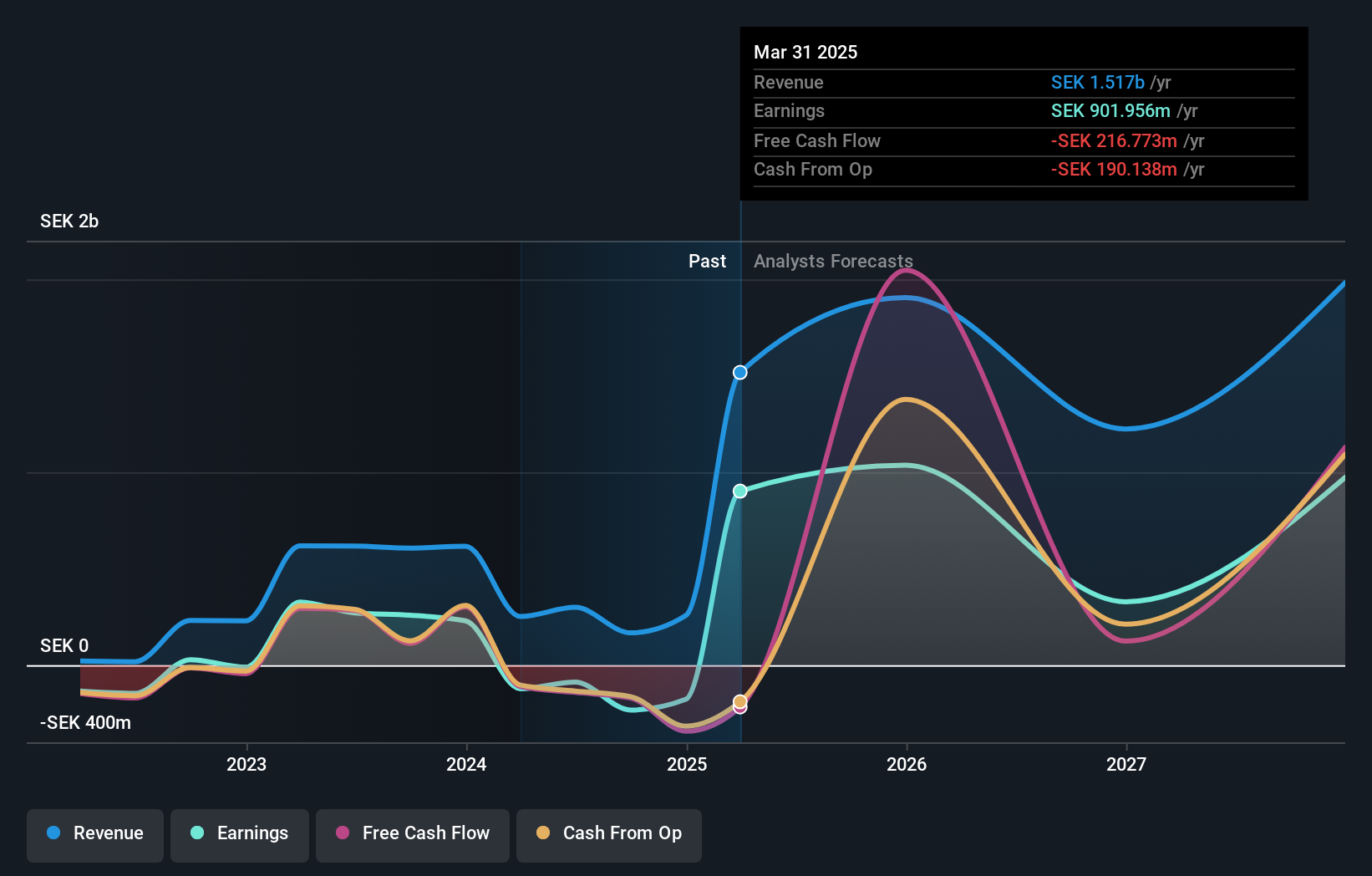

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK16.48 billion.

Operations: BioArctic generates revenue primarily from its biotechnology segment, amounting to SEK257.35 million.

Insider Ownership: 33.7%

Return On Equity Forecast: 34% (2027 estimate)

BioArctic is poised for significant growth, with revenue forecasted to grow 36.9% annually and earnings expected to rise by 46.92% per year, outpacing the Swedish market. The company is anticipated to become profitable within three years, and analysts agree on a potential stock price increase of 69.9%. Recent strategic moves include a US$100 million upfront payment from Bristol Myers Squibb for licensing agreements, enhancing BioArctic's financial position amid ongoing Alzheimer's and Parkinson's drug developments.

- Dive into the specifics of BioArctic here with our thorough growth forecast report.

- According our valuation report, there's an indication that BioArctic's share price might be on the cheaper side.

Where To Now?

- Click this link to deep-dive into the 204 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOA B

BioArctic

Develops biological drugs for patients with central nervous system disorders in Sweden.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives