Euronext Paris Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As European markets continue to rally, supported by slower inflation and potential interest rate cuts from the European Central Bank, investors are increasingly looking for growth opportunities. In this favorable economic climate, companies with high insider ownership often stand out as promising investments due to the confidence their executives have in their future prospects.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.2% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Let's uncover some gems from our specialized screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.05 billion.

Operations: The company's revenue segments are: Americas (€172.65 million), Asia-Pacific (€118.54 million), and Segment Adjustment (€209.13 million).

Insider Ownership: 19.6%

Revenue Growth Forecast: 10.4% p.a.

Lectra, trading 48.4% below its fair value, is expected to see earnings grow 29.3% annually over the next three years, outpacing the French market's 12.3%. Revenue growth is forecast at 10.4% per year, also above the market average of 5.8%. Recent earnings reported EUR262.29 million in sales for H1 2024, up from EUR239.55 million a year ago, though net income declined to EUR12.51 million from EUR14.47 million last year.

- Take a closer look at Lectra's potential here in our earnings growth report.

- Our expertly prepared valuation report Lectra implies its share price may be lower than expected.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €536.96 million.

Operations: MedinCell generates €11.95 million in revenue from its pharmaceuticals segment.

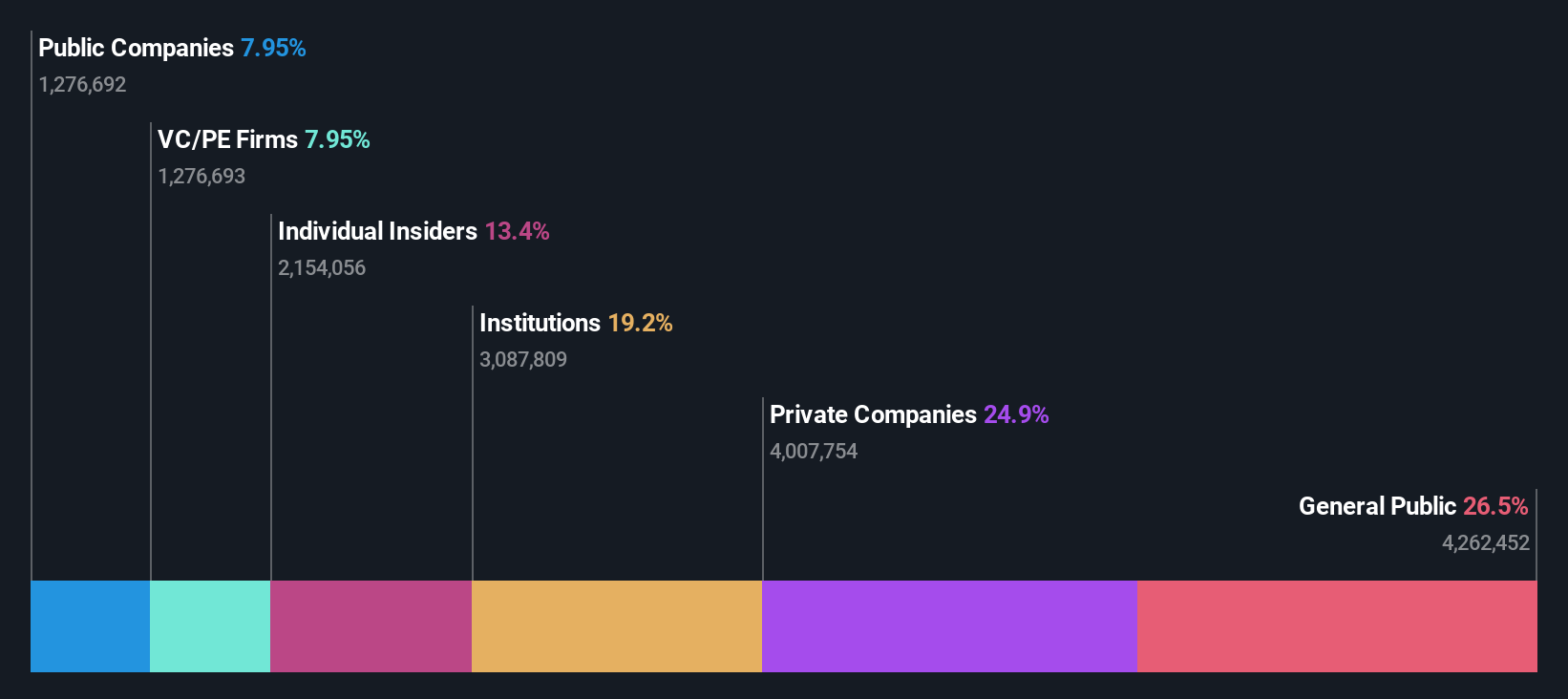

Insider Ownership: 15.8%

Revenue Growth Forecast: 46.2% p.a.

MedinCell's strategic collaboration with AbbVie to co-develop and commercialize up to six therapeutic products highlights its growth potential, supported by a $35 million upfront payment and potential milestones up to $1.9 billion. The company’s innovative BEPO® technology has already led to the FDA approval of UZEDY®, generating EUR1.7 million in royalties from Teva's sales. Despite a net loss of EUR25.04 million for FY2024, MedinCell is forecasted to achieve high revenue growth (46.2% annually) and profitability within three years, outpacing market averages.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- Our valuation report here indicates MedinCell may be overvalued.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.27 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €801.96 million.

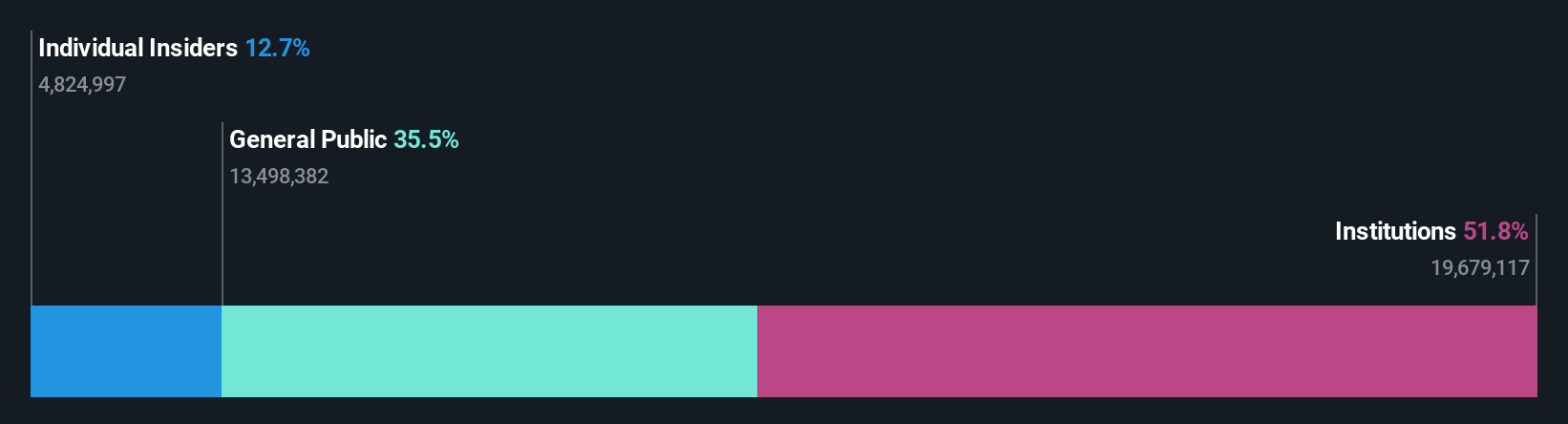

Insider Ownership: 13.4%

Revenue Growth Forecast: 21.3% p.a.

VusionGroup is poised for significant growth with forecasted earnings and revenue increases of 25.7% and 21.3% annually, respectively, outpacing the French market. Recent partnerships with Ace Hardware and Hy-Vee underscore its innovative digital shelf label technology's impact on retail operations, enhancing customer experience and operational efficiency. The company's high insider ownership aligns management interests with shareholders, suggesting confidence in VusionGroup's future performance despite no recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of VusionGroup.

- Our expertly prepared valuation report VusionGroup implies its share price may be too high.

Seize The Opportunity

- Access the full spectrum of 22 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and fair value.