- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

3 Top Growth Companies With High Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

The French stock market has been buoyant recently, with the CAC 40 Index gaining 1.54% following an interest rate cut by the European Central Bank. Amid these favorable conditions, growth companies with high insider ownership are particularly appealing to investors seeking strong alignment between management and shareholder interests. In this article, we will explore three top growth companies listed on Euronext Paris that boast significant insider ownership, a factor often indicative of confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| VusionGroup (ENXTPA:VU) | 13.4% | 82.3% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 28.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 33.2% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.2% | 149.1% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Here we highlight a subset of our preferred stocks from the screener.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France that develops long-acting injectables across various therapeutic areas, with a market cap of €474.13 million.

Operations: In the fiscal year, MedinCell generated €11.95 million in revenue from its pharmaceuticals segment.

Insider Ownership: 15.8%

Earnings Growth Forecast: 93.9% p.a.

MedinCell, a French growth company with high insider ownership, has recently restructured its management and governance. Christophe Douat is now CEO, and Stéphane Postic confirmed as CFO. The company announced a strategic collaboration with AbbVie for up to six therapeutic products, receiving $35 million upfront and potential milestones up to $1.9 billion. MedinCell's revenue is forecast to grow 46.2% annually, significantly outpacing the market average of 5.7%, with profitability expected within three years.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that MedinCell is trading behind its estimated value.

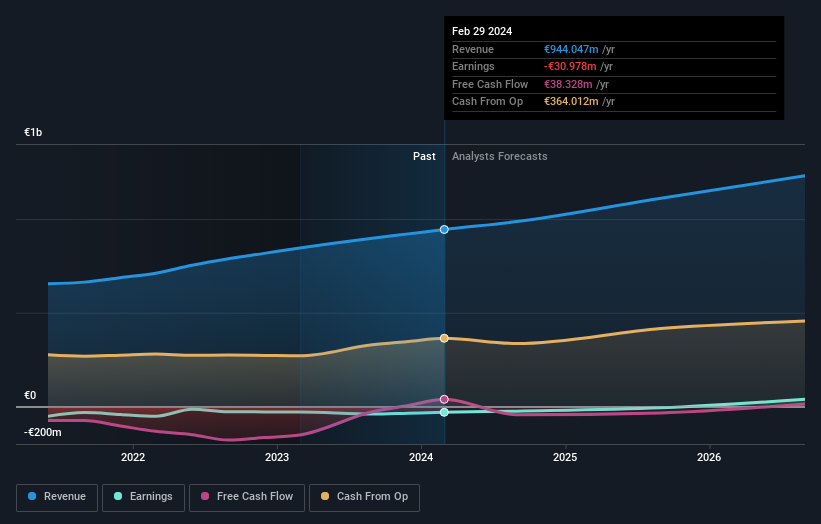

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.16 billion.

Operations: The company's revenue segments are as follows: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

OVH Groupe, a French growth company with high insider ownership, is forecast to become profitable within three years, outpacing average market growth. Despite its volatile share price, it trades at 30.7% below fair value estimates. Revenue is expected to grow at 9.7% annually, faster than the French market's 5.7%. Recent innovations include new ADV-Gen3 Bare Metal servers powered by AMD EPYC processors, enhancing performance and sustainability in data centers globally.

- Click here to discover the nuances of OVH Groupe with our detailed analytical future growth report.

- The valuation report we've compiled suggests that OVH Groupe's current price could be quite moderate.

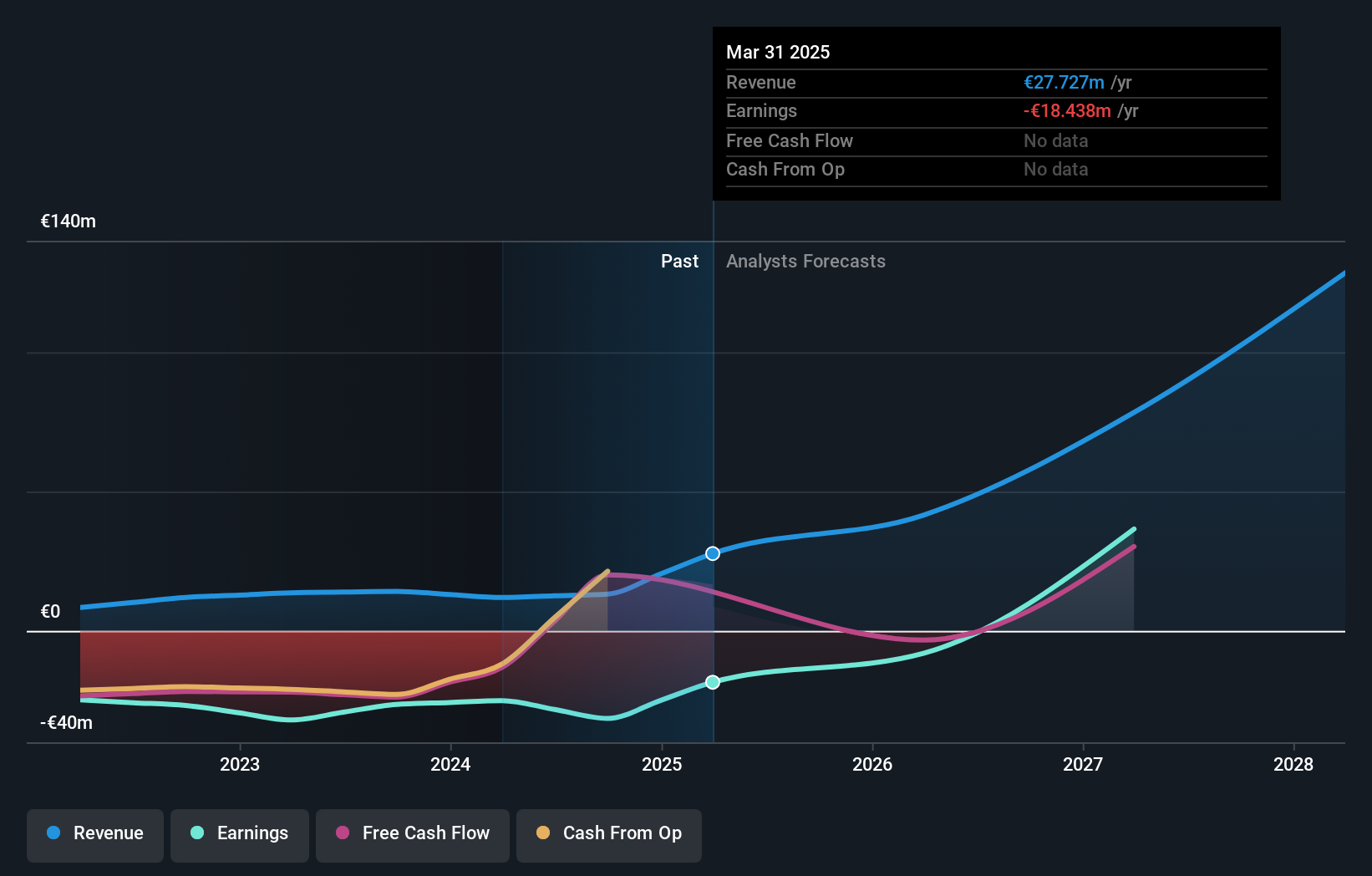

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.41 billion.

Operations: Revenue segments (in millions of €): Digital Solutions: €1,200.50, Retail Technologies: €850.75, Software Services: €600.30

Insider Ownership: 13.4%

Earnings Growth Forecast: 82.3% p.a.

VusionGroup's high insider ownership aligns with its strong growth prospects, as it is forecast to become profitable within three years and achieve annual revenue growth of 28.4%, significantly outpacing the French market. Despite a net loss of €24.4 million for H1 2024, recent partnerships with Ace Hardware and Hy-Vee underscore its innovative digital shelf label technology, enhancing operational efficiencies and customer experience in retail environments. The stock trades at 41.7% below fair value estimates, with analysts predicting a 29.2% price increase.

- Click to explore a detailed breakdown of our findings in VusionGroup's earnings growth report.

- Our valuation report here indicates VusionGroup may be undervalued.

Where To Now?

- Navigate through the entire inventory of 24 Fast Growing Euronext Paris Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with adequate balance sheet.