- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

3 High Growth Companies With Significant Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

The French market has shown resilience, with the CAC 40 Index gaining 1.54% following an interest rate cut by the European Central Bank. This positive momentum underscores the importance of identifying high-growth companies, especially those with significant insider ownership, as they often signal strong confidence in future performance. In this context, insider ownership can be a key indicator of a company's potential for sustained growth and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| VusionGroup (ENXTPA:VU) | 13.4% | 82.3% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 28.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.2% | 149.1% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Let's uncover some gems from our specialized screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.09 billion.

Operations: Revenue segments for the company are as follows: Americas: €172.65 million, Asia-Pacific: €118.54 million, and Segment Adjustment: €209.13 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 29.3% p.a.

Lectra, a growth company with high insider ownership, is forecast to achieve annual earnings growth of 29.3%, significantly outpacing the French market's 12.3%. Despite trading at 46.4% below its estimated fair value, revenue growth is projected at 10.4% per year, faster than the market's 5.8%. However, recent earnings showed a slight decline in net income to €12.51 million from €14.47 million last year despite increased sales of €262.29 million from €239.55 million.

- Click here and access our complete growth analysis report to understand the dynamics of Lectra.

- Our valuation report here indicates Lectra may be undervalued.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.17 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

OVH Groupe, with significant insider ownership, is expected to become profitable within three years and has a forecasted annual earnings growth of 101.12%. Despite trading at 30.4% below its estimated fair value, its revenue is projected to grow at 9.7% per year, outpacing the French market's 5.8%. Recent innovations include new ADV-Gen3 Bare Metal servers featuring AMD EPYC processors, enhancing performance and sustainability in various configurations for diverse business needs.

- Dive into the specifics of OVH Groupe here with our thorough growth forecast report.

- According our valuation report, there's an indication that OVH Groupe's share price might be on the cheaper side.

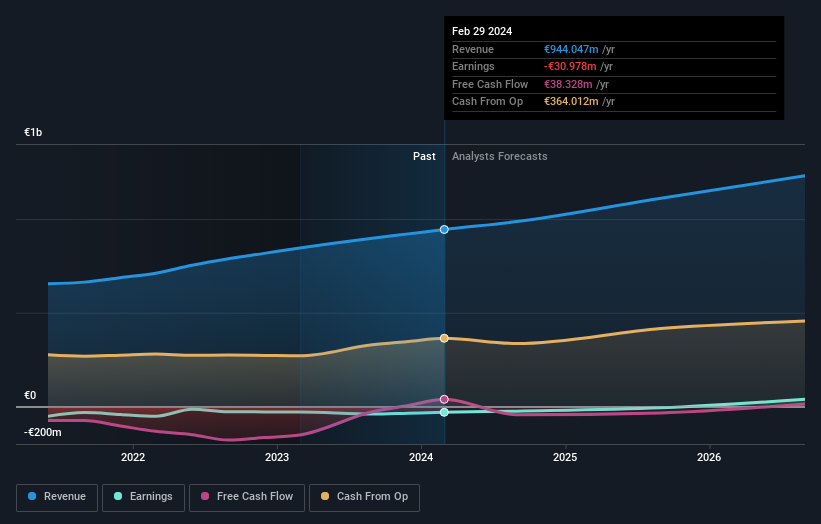

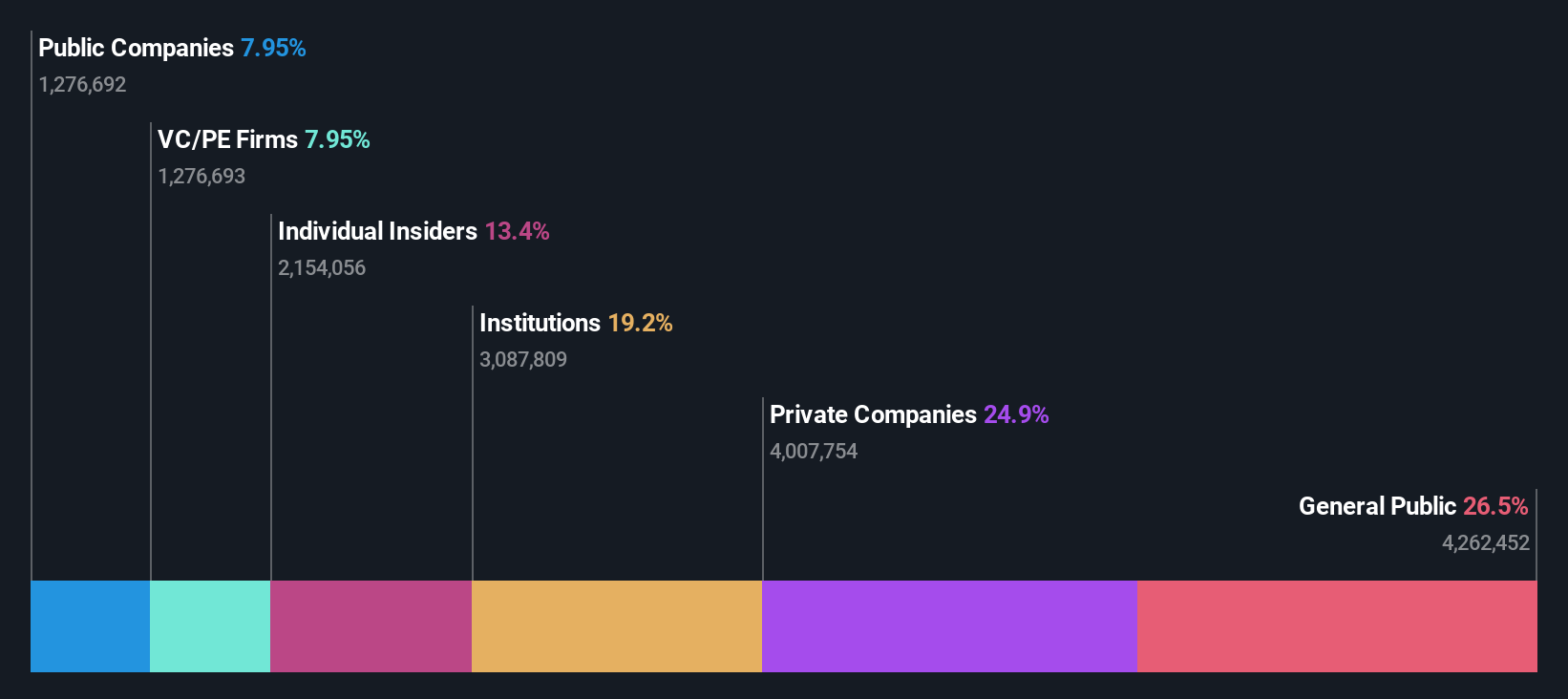

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.41 billion.

Operations: Revenue Segments (in millions of €): Retail Solutions: 220.45, IoT Services: 150.30, Software & Analytics: 95.75

Insider Ownership: 13.4%

Earnings Growth Forecast: 82.3% p.a.

VusionGroup, a growth company with high insider ownership, recently reported H1 2024 sales of €408.9 million but faced a net loss of €24.4 million. Despite this, the company's revenue is forecast to grow at 28.4% annually, outpacing the French market's 5.8%. A key partnership with Ace Hardware highlights VusionGroup’s innovative digital shelf label technology and positions it for future profitability within three years, trading at 41.8% below estimated fair value.

- Unlock comprehensive insights into our analysis of VusionGroup stock in this growth report.

- The analysis detailed in our VusionGroup valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Reveal the 22 hidden gems among our Fast Growing Euronext Paris Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with adequate balance sheet.