The European market has recently seen a modest uptick, with the pan-European STOXX Europe 600 Index rising by 0.56%, driven by hopes of increased government spending, although concerns over proposed U.S. tariffs have tempered gains. In this environment of mixed economic signals and cautious central bank policies, identifying high growth tech stocks requires careful consideration of companies' innovation potential and their ability to navigate geopolitical uncertainties while capitalizing on emerging opportunities in the tech sector.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| Xbrane Biopharma | 39.92% | 95.35% | ★★★★★★ |

| Truecaller | 20.10% | 24.70% | ★★★★★★ |

| Skolon | 29.73% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 34.04% | 40.93% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Lumibird (ENXTPA:LBIRD)

Simply Wall St Growth Rating: ★★★★☆☆

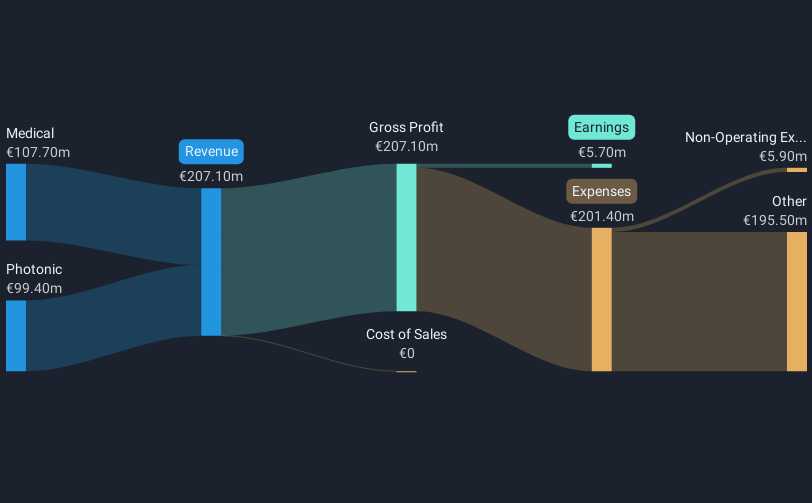

Overview: Lumibird SA designs, manufactures, and sells lasers for scientific, industrial, and medical applications globally with a market cap of €236.49 million.

Operations: The company generates revenue from two primary segments: Medical (€102.31 million) and Photonic (€102.07 million).

Lumibird, a contender in the European high-growth tech scene, has demonstrated robust financial dynamics with an expected annual revenue growth of 6.6%, outpacing the French market's 5.9%. This growth is complemented by an impressive projected annual earnings increase of 42%, significantly higher than the market average of 13%. Despite these strong growth metrics, challenges such as a highly volatile share price and a substantial one-off loss of €2.5 million last year underline the complexities in its financial landscape. Moreover, with recent sales reaching €207.1 million for FY2024 and consistent year-over-year quarterly sales growth, Lumibird continues to expand its market presence while navigating through operational hurdles and maintaining competitive momentum in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Lumibird.

Gain insights into Lumibird's historical performance by reviewing our past performance report.

Bouvet (OB:BOUV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving public and private sector clients in Norway, Sweden, and internationally, with a market cap of NOK7.66 billion.

Operations: The company generates revenue primarily through its IT consultancy services, amounting to NOK3.92 billion.

Bouvet ASA, amidst a bustling European tech landscape, has shown commendable financial resilience with an 8.2% annual revenue growth and an 8% increase in earnings, both figures outpacing the average growth rates within the Norwegian market. This robust performance is further underscored by a recent strategic move to repurchase up to 1 million shares for NOK 90 million, reflecting confidence in its operational stability and future prospects. Moreover, Bouvet's commitment to shareholder value is evident from its proposed dividend of NOK 3.00 per share for FY2024, showcasing its ability to maintain liquidity and reward investors despite broader market challenges. These initiatives highlight Bouvet's proactive approach in navigating through tech industry dynamics while bolstering its market position through focused investments and consistent financial policies.

- Click to explore a detailed breakdown of our findings in Bouvet's health report.

Examine Bouvet's past performance report to understand how it has performed in the past.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

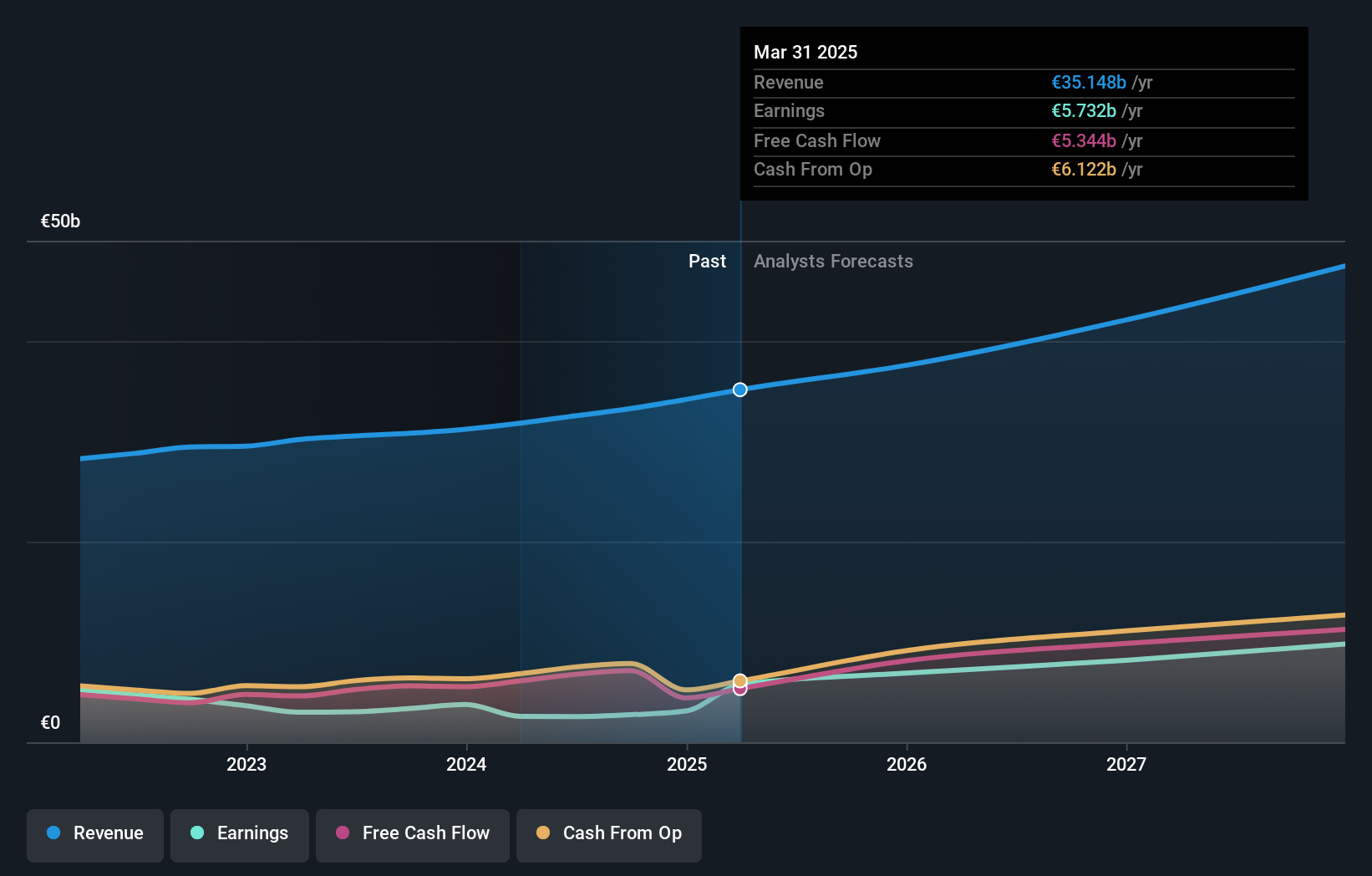

Overview: SAP SE, along with its subsidiaries, delivers enterprise application and business solutions globally and has a market capitalization of €291.76 billion.

Operations: The primary revenue stream for SAP comes from its Applications, Technology & Services segment, generating €34.18 billion.

Amidst a dynamic European tech landscape, SAP SE stands out with its strategic focus on integrating cutting-edge AI and network APIs through collaborations like the recent one with Vonage. This partnership is set to revolutionize enterprise operations by embedding agentic AI-driven experiences into SAP’s robust Business Technology Platform, enhancing customer engagement and operational efficiency across industries. Additionally, SAP's commitment to innovation is evident in its R&D spending trends which have consistently aligned with its revenue growth, ensuring sustained advancements in technology and market competitiveness. These strategic moves not only underscore SAP's agility in adapting to technological shifts but also highlight its potential to shape future industry standards and maintain a strong market presence.

- Click here to discover the nuances of SAP with our detailed analytical health report.

Gain insights into SAP's past trends and performance with our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 243 European High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SAP, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives