As of June 2025, the European market has been experiencing fluctuations, with the pan-European STOXX Europe 600 Index ending 1.54% lower amid concerns about tensions in the Middle East and a mixed economic outlook across major economies like Germany and France. In this context, identifying potential high-growth tech stocks involves looking for companies that can navigate current uncertainties while leveraging innovation to drive growth despite broader market challenges.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 20.56% | 66.21% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| argenx | 21.69% | 26.78% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| Smartoptics Group | 20.34% | 47.07% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Lumibird (ENXTPA:LBIRD)

Simply Wall St Growth Rating: ★★★★☆☆

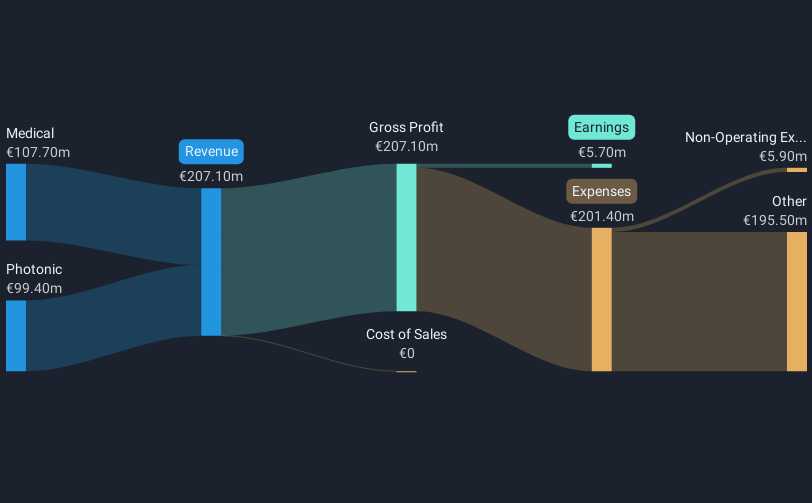

Overview: Lumibird SA is a company that specializes in the design, manufacture, and sale of lasers for scientific, industrial, and medical applications on an international scale with a market capitalization of €397.27 million.

Operations: The company generates revenue primarily from its Medical and Photonic segments, with the Medical segment contributing €107.75 million and the Photonic segment adding €99.37 million.

Lumibird, a player in the European high-tech sector, demonstrates a complex financial landscape with promising growth metrics juxtaposed against certain challenges. With an impressive forecasted annual earnings growth of 38%, the company significantly outpaces the French market's average of 12.5%. Despite this robust projection, Lumibird has experienced a setback with a one-off loss of €3.4 million last year, which has impacted its financial results. Additionally, its revenue growth rate at 7.3% per year surpasses the French market trend of 5% but falls behind the more aggressive industry benchmarks. The firm's ability to navigate these waters while maintaining innovation and adapting to market demands will be crucial for its trajectory in the competitive tech landscape.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with communication impairments, with a market capitalization of SEK11.89 billion.

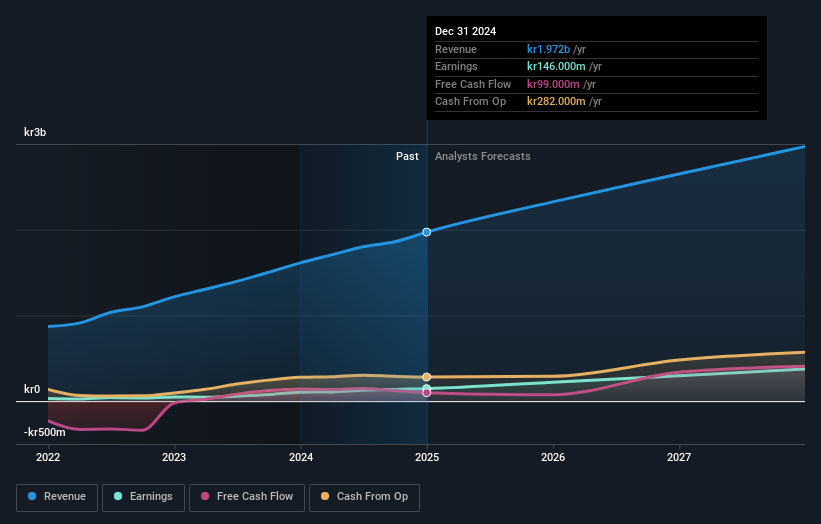

Operations: The company generates revenue primarily through its computer hardware segment, amounting to SEK2.13 billion.

Dynavox Group, a burgeoning force in the European tech scene, has demonstrated robust financial performance with a notable 46.9% earnings growth over the past year, significantly outpacing its industry's average of 26.2%. This growth is underpinned by an annual revenue increase of 14.9%, surpassing Sweden's market average of 4.1%. Recently, Dynavox initiated a share repurchase program, reflecting confidence in its financial health and commitment to shareholder value. Additionally, the company's strategic focus on R&D has fostered innovation and competitiveness within the tech sector, positioning it well for future advancements despite its high debt levels.

- Navigate through the intricacies of Dynavox Group with our comprehensive health report here.

Gain insights into Dynavox Group's past trends and performance with our Past report.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market capitalization of €498.81 million.

Operations: Specializing in biosimilar drug development, Formycon AG generates revenue primarily from its Drug Delivery Systems segment, which contributes €69.67 million.

Formycon, amidst a dynamic European tech landscape, is poised for considerable growth with an expected revenue surge of 18.8% annually, outstripping Germany's average of 6.9%. This growth trajectory is bolstered by recent product approvals across Latin America and Canada, enhancing its market footprint significantly. Moreover, the company's commitment to research and development is evident from its strategic product launches like Otulfi™ in diverse international markets, promising robust future prospects despite current unprofitability. With earnings anticipated to climb by 78.7% annually over the next three years as it moves towards profitability, Formycon demonstrates a strong potential for transformation within the biotech sector.

- Unlock comprehensive insights into our analysis of Formycon stock in this health report.

Evaluate Formycon's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 232 European High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026