- France

- /

- Tech Hardware

- /

- ENXTPA:GUI

There's Reason For Concern Over Guillemot Corporation S.A.'s (EPA:GUI) Price

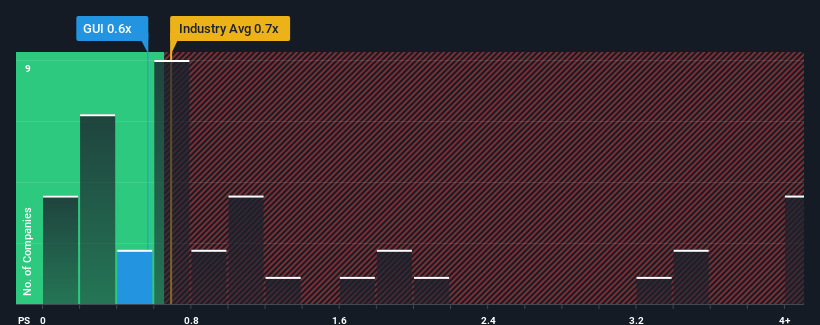

It's not a stretch to say that Guillemot Corporation S.A.'s (EPA:GUI) price-to-sales (or "P/S") ratio of 0.6x seems quite "middle-of-the-road" for Tech companies in France, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Guillemot

How Guillemot Has Been Performing

Guillemot could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Guillemot will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Guillemot's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. Even so, admirably revenue has lifted 79% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 8.3% as estimated by the two analysts watching the company. With the industry predicted to deliver 2.6% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Guillemot's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Guillemot's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Guillemot currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Having said that, be aware Guillemot is showing 2 warning signs in our investment analysis, and 1 of those is significant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GUI

Guillemot

Engages in designing, manufacturing, and selling of interactive entertainment equipment and accessories in European Union, the United Kingdom, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives