The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising for a fourth consecutive week amid hopes for easing trade tensions between China and the U.S. In this context, penny stocks—often seen as relics of past market eras—continue to hold potential for investors seeking affordability and growth opportunities. These smaller or newer companies can offer unique value when backed by strong financial health, making them intriguing prospects in today's economic landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.26 | SEK2.16B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.00 | SEK302.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.62 | SEK271.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.64 | PLN123.37M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.478 | NOK106.21M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 4 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €1.62 | €22.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.999 | €33.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.215 | €305.81M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 440 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment hardware and accessories across several countries including France, Germany, the United Kingdom, and the United States with a market cap of €69.17 million.

Operations: The company's revenue is primarily derived from its Thrustmaster segment, which accounts for €113.1 million, while the Hercules segment contributes €12 million.

Market Cap: €69.17M

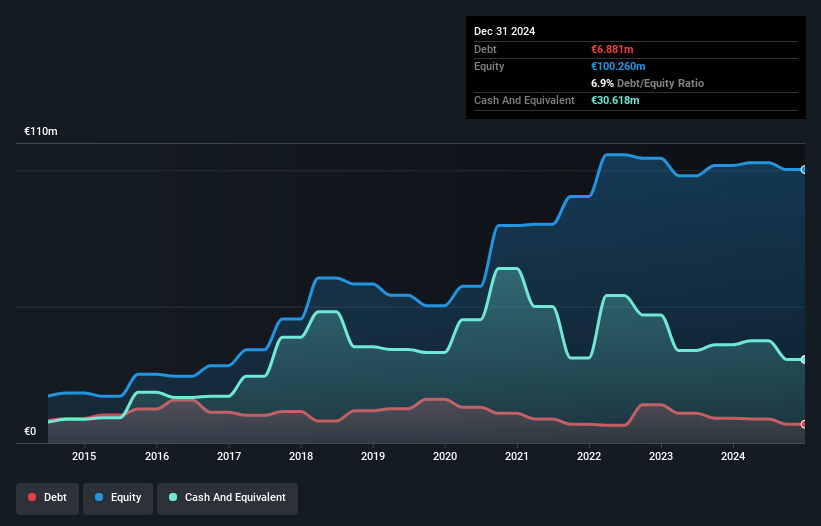

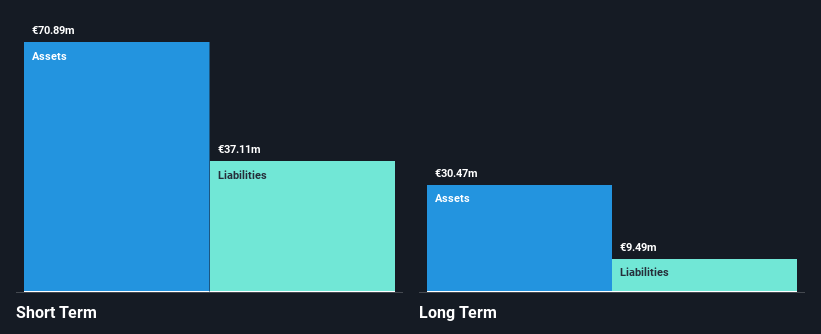

Guillemot Corporation S.A. has demonstrated financial resilience, with its short-term assets of €110.9 million comfortably covering both short and long-term liabilities. The company reported a net income increase to €1.18 million for the year ending December 31, 2024, up from €0.964 million the previous year, despite a significant one-off loss impacting recent results. Guillemot's earnings growth over the past year outpaced its five-year average decline, and it maintains more cash than total debt with robust interest coverage by profits. Trading below estimated fair value suggests potential for investment interest in this penny stock segment.

- Click here to discover the nuances of Guillemot with our detailed analytical financial health report.

- Gain insights into Guillemot's outlook and expected performance with our report on the company's earnings estimates.

Ilkka Oyj (HLSE:ILKKA2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ilkka Oyj, with a market cap of €88.89 million, operates in the publishing and printing sectors both in Finland and internationally through its subsidiaries.

Operations: Ilkka Oyj does not report detailed revenue segments.

Market Cap: €88.89M

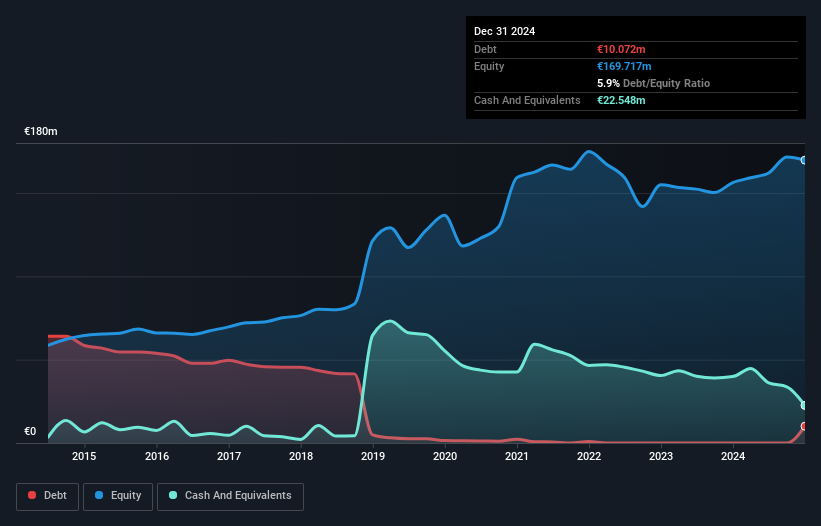

Ilkka Oyj, operating in the publishing and printing sectors, shows a mixed financial picture. The management team is seasoned with an average tenure of 8.2 years, and the board has even longer experience at 16.5 years. Despite having more cash than total debt and short-term assets exceeding liabilities, Ilkka reported a net loss of €0.992 million for Q1 2025 compared to a profit last year. Earnings have been impacted by large one-off gains recently, while earnings are forecast to decline slightly over the next three years. The company's dividend yield is high but not well covered by earnings or free cash flow.

- Get an in-depth perspective on Ilkka Oyj's performance by reading our balance sheet health report here.

- Explore Ilkka Oyj's analyst forecasts in our growth report.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €29.85 million.

Operations: The company's revenue is derived from Service (€19.90 million), Optical and X-Ray Series Inspection Systems (€51.60 million), and Special Optical and X-Ray Inspection Systems (€12.59 million).

Market Cap: €29.85M

Viscom SE, a developer of inspection systems, presents a nuanced picture for penny stock investors. The company is trading significantly below its estimated fair value and maintains satisfactory debt levels with short-term assets exceeding liabilities. Despite being unprofitable with a negative return on equity, Viscom's operating cash flow covers its debt well. Recent earnings show reduced revenue and a net loss of €9.44 million in 2024 compared to profits the previous year. The management team is experienced, yet the company faces economic uncertainties impacting customer demand in 2025 but anticipates growth from 2026 onwards.

- Unlock comprehensive insights into our analysis of Viscom stock in this financial health report.

- Understand Viscom's earnings outlook by examining our growth report.

Make It Happen

- Embark on your investment journey to our 440 European Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ILKKA2

Ilkka Oyj

Operates in publishing and printing businesses in Finland and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives