- France

- /

- Tech Hardware

- /

- ENXTPA:ARTO

Is Société Industrielle et Financière de l'Artois (ENXTPA:ARTO) Overvalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

Société Industrielle et Financière de l'Artois Société anonyme (ENXTPA:ARTO) Moves Draw Investor Curiosity

Société Industrielle et Financière de l'Artois Société anonyme (ENXTPA:ARTO) has been on the radar for investors recently, even without a specific news catalyst lighting up the headlines. The absence of a headline-grabbing event may itself be worth noting, as it invites a fresh look at the company’s underlying fundamentals and recent performance. Sometimes, the quiet spells catch the market’s attention just as much as the big announcements do, raising questions about whether the current stock price is truly reflective of what is ahead for the business.

Over the past year, ARTO’s share price has drifted lower overall, declining about 3 percent. Its longer-term record is a different story. Shares are down nearly 17 percent year to date, and flat for the past quarter. However, over the past five years, the stock has delivered a strong cumulative return of more than 150 percent. The lack of recent momentum, especially compared to the longer-term gains, means that investors are left weighing whether this subdued period signals stability or a pause before the next leg up. There have not been fresh events in the past month, so attention shifts toward the numbers and whether the market has caught up to the company’s potential.

With such a mixed pattern of performance, is ARTO an undervalued opportunity hiding in plain sight, or is the market already pricing in everything it knows about the company’s prospects?

Price-to-Earnings of 117.8x: Is it justified?

Based on its current price-to-earnings (P/E) ratio, Société Industrielle et Financière de l'Artois Société anonyme appears expensive compared to both its local peers and the wider European tech sector.

The P/E ratio reflects how much investors are willing to pay for each euro of earnings. This is a key metric for assessing whether a stock price reasonably matches company profits, especially in the tech industry where growth prospects can fuel high valuations.

Compared to the French market average of 31.1x and the European tech sector average of 24.7x, ARTO's multiple of 117.8x stands out by a wide margin. The market may be pricing in future growth or unique company attributes. However, at these levels, expectations are high and not currently supported by accelerating profit growth.

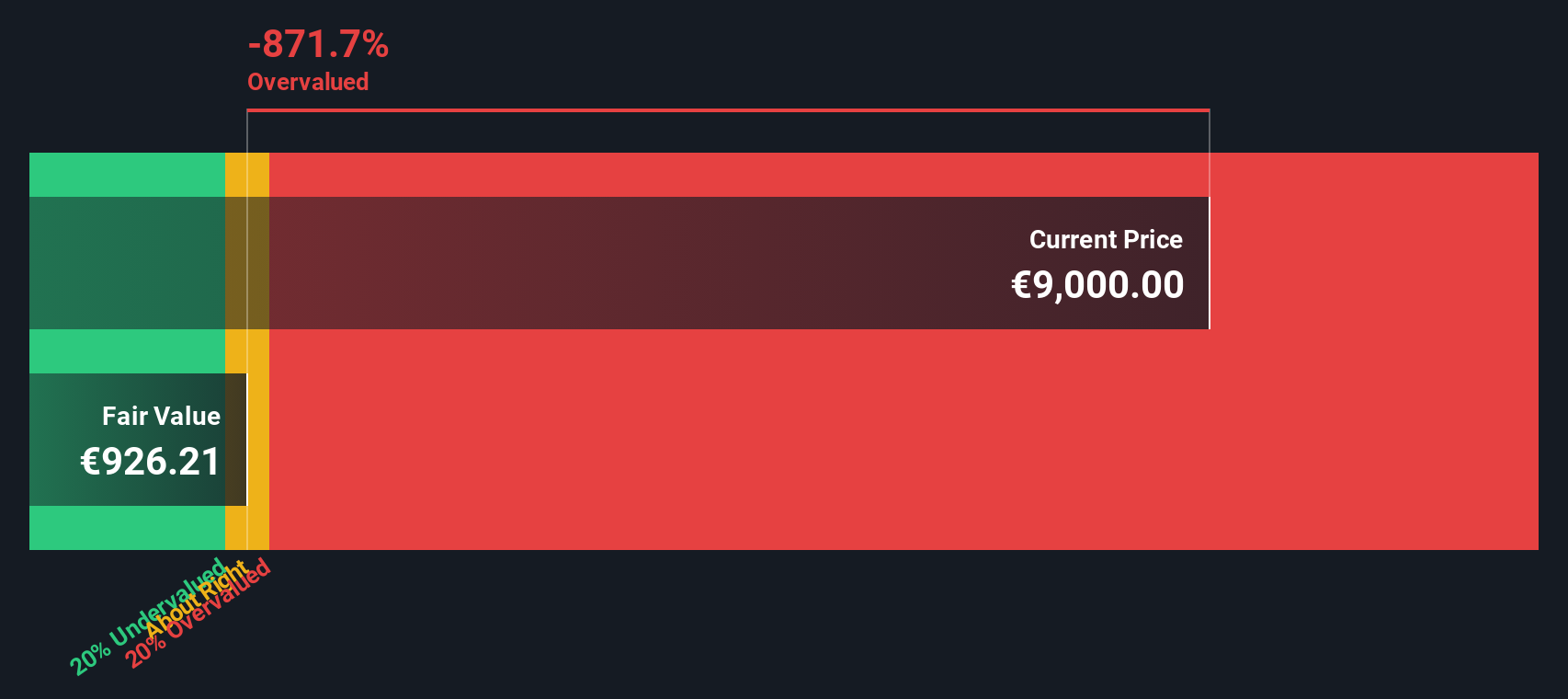

Result: Fair Value of €927.4 (Overvalued)

See our latest analysis for Société Industrielle et Financière de l'Artois Société anonyme.However, slowing revenue growth or unexpected sector volatility could challenge the optimistic outlook and quickly shift the narrative around Société Industrielle et Financière de l'Artois Société anonyme.

Find out about the key risks to this Société Industrielle et Financière de l'Artois Société anonyme narrative.Another View: SWS DCF Model Offers a Second Opinion

While company multiples point to a stretched valuation, our DCF model takes a different approach by focusing on cash flows. This method also indicates the shares are priced above what fundamentals suggest. Could both methods be missing something? Or is the market expectation simply too high?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Société Industrielle et Financière de l'Artois Société anonyme Narrative

If you see things differently or want to take a deeper dive into the figures, it only takes a few minutes to craft your own perspective. So why not Do it your way?

A great starting point for your Société Industrielle et Financière de l'Artois Société anonyme research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock a wealth of original ideas and stay ahead of the pack by scouting new sectors with the Simply Wall Street Screener. Miss these opportunities, and you might miss out on tomorrow's winning stocks.

- Capitalize on small companies with real financial strength by browsing penny stocks with strong financials that are quietly outperforming expectations.

- Ride the AI innovation wave by tracking AI penny stocks leading developments in machine learning and automation breakthroughs.

- Secure reliable returns by filtering for dividend stocks with yields > 3% to find yields that can boost your portfolio's income stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARTO

Société Industrielle et Financière de l'Artois Société anonyme

Designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems.

Adequate balance sheet with low risk.

Market Insights

Community Narratives