- France

- /

- Tech Hardware

- /

- ENXTPA:ARTO

After Leaping 79% Société Industrielle et Financière de l'Artois Société anonyme (EPA:ARTO) Shares Are Not Flying Under The Radar

The Société Industrielle et Financière de l'Artois Société anonyme (EPA:ARTO) share price has done very well over the last month, posting an excellent gain of 79%. The last 30 days bring the annual gain to a very sharp 92%.

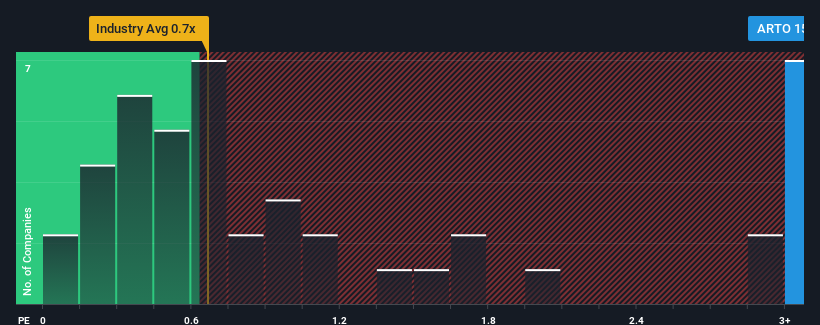

After such a large jump in price, you could be forgiven for thinking Société Industrielle et Financière de l'Artois Société anonyme is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 15.3x, considering almost half the companies in France's Tech industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Société Industrielle et Financière de l'Artois Société anonyme

How Has Société Industrielle et Financière de l'Artois Société anonyme Performed Recently?

Revenue has risen firmly for Société Industrielle et Financière de l'Artois Société anonyme recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Société Industrielle et Financière de l'Artois Société anonyme will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Société Industrielle et Financière de l'Artois Société anonyme would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.0%. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 7.4%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Société Industrielle et Financière de l'Artois Société anonyme's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Société Industrielle et Financière de l'Artois Société anonyme's P/S Mean For Investors?

Société Industrielle et Financière de l'Artois Société anonyme's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Société Industrielle et Financière de l'Artois Société anonyme revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Société Industrielle et Financière de l'Artois Société anonyme has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Société Industrielle et Financière de l'Artois Société anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ARTO

Société Industrielle et Financière de l'Artois Société anonyme

Designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems.

Adequate balance sheet very low.

Market Insights

Community Narratives