- Poland

- /

- Capital Markets

- /

- WSE:INC

European Penny Stocks Worth Watching In December 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with major indices like the STOXX Europe 600 Index posting gains and inflation data suggesting stability around the ECB's target, investors are keenly observing opportunities across various sectors. Though often overlooked, penny stocks—typically representing smaller or newer companies—can offer unique growth potential at lower price points when supported by strong financials. In this article, we explore three European penny stocks that stand out for their financial strength and potential to uncover hidden value for investors.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €230.2M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.84 | €68.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.42 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.295 | €317.22M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0812 | €8.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.83 | €27.79M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Munic (ENXTPA:ALMUN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Munic S.A. is a company that focuses on vehicle data collection, processing, and monetization in Europe and North America, with a market cap of €7.40 million.

Operations: The company's revenue is primarily generated from its Auto Parts & Accessories segment, amounting to €13.96 million.

Market Cap: €7.4M

Munic S.A., with a market cap of €7.40 million, has recently turned profitable, although its Return on Equity is low at 2.1%. Despite stable weekly volatility over the past year, it remains higher than most French stocks. The company reported half-year revenue growth to €8.52 million and reduced its net loss significantly from the previous year. While trading below estimated fair value, Munic's short-term assets comfortably cover both short- and long-term liabilities. However, earnings were impacted by a significant one-off gain of €856.4K in the last 12 months ending June 2025, suggesting caution in evaluating financial quality.

- Click here and access our complete financial health analysis report to understand the dynamics of Munic.

- Gain insights into Munic's historical outcomes by reviewing our past performance report.

INC (WSE:INC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INC S.A. offers investment and advisory services to small and medium-sized enterprises, as well as local government units in Poland, with a market cap of PLN26.17 million.

Operations: No revenue segments are reported for this company.

Market Cap: PLN26.17M

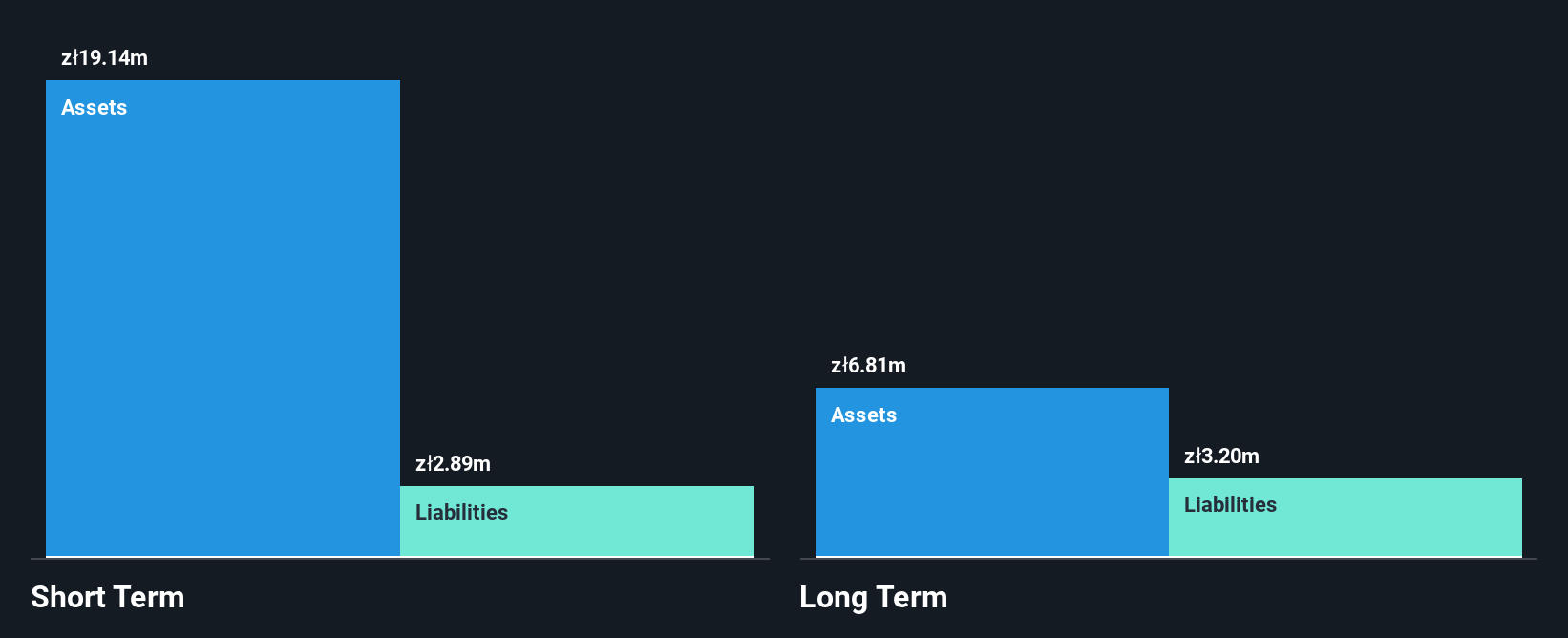

INC S.A., with a market cap of PLN26.17 million, remains pre-revenue despite reporting improved sales figures for the third quarter of 2025 at PLN2.1 million, up from PLN1.66 million the previous year. The company has a robust cash runway exceeding three years and maintains more cash than its total debt, reflecting prudent financial management. Short-term assets of PLN19.1 million comfortably cover both short- and long-term liabilities, indicating solid liquidity positions. However, INC is currently unprofitable with increasing losses over the past five years and a negative Return on Equity of -1.74%, highlighting challenges in achieving profitability despite experienced board oversight.

- Take a closer look at INC's potential here in our financial health report.

- Learn about INC's historical performance here.

hGears (XTRA:HGEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: hGears AG, with a market cap of €14.98 million, develops, manufactures, distributes, and supplies precision components and subsystems as well as system solutions across the European Union, the United States, China, and other global markets.

Operations: The company's revenue is derived from the USA (€7.31 million), China (€6.14 million), and the Rest of The World (€14.92 million).

Market Cap: €14.98M

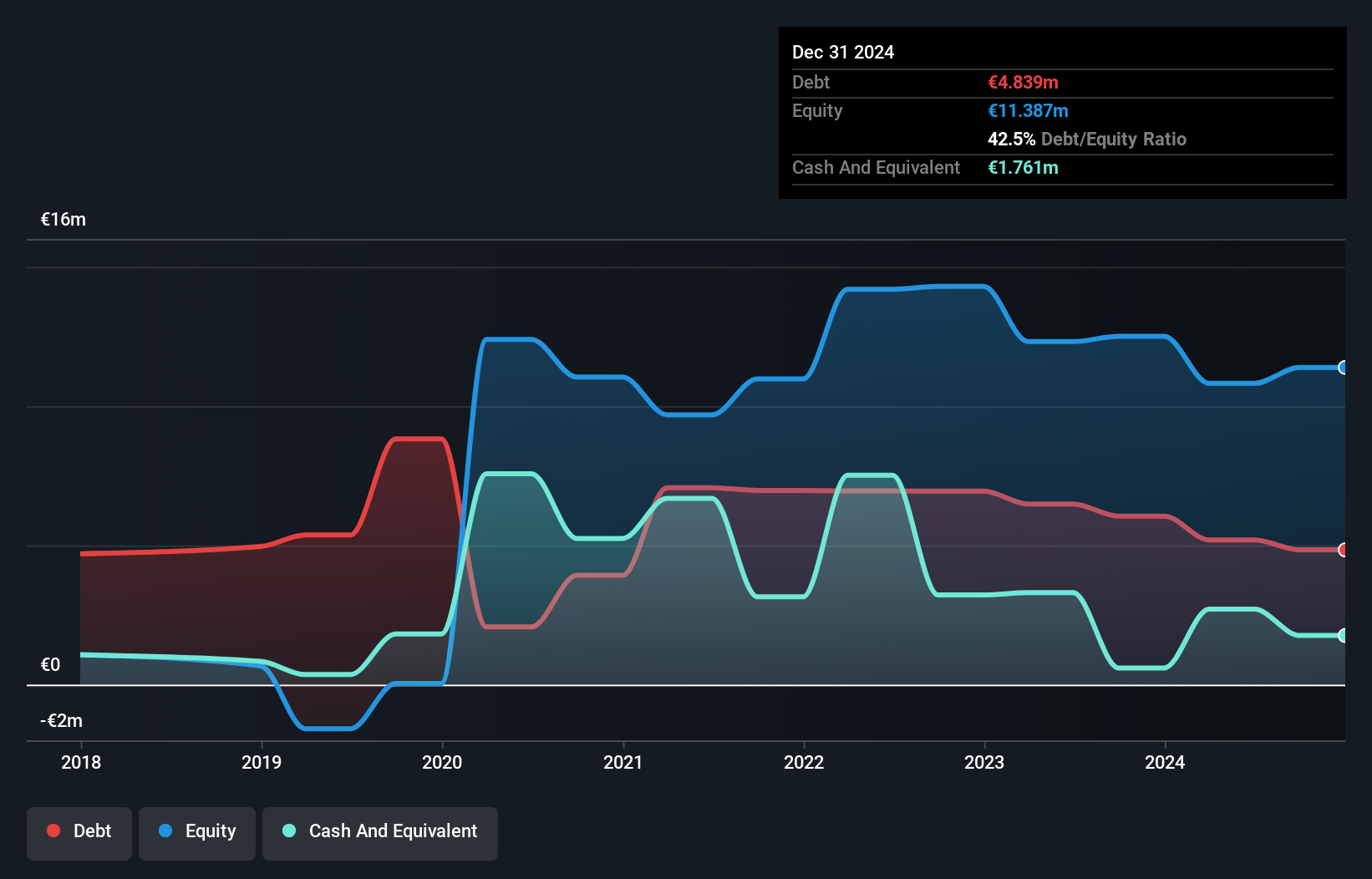

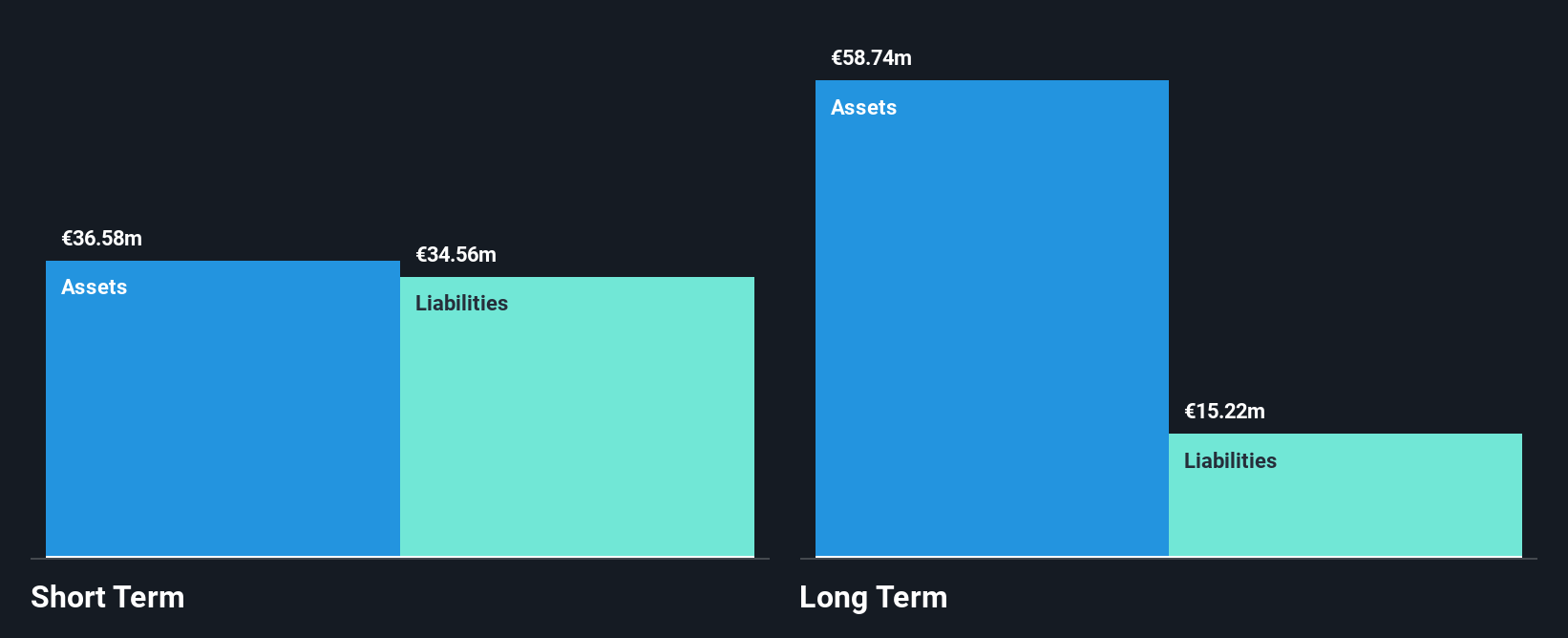

hGears AG, with a market cap of €14.98 million, operates across major global markets with significant revenue contributions from the USA (€7.31 million) and China (€6.14 million). Despite being unprofitable and having increased losses over five years, its financial health is supported by short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 14.6%. The company has raised its 2025 revenue guidance to €87-€90 million, reflecting potential growth prospects despite high volatility in share price and challenges in achieving profitability within the next three years.

- Jump into the full analysis health report here for a deeper understanding of hGears.

- Understand hGears' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 274 European Penny Stocks now.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:INC

INC

Provides investment and advisory services to small and medium-sized enterprises, and local government units in Poland.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026