- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALATI

1.6% earnings growth over 5 years has not materialized into gains for ACTIA Group (EPA:ALATI) shareholders over that period

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term ACTIA Group S.A. (EPA:ALATI) shareholders for doubting their decision to hold, with the stock down 33% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 29%. On top of that, the share price is down 17% in the last week.

Since ACTIA Group has shed €11m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for ACTIA Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

ACTIA Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The steady dividend doesn't really explain why the share price is down. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

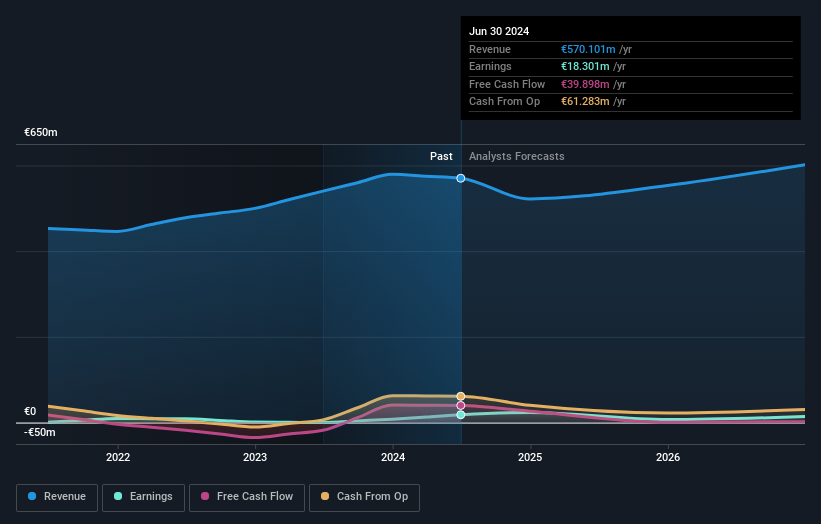

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how ACTIA Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for ACTIA Group the TSR over the last 5 years was -25%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that ACTIA Group shareholders are down 26% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with ACTIA Group (including 1 which makes us a bit uncomfortable) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALATI

ACTIA Group

ACTIA Group S.A. design, manufactures, and operates electronics for systems management in automotive, aeronautics, railway, home automation, telecommunication, energy, and healthcare sectors.

Excellent balance sheet average dividend payer.