The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising for a fourth consecutive week amid optimism over easing trade tensions between China and the U.S., while Germany's DAX and Italy's FTSE MIB posted gains. In this environment of cautious economic optimism, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities, adaptability to changing trade dynamics, and robust financial health to navigate potential uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| CD Projekt | 33.48% | 37.10% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

We'll examine a selection from our screener results.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA is a global company that specializes in designing, integrating, and operating mission-critical systems, with a market capitalization of €281.82 million.

Operations: CS Communication & Systemes SA focuses on the design, integration, and operation of mission-critical systems globally. The company generates revenue through its specialized services in these areas.

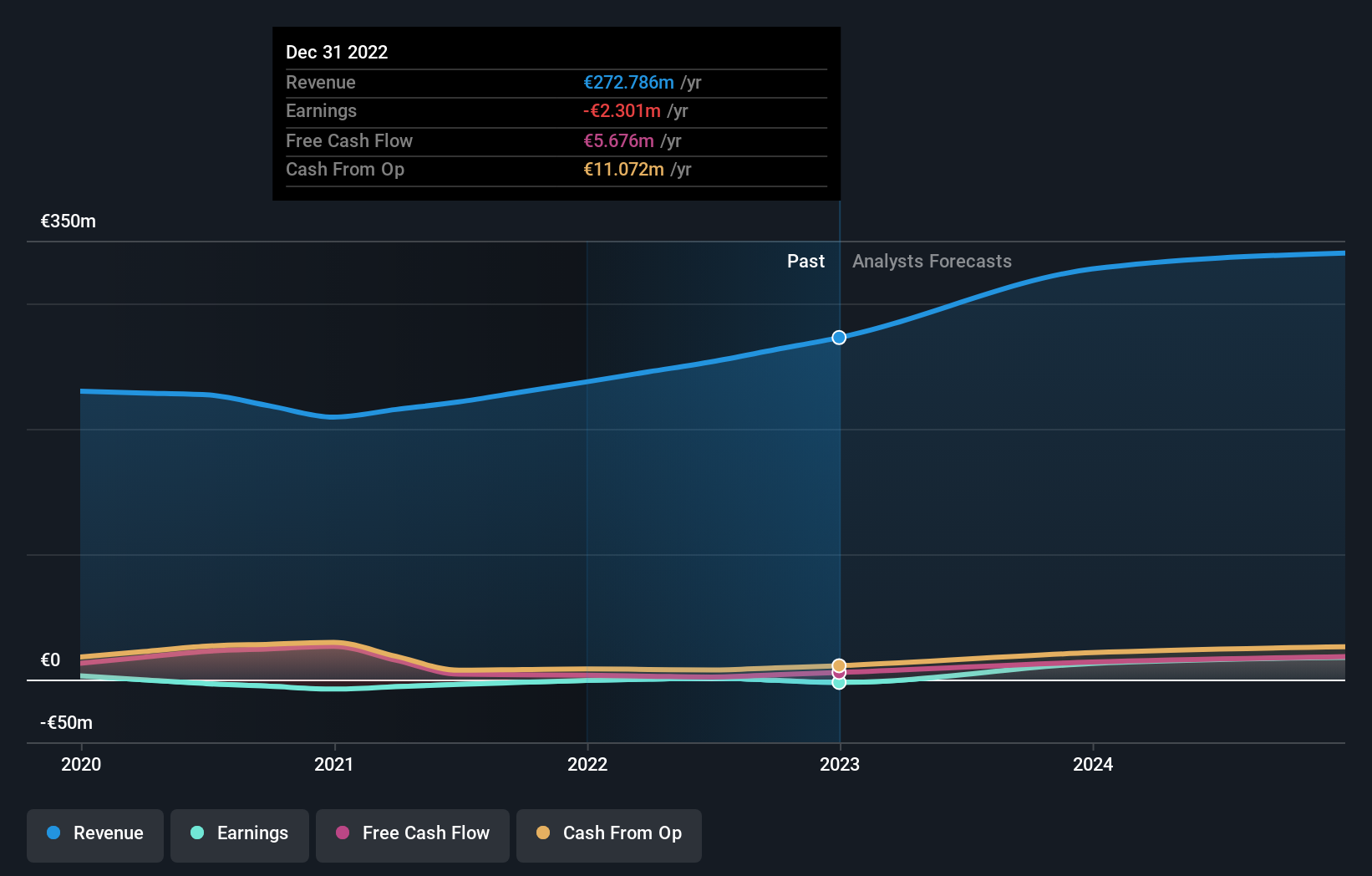

CS Communication & Systemes, a contender in Europe’s tech sector, is navigating through challenging but promising financial landscapes. Despite being unprofitable currently, the company is on a trajectory to profitability with expected earnings growth of 88.23% annually. This growth is underpinned by significant R&D investments that align with industry demands for innovative solutions. With revenues growing at 10.4% per year—double the French market average—the firm demonstrates resilience and potential in a competitive environment. Moreover, its ability to generate positive free cash flow highlights operational efficiency and strategic foresight in capital management. As CS Communication & Systemes progresses towards profitability within three years, its evolving business model and robust R&D focus suggest it could play an increasingly influential role in shaping tech advancements regionally.

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Valneva SE is a specialty vaccine company focused on developing, manufacturing, and commercializing prophylactic vaccines for infectious diseases with unmet needs, with a market cap of €487.40 million.

Operations: Valneva SE generates revenue primarily through the development, manufacturing, and commercialization of prophylactic vaccines targeting infectious diseases with unmet needs. The company's focus on specialty vaccines positions it within a niche market segment.

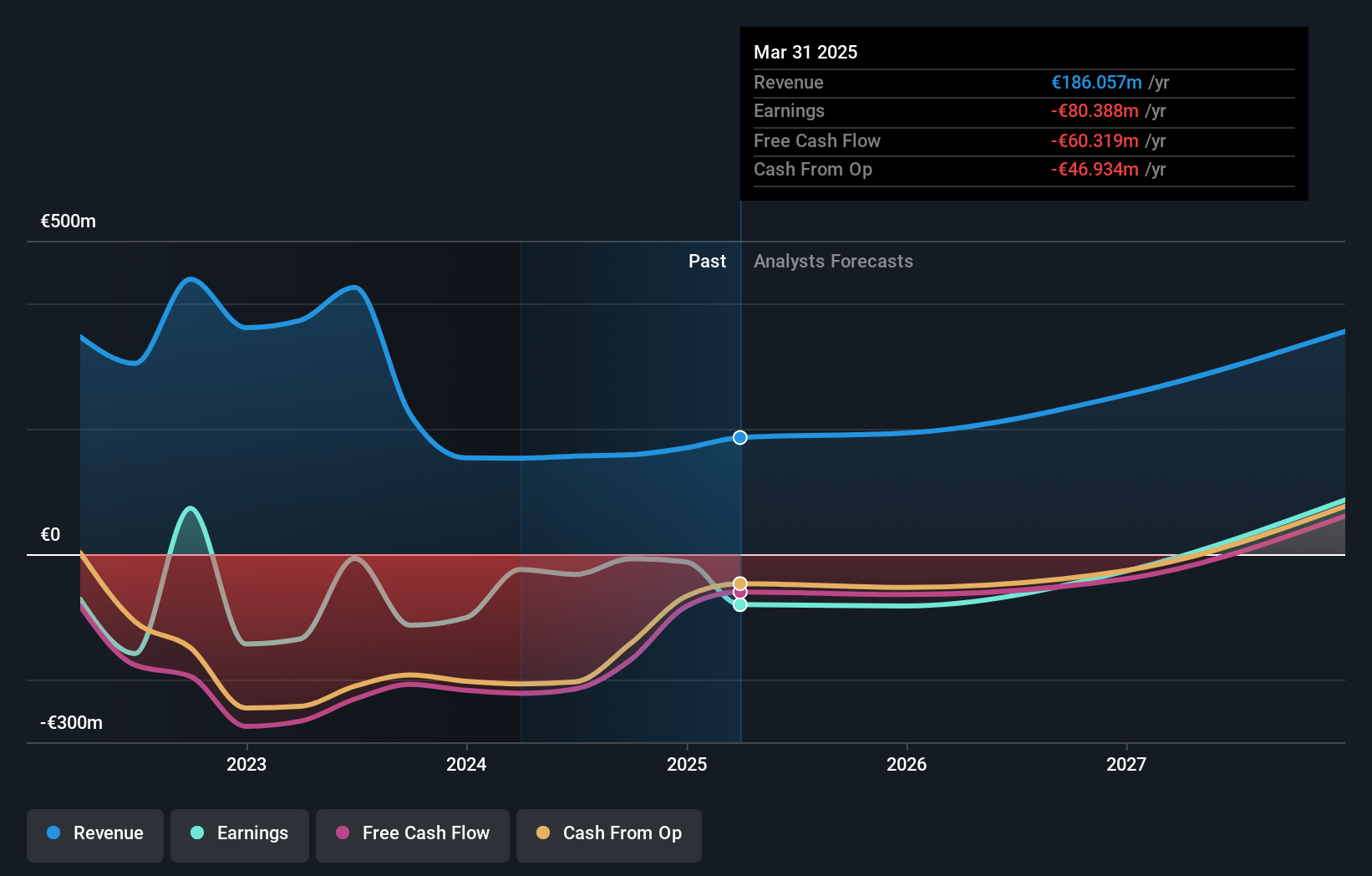

Valneva, amidst regulatory scrutiny, continues to project robust financial health with expected revenues reaching €180 million in 2025, bolstered by product sales potentially hitting €180 million. Despite recent challenges including temporary suspensions of its chikungunya vaccine IXCHIQ for older adults due to safety concerns, the company maintains a positive outlook for its use in younger demographics. This resilience is underlined by a substantial R&D focus, crucial for navigating through the evolving regulatory landscapes and maintaining innovation in vaccine development. The strategic emphasis on younger populations and ongoing collaborations with health authorities exemplify Valneva's adaptability and commitment to public health amidst emergent challenges.

- Dive into the specifics of Valneva here with our thorough health report.

Understand Valneva's track record by examining our Past report.

Allgeier (XTRA:AEIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allgeier SE is a company that offers IT solutions and software services primarily in Germany, with a market capitalization of €226.58 million.

Operations: Allgeier SE generates revenue through its Enterprise IT and Mgm Technology Partners segments, with Enterprise IT contributing €281.89 million and Mgm Technology Partners adding €130.35 million.

Allgeier SE, navigating a challenging fiscal year with sales dipping to €410.9 million from €428.05 million, still managed to confirm its earnings guidance for 2025, reflecting resilience and strategic foresight. Despite a decrease in net income from €13.08 million to €7.34 million year-over-year, the company's commitment to growth is underscored by an expected annual earnings increase of 30.1%. This projection outpaces the German market's forecasted growth of 16.1%, positioning Allgeier as a potential rebound candidate in the tech sector amidst its current financial recalibration.

- Click here to discover the nuances of Allgeier with our detailed analytical health report.

Examine Allgeier's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Gain an insight into the universe of 227 European High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SX

CS Communication & Systemes

CS Communication & Systemes SA designs, integrates, and operates mission critical systems worldwide.

Reasonable growth potential and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion