As European inflation nears the central bank's target, France's CAC 40 Index has shown steady growth, reflecting broader market optimism. In this favorable economic climate, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on innovation and robust performance in the French market.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 16.18% | 35.08% | ★★★★★☆ |

| Cogelec | 11.32% | 24.06% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Munic | 26.68% | 149.17% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Valneva | 24.22% | 28.34% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. provides IT and software solutions worldwide and has a market cap of €291.60 million.

Operations: Sword Group S.E. generates revenue through its IT and software solutions, with significant contributions from its operations in Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

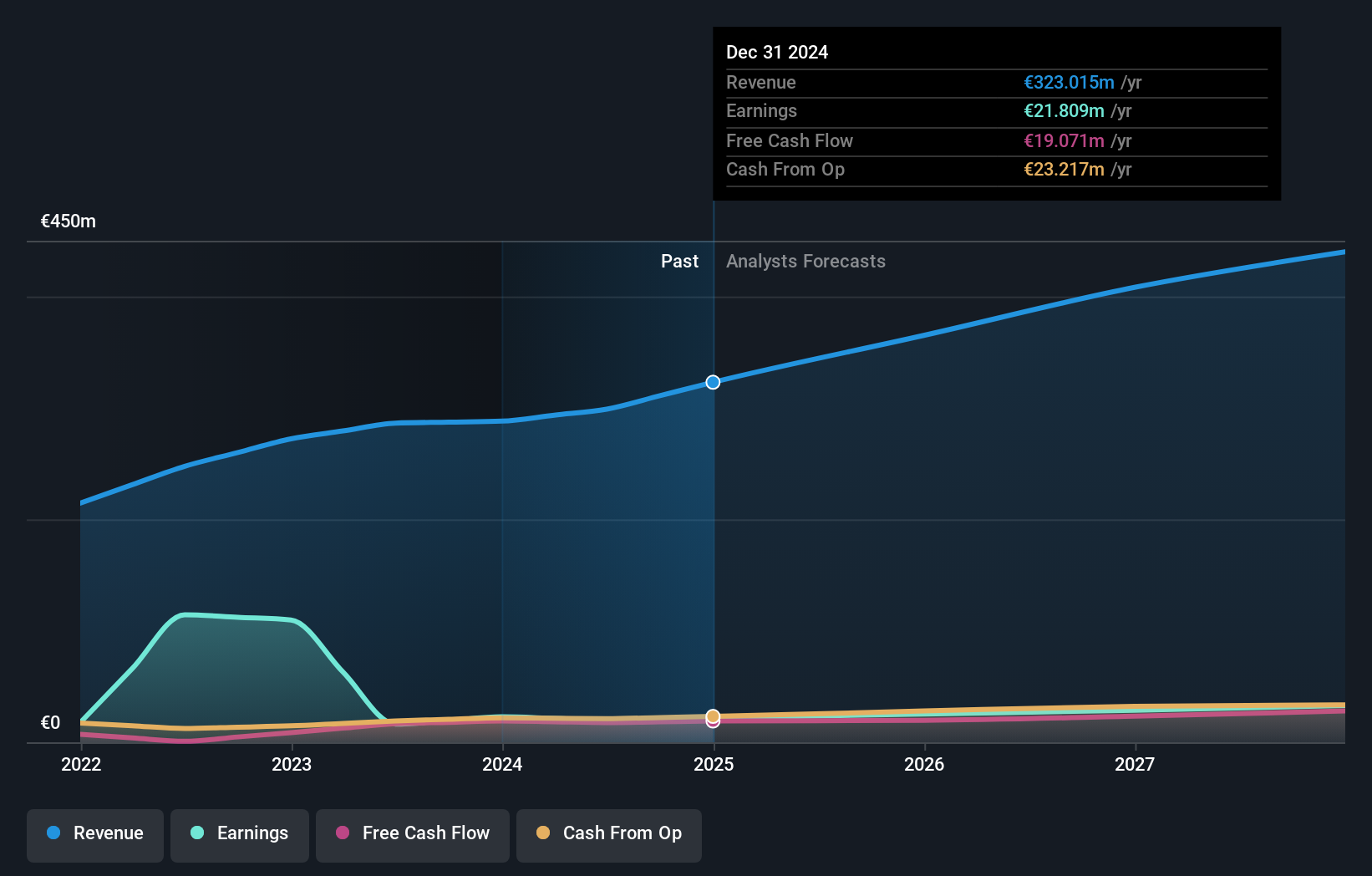

Sword Group, a prominent player in the tech sector, reported half-year sales of €156.89 million, up from €146.12 million last year. Despite this revenue growth of 13.6% annually, net income saw a 7.3% decline to €10.16 million from €12.87 million previously, reflecting challenges in profitability amidst expansion efforts. Notably, their earnings are forecasted to grow at an impressive rate of 18.5% per year over the next three years, outpacing both the IT industry and French market averages. The company’s commitment to innovation is evident with significant R&D investments aimed at enhancing their software solutions and AI capabilities—key drivers for future growth in an increasingly digital economy where SaaS models dominate for recurring revenue streams. Sword Group's strategic focus on high-quality earnings and robust client relationships positions it well despite current profitability pressures; however, investors should remain aware of potential volatility as they navigate this high-growth trajectory.

- Click to explore a detailed breakdown of our findings in Sword Group's health report.

Review our historical performance report to gain insights into Sword Group's's past performance.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA designs, integrates, and operates mission-critical systems worldwide with a market cap of €281.82 million.

Operations: The company generates revenue primarily from designing, integrating, and operating mission-critical systems globally. With a market cap of €281.82 million, it focuses on providing advanced technological solutions for various industries.

CS Communication & Systemes has shown a notable commitment to innovation, with R&D expenses accounting for 10.4% of its total revenue. This emphasis on research and development is crucial in the tech sector, particularly as software firms transition to SaaS models that ensure recurring revenue from subscriptions. Despite being unprofitable currently, the company's forecasted annual profit growth of 88.23% over the next three years indicates strong potential for future profitability. Additionally, their projected revenue growth rate of 10.4% per year surpasses the French market average of 5%, highlighting their competitive edge in a rapidly evolving industry.

- Click here and access our complete health analysis report to understand the dynamics of CS Communication & Systemes.

Learn about CS Communication & Systemes' historical performance.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa and has a market cap of approximately €10.28 billion.

Operations: Vivendi SE generates revenue primarily from its Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million) segments, with additional contributions from Prisma Media and Vivendi Village. The company’s operations are diversified across multiple regions including France, Europe, the Americas, Asia/Oceania, and Africa.

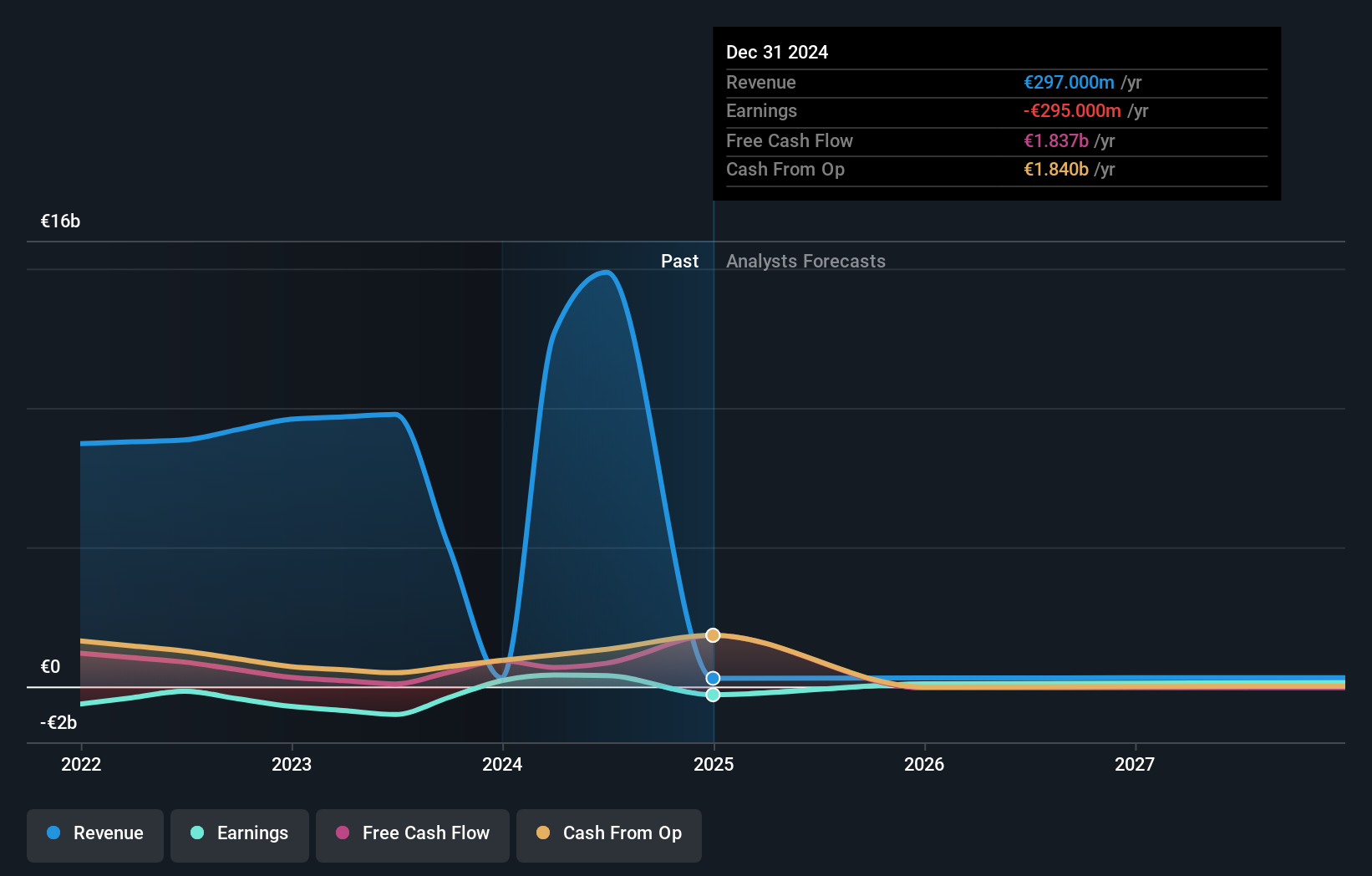

Vivendi's revenue growth of 9.3% annually outpaces the French market's 5.8%, reflecting its solid positioning in the tech sector. The company's earnings are forecasted to grow at an impressive 30.6% per year, significantly higher than the market average of 12.3%. R&D expenses have been substantial, contributing to innovation and future growth potential; for instance, Vivendi spent €184 million on share repurchases this year, demonstrating confidence in its financial health and future prospects.

- Unlock comprehensive insights into our analysis of Vivendi stock in this health report.

Gain insights into Vivendi's historical performance by reviewing our past performance report.

Where To Now?

- Navigate through the entire inventory of 44 Euronext Paris High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Very undervalued with solid track record.