As the French CAC 40 Index experiences a notable climb, buoyed by hopes for potential interest rate cuts and China's economic stimulus measures, investors are increasingly focused on growth opportunities within the Euronext Paris. In this climate of renewed optimism, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 20.6% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.8% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| Adocia (ENXTPA:ADOC) | 11.9% | 64% |

| Munic (ENXTPA:ALMUN) | 29.2% | 150% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

We're going to check out a few of the best picks from our screener tool.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue segments are comprised of €4.19 billion from EMEA, €705 million from the Americas, and €480 million from APAC.

Insider Ownership: 13.1%

Exclusive Networks is experiencing significant earnings growth, forecasted at 33.5% annually, surpassing the French market's average. Despite lower profit margins this year compared to last, the company remains undervalued by 14.8% against its estimated fair value. Recently, a consortium led by Permira and Clayton, Dubilier & Rice offered to take Exclusive Networks private for €2.2 billion (US$2.4 billion), reflecting a substantial insider ownership and offering a premium on share price amidst regulatory approval processes.

- Get an in-depth perspective on Exclusive Networks' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Exclusive Networks' shares may be trading at a premium.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France that specializes in developing long-acting injectables across various therapeutic areas, with a market cap of €450.86 million.

Operations: The company's revenue is primarily generated from its pharmaceuticals segment, amounting to €11.95 million.

Insider Ownership: 15.8%

MedinCell's revenue is forecast to grow at 46.2% annually, significantly outpacing the French market, with expectations of profitability within three years. The company trades well below its estimated fair value and was recently added to the S&P Global BMI Index. Strategic partnerships, such as with AbbVie and Teva, highlight MedinCell's innovative long-acting injectable technology platform, potentially yielding up to $1.9 billion in milestones plus royalties from commercialized products like UZEDY.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- The analysis detailed in our MedinCell valuation report hints at an deflated share price compared to its estimated value.

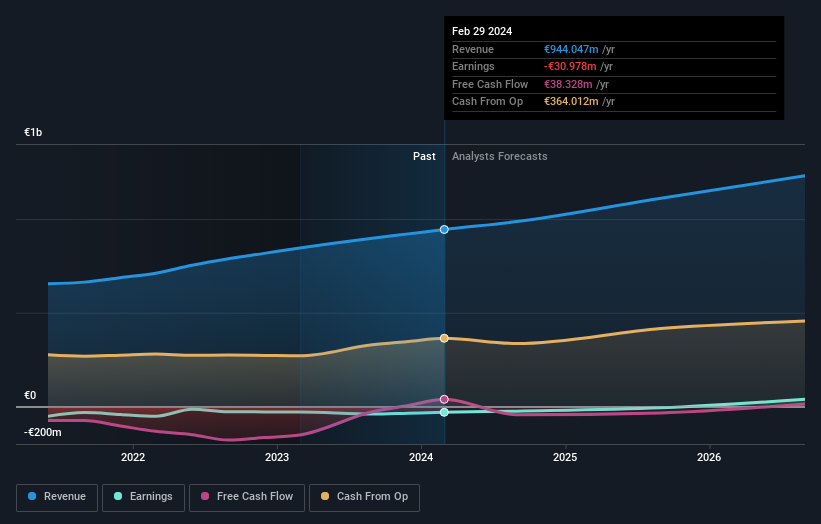

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of €1.28 billion.

Operations: The company's revenue is derived from segments including Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud (€185.43 million).

Insider Ownership: 10.5%

OVH Groupe is expected to achieve profitability within three years, with earnings forecasted to grow at 101.12% annually, surpassing the average market growth. Although its revenue growth rate of 9.7% per year outpaces the broader French market, it remains below high-growth thresholds. The stock trades at a 25.8% discount to its estimated fair value but exhibits significant share price volatility and low projected return on equity (1.7%) in three years.

- Click here to discover the nuances of OVH Groupe with our detailed analytical future growth report.

- According our valuation report, there's an indication that OVH Groupe's share price might be on the cheaper side.

Turning Ideas Into Actions

- Dive into all 23 of the Fast Growing Euronext Paris Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure.

Flawless balance sheet with reasonable growth potential.