- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

European Growth Stocks With Insider Ownership Up To 13%

Reviewed by Simply Wall St

As European markets show tentative optimism with the pan-European STOXX Europe 600 Index rising by 0.54%, the focus remains on potential trade deals between the EU and U.S., which are bolstering investor sentiment. In this environment, growth companies with high insider ownership can be particularly appealing, as they may indicate strong confidence from those closest to the business—an important consideration when navigating uncertain economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's dive into some prime choices out of the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €986.24 million.

Operations: The company's revenue segments are distributed across the Americas (€176.26 million), Asia-Pacific (€134.84 million), and EMEA (Europe, Middle East, and Africa) (€220.46 million).

Insider Ownership: 12.7%

Lectra's strategic expansion of its Valia platforms in key markets and partnerships with companies like Edgecombe Furniture highlight its commitment to driving Industry 4.0 advancements. Despite a low forecasted return on equity, Lectra's earnings are expected to grow significantly at 21.8% annually, outpacing the French market. Trading well below fair value estimates and with no recent insider trading activity, Lectra presents potential growth opportunities aligned with industry-specific technological innovations.

- Navigate through the intricacies of Lectra with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Lectra implies its share price may be lower than expected.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★★

Overview: MedinCell S.A. is a pharmaceutical company based in France that specializes in developing long-acting injectables across various therapeutic areas, with a market cap of €565.99 million.

Operations: The company's revenue segment is comprised entirely of its pharmaceuticals division, generating €27.73 million.

Insider Ownership: 13.9%

MedinCell's significant insider ownership aligns with its robust growth prospects, highlighted by a forecasted annual revenue increase of 26%, surpassing the French market average. Despite recent net losses narrowing from €25.04 million to €18.44 million, MedinCell is expected to achieve profitability within three years, supported by a projected 130.82% annual earnings growth rate. Trading at 80.3% below fair value estimates and with no substantial insider trading activity recently, it offers compelling long-term potential for investors seeking high-growth opportunities in Europe.

- Click to explore a detailed breakdown of our findings in MedinCell's earnings growth report.

- The valuation report we've compiled suggests that MedinCell's current price could be quite moderate.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry with a market capitalization of SEK19.52 billion.

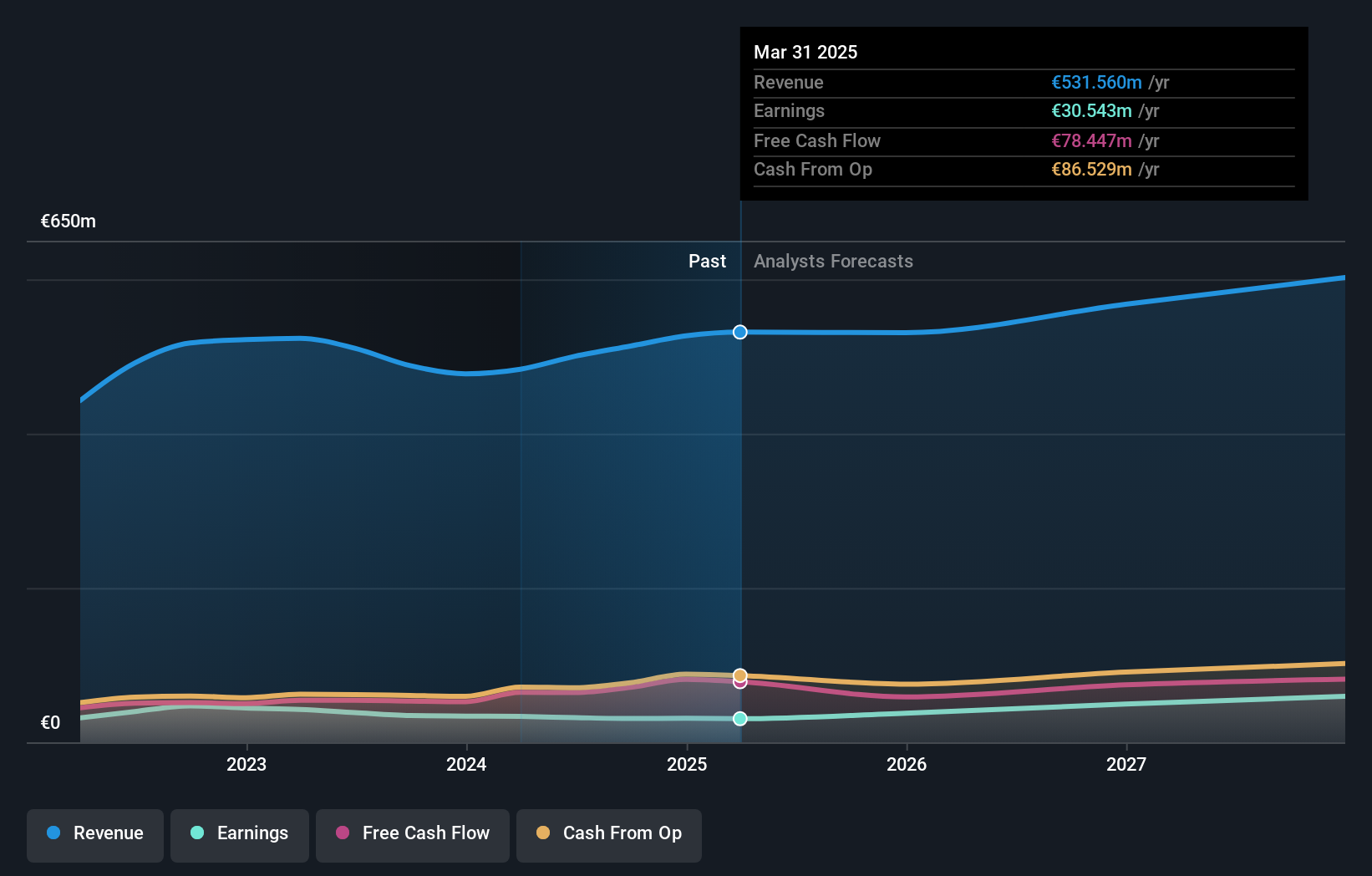

Operations: The company's revenue segments include Medtech at €142.10 million, Diagnostics at €22.50 million, Specialty Pharma at €178.20 million, and Veterinary Services at €61.60 million.

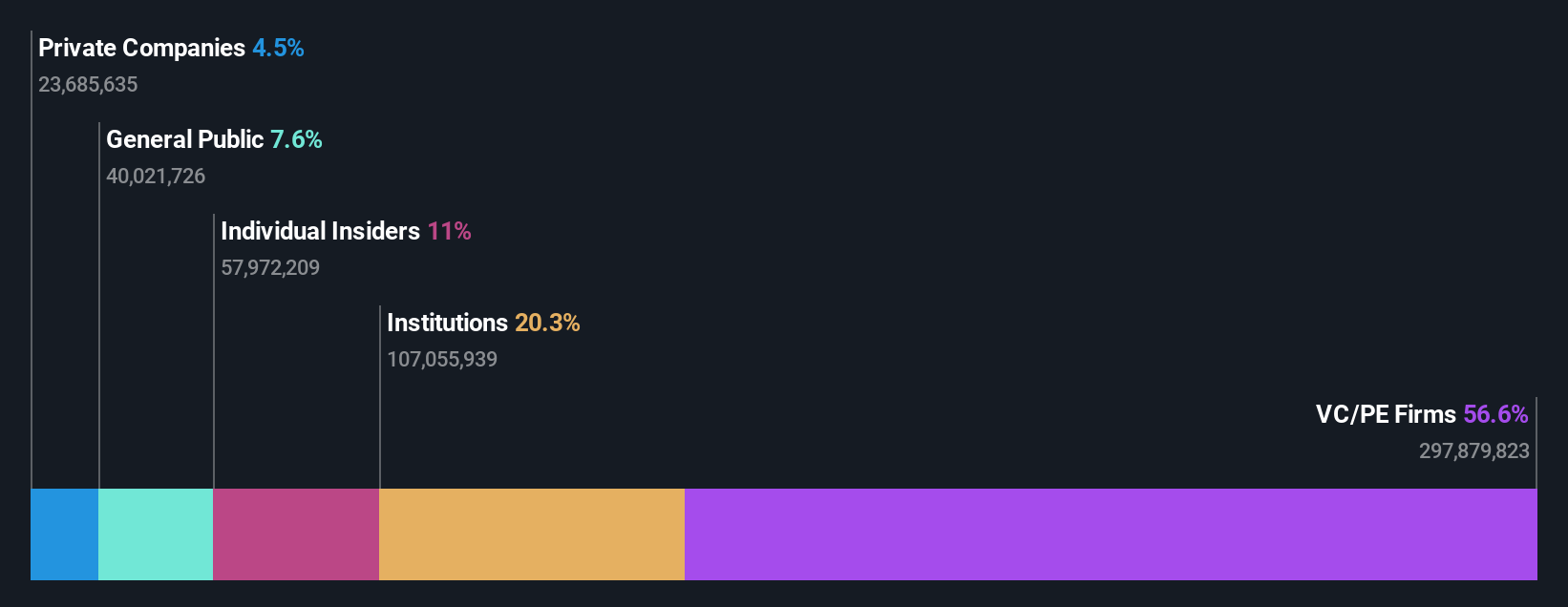

Insider Ownership: 10.9%

Vimian Group exhibits strong growth potential with earnings forecasted to grow significantly at 44.6% annually, outpacing the Swedish market. Recent insider activity indicates more shares have been bought than sold, reflecting confidence in its future prospects despite recent executive changes. The company reported a notable increase in net income for Q2 2025, reaching €8.3 million from €4.9 million the previous year, while trading below estimated fair value enhances its attractiveness for growth-focused investors in Europe.

- Click here and access our complete growth analysis report to understand the dynamics of Vimian Group.

- Insights from our recent valuation report point to the potential overvaluation of Vimian Group shares in the market.

Summing It All Up

- Investigate our full lineup of 216 Fast Growing European Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives