Amid a period of fluctuating global markets, the French stock market has shown resilience with the CAC 40 Index experiencing modest gains. This stability presents an opportune moment for investors to consider potentially undervalued stocks within Euronext Paris as they seek value in July 2024. A good stock often combines robust fundamentals with a price that does not fully reflect its future prospects, particularly in a market environment where broader economic indicators suggest potential for growth or recovery.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wavestone (ENXTPA:WAVE) | €56.20 | €93.21 | 39.7% |

| Lectra (ENXTPA:LSS) | €28.50 | €44.00 | 35.2% |

| Kalray (ENXTPA:ALKAL) | €10.18 | €17.99 | 43.4% |

| Thales (ENXTPA:HO) | €153.25 | €266.42 | 42.5% |

| Tikehau Capital (ENXTPA:TKO) | €23.00 | €32.94 | 30.2% |

| ENENSYS Technologies (ENXTPA:ALNN6) | €0.628 | €1.09 | 42.1% |

| Vivendi (ENXTPA:VIV) | €11.08 | €16.42 | 32.5% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.74 | €9.98 | 42.5% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.92 | €6.20 | 36.7% |

| Esker (ENXTPA:ALESK) | €186.10 | €259.28 | 28.2% |

Let's dive into some prime choices out of from the screener.

Esker (ENXTPA:ALESK)

Overview: Esker SA is a company that operates a cloud platform for finance and customer service professionals both in France and globally, with a market capitalization of approximately €1.10 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to €190.92 million.

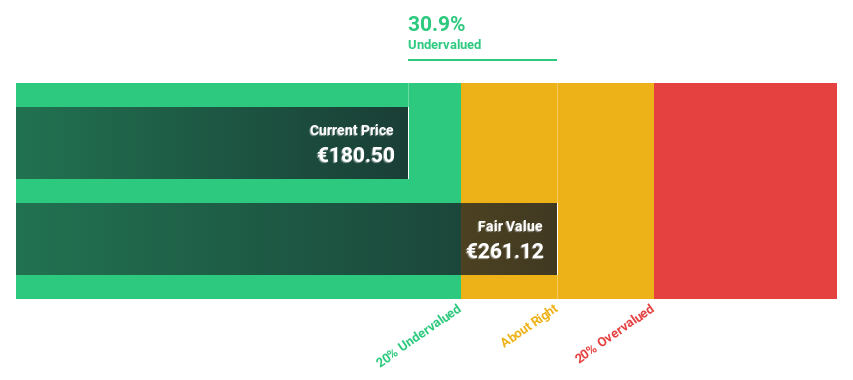

Estimated Discount To Fair Value: 28.2%

Esker, a French software company, appears undervalued based on discounted cash flow analysis, trading at €186.1 against a fair value estimate of €259.28—a 28.2% discount. Despite recent dividend cuts, Esker's strategic enhancements in its Source-to-Pay suite signal robust future prospects by integrating sustainability and ESG compliance—factors critical in today's regulatory environment. These developments are expected to support an earnings growth forecast of 25.21% annually over the next three years, outpacing the French market prediction of 10.9%.

- Our comprehensive growth report raises the possibility that Esker is poised for substantial financial growth.

- Navigate through the intricacies of Esker with our comprehensive financial health report here.

Lectra (ENXTPA:LSS)

Overview: Lectra SA specializes in industrial intelligence solutions for the fashion, automotive, and furniture industries across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.08 billion.

Operations: The company generates revenue from the Americas and Asia Pacific regions, amounting to €170.33 million and €110.28 million respectively.

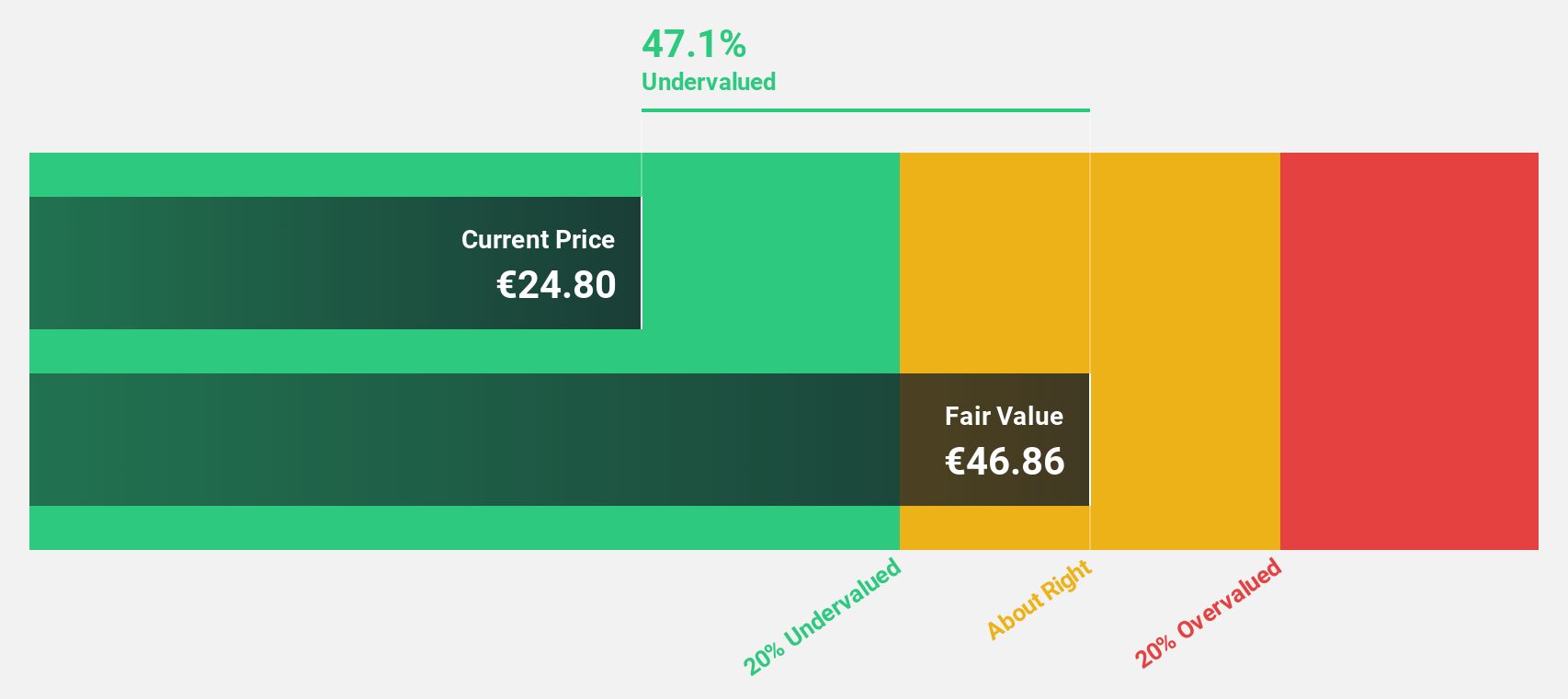

Estimated Discount To Fair Value: 35.2%

Lectra appears undervalued based on discounted cash flow, with its current trading price of €28.5 well below the estimated fair value of €44, marking a significant discount. While its revenue growth at 11.3% per year is modest compared to faster-growing sectors, it outpaces the French market average. Earnings are expected to surge by 28.6% annually over the next three years, exceeding market trends significantly. However, a lower forecasted return on equity at 13.3% tempers this outlook slightly.

- In light of our recent growth report, it seems possible that Lectra's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Lectra stock in this financial health report.

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is a France-based entertainment, media, and communication company with operations across Europe, the Americas, Asia/Oceania, and Africa, boasting a market capitalization of €11.35 billion.

Operations: Vivendi's revenue is generated from several segments including Gameloft (€0.31 billion), Lagardère (€0.67 billion), Havas Group (€2.87 billion), Prisma Media (€0.31 billion), Canal + Group (€6.06 billion), and New Initiatives (€0.15 billion).

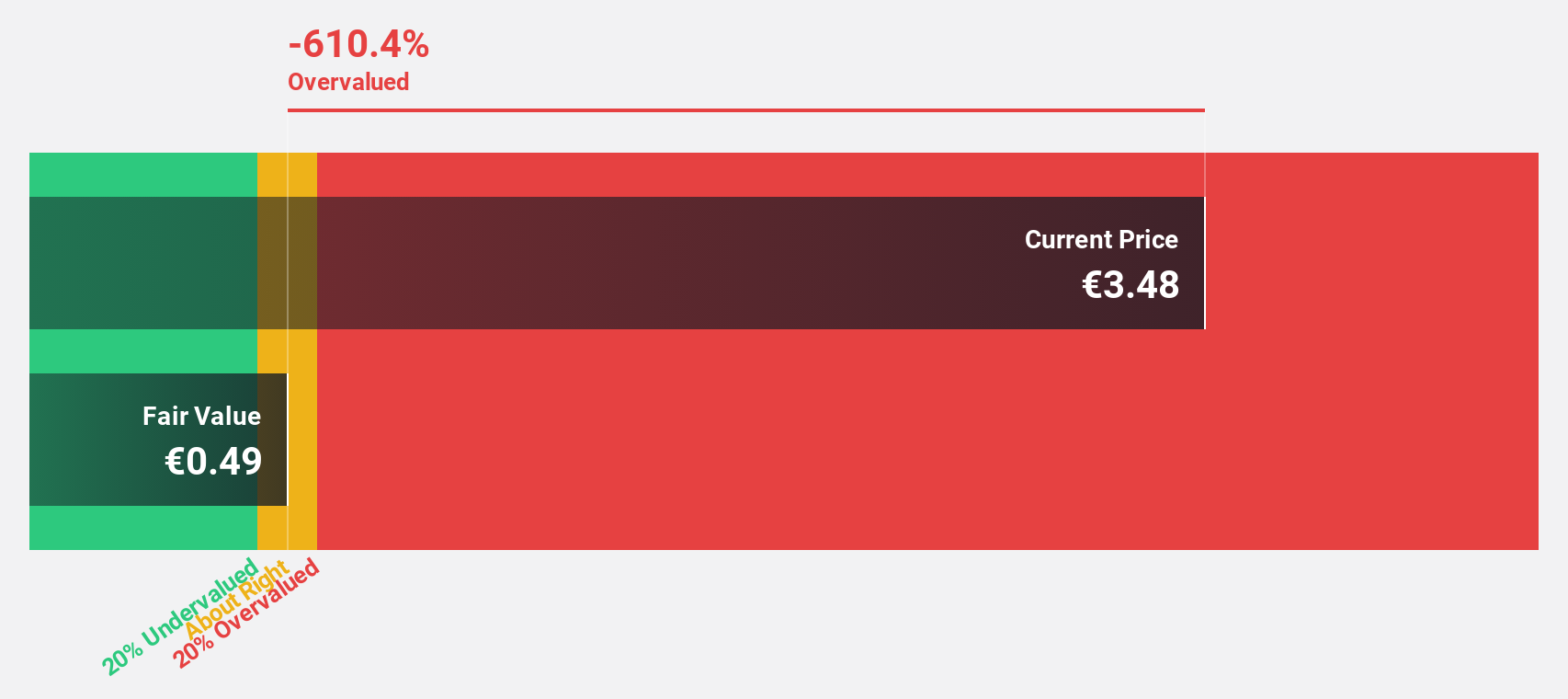

Estimated Discount To Fair Value: 32.5%

Vivendi, currently trading at €11.08, is perceived as undervalued with a fair value estimation of €16.42 based on discounted cash flow analysis. Despite recent legal settlements and plans for Canal+'s potential listing, the firm's financial outlook shows promise with expected annual earnings growth of 29.3% over the next three years—substantially outpacing the French market's forecast of 10.9%. However, its projected return on equity remains low at 6%, suggesting some caution in assessing its overall investment potential.

- According our earnings growth report, there's an indication that Vivendi might be ready to expand.

- Take a closer look at Vivendi's balance sheet health here in our report.

Where To Now?

- Dive into all 16 of the Undervalued Euronext Paris Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Esker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALESK

Esker

Operates cloud platform for finance, procurement, and customer service professionals in France, Germany, the United Kingdom, Southern Europe, Australia, Asia, the Americas, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives