- France

- /

- Auto Components

- /

- ENXTPA:FR

3 Top Value Stocks On Euronext Paris Trading Up To 46.7% Below Intrinsic Estimates

Reviewed by Simply Wall St

As the French CAC 40 Index experiences slight fluctuations amid mixed earnings reports and economic data, investors are increasingly turning their attention to value stocks that may be trading below their intrinsic estimates. In this article, we will explore three top value stocks on Euronext Paris that are currently priced up to 46.7% below their intrinsic worth, offering potential opportunities for discerning investors in today's market environment.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cogelec (ENXTPA:ALLEC) | €11.50 | €20.55 | 44% |

| Valeo (ENXTPA:FR) | €10.24 | €17.48 | 41.4% |

| MEMSCAP (ENXTPA:MEMS) | €6.36 | €9.11 | 30.2% |

| Thales (ENXTPA:HO) | €147.05 | €275.88 | 46.7% |

| Lectra (ENXTPA:LSS) | €25.95 | €46.23 | 43.9% |

| NSE (ENXTPA:ALNSE) | €29.50 | €51.15 | 42.3% |

| Vivendi (ENXTPA:VIV) | €9.876 | €16.19 | 39% |

| Guillemot (ENXTPA:GUI) | €5.84 | €8.21 | 28.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €6.10 | €10.29 | 40.7% |

| Vogo (ENXTPA:ALVGO) | €3.52 | €5.76 | 38.9% |

We'll examine a selection from our screener results.

Valeo (ENXTPA:FR)

Overview: Valeo SE designs, produces, and sells automotive products and systems globally, with a market cap of €2.49 billion.

Operations: Revenue segments include Visibility Systems at €5.58 billion.

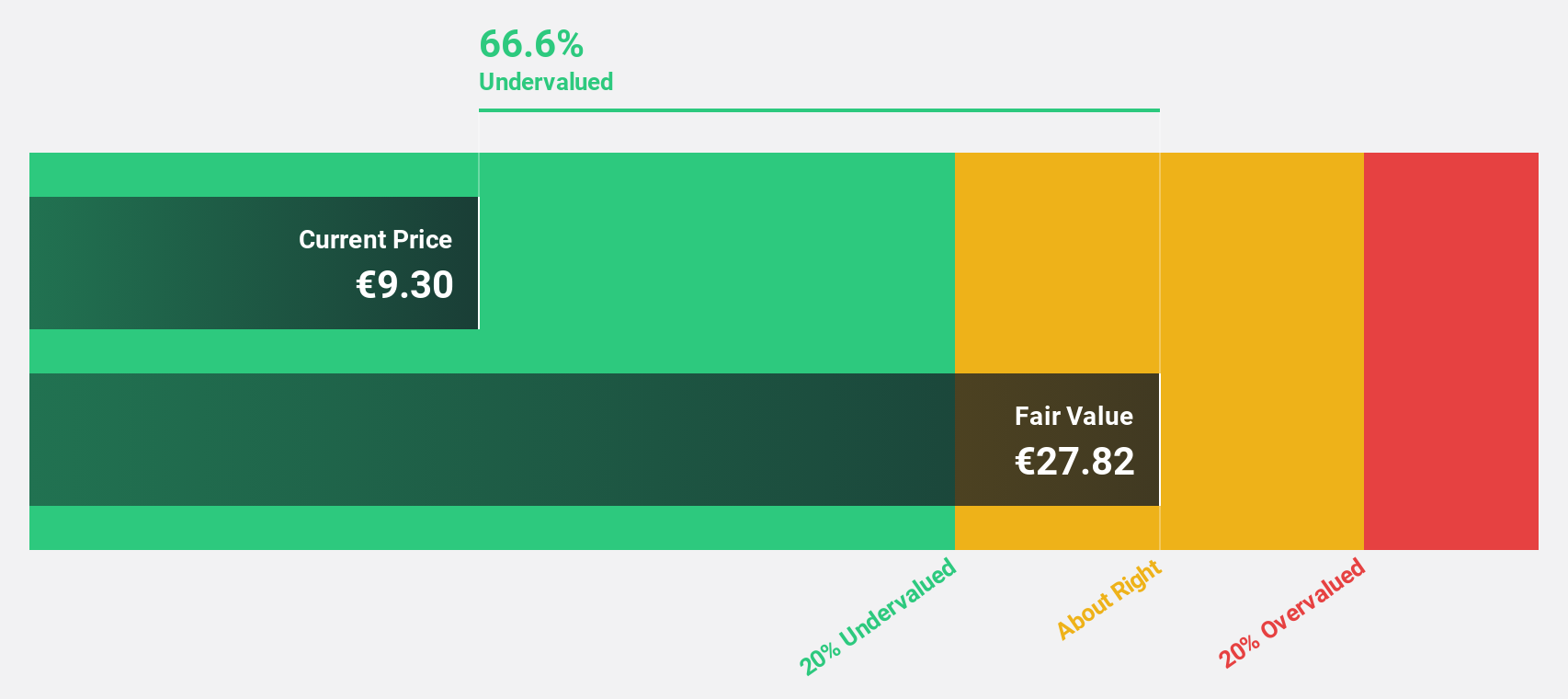

Estimated Discount To Fair Value: 41.4%

Valeo SE appears undervalued based on discounted cash flow analysis, trading at €10.24 against an estimated fair value of €17.48. Despite a high debt level and unstable dividend track record, the company's earnings are forecast to grow significantly at 48.84% annually over the next three years, outpacing the French market's 11.8%. Recent guidance revisions lowered sales expectations for 2024 and 2025, yet net income improved to €141 million in H1 2024 from €119 million a year ago.

- According our earnings growth report, there's an indication that Valeo might be ready to expand.

- Get an in-depth perspective on Valeo's balance sheet by reading our health report here.

Thales (ENXTPA:HO)

Overview: Thales S.A. offers solutions in defence and security, aerospace and space, digital identity and security, and transport markets globally, with a market cap of €30.20 billion.

Operations: The company's revenue segments include €5.49 billion from Aerospace, €3.69 billion from Digital Identity and Security, and €10.56 billion from Defence and Security (excluding Digital Identity and Security).

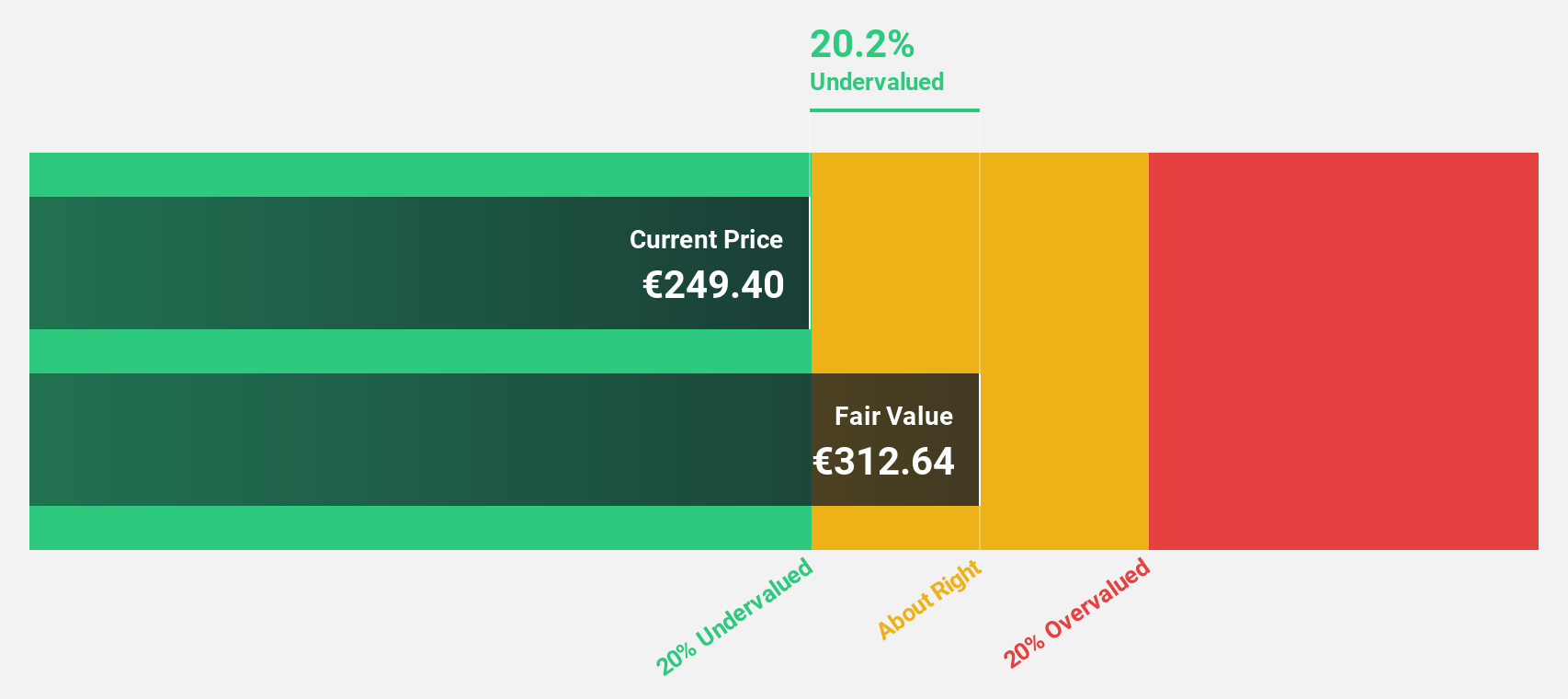

Estimated Discount To Fair Value: 46.7%

Thales S.A., trading at €147.05, is significantly undervalued against an estimated fair value of €275.88 based on discounted cash flow analysis. Despite a high debt level and unstable dividend track record, Thales's earnings are projected to grow 16.65% annually, outpacing the French market's 11.8%. Recent H1 2024 results showed sales increasing to €9.49 billion from €8.72 billion and net income rising to €1.02 billion from €648.9 million year-over-year, indicating strong cash flow performance amidst strategic expansions in cybersecurity and aviation sectors.

- Our growth report here indicates Thales may be poised for an improving outlook.

- Navigate through the intricacies of Thales with our comprehensive financial health report here.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern and Southern Europe, the Americas, and the Asia Pacific, with a market cap of €982.97 million.

Operations: The company's revenue segments are €172.65 million from the Americas and €118.54 million from the Asia-Pacific region.

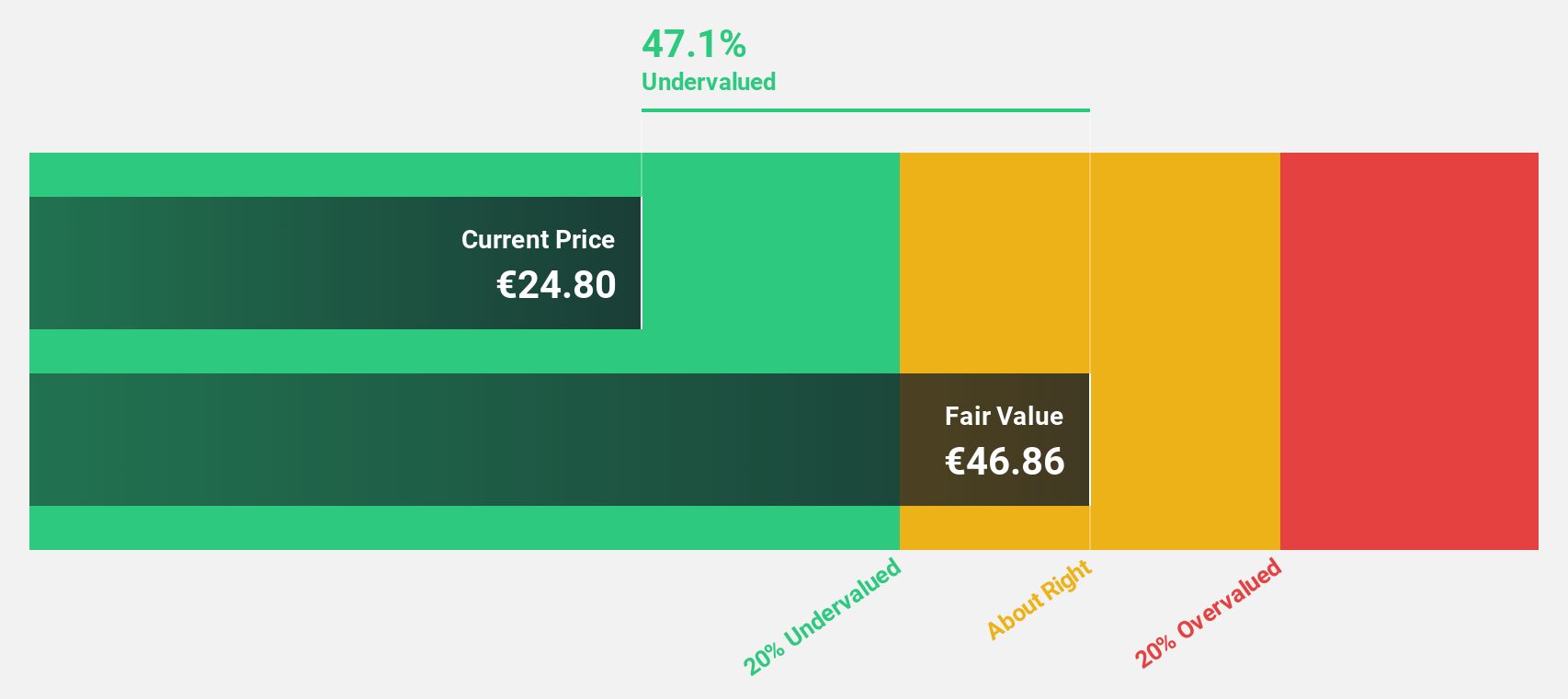

Estimated Discount To Fair Value: 43.9%

Lectra, trading at €25.95, is undervalued compared to its estimated fair value of €46.23 based on discounted cash flow analysis. Analysts forecast earnings growth at 32.6% annually, surpassing the French market's 11.8%. Despite a recent dip in net income to €12.51 million for H1 2024 from €14.47 million a year ago, revenue increased to €262.29 million from €239.55 million, highlighting robust cash flow potential amidst market challenges and strategic initiatives.

- In light of our recent growth report, it seems possible that Lectra's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Lectra's balance sheet health report.

Make It Happen

- Reveal the 18 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives