Exploring Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative And 2 Other Hidden Small Cap Gems

Reviewed by Simply Wall St

As the European markets react to the latest interest rate cut by the ECB, France's CAC 40 Index has shown a modest gain of 1.54%, reflecting cautious optimism amid signs of weakening economic growth and slowing inflation in the eurozone. This environment presents an opportune moment to explore some lesser-known small-cap stocks that might be poised for growth. In this article, we will uncover three hidden gems in France’s market, starting with Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 72.14% | 5.72% | 19.86% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Fiducial Real Estate | 33.77% | 1.63% | 3.30% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, with a market cap of €919.62 million.

Operations: The cooperative generates revenue through various banking products and services catering to individuals, professionals, farmers, businesses, and other client groups in France. With a market cap of €919.62 million, it focuses on diverse financial offerings within the regional market.

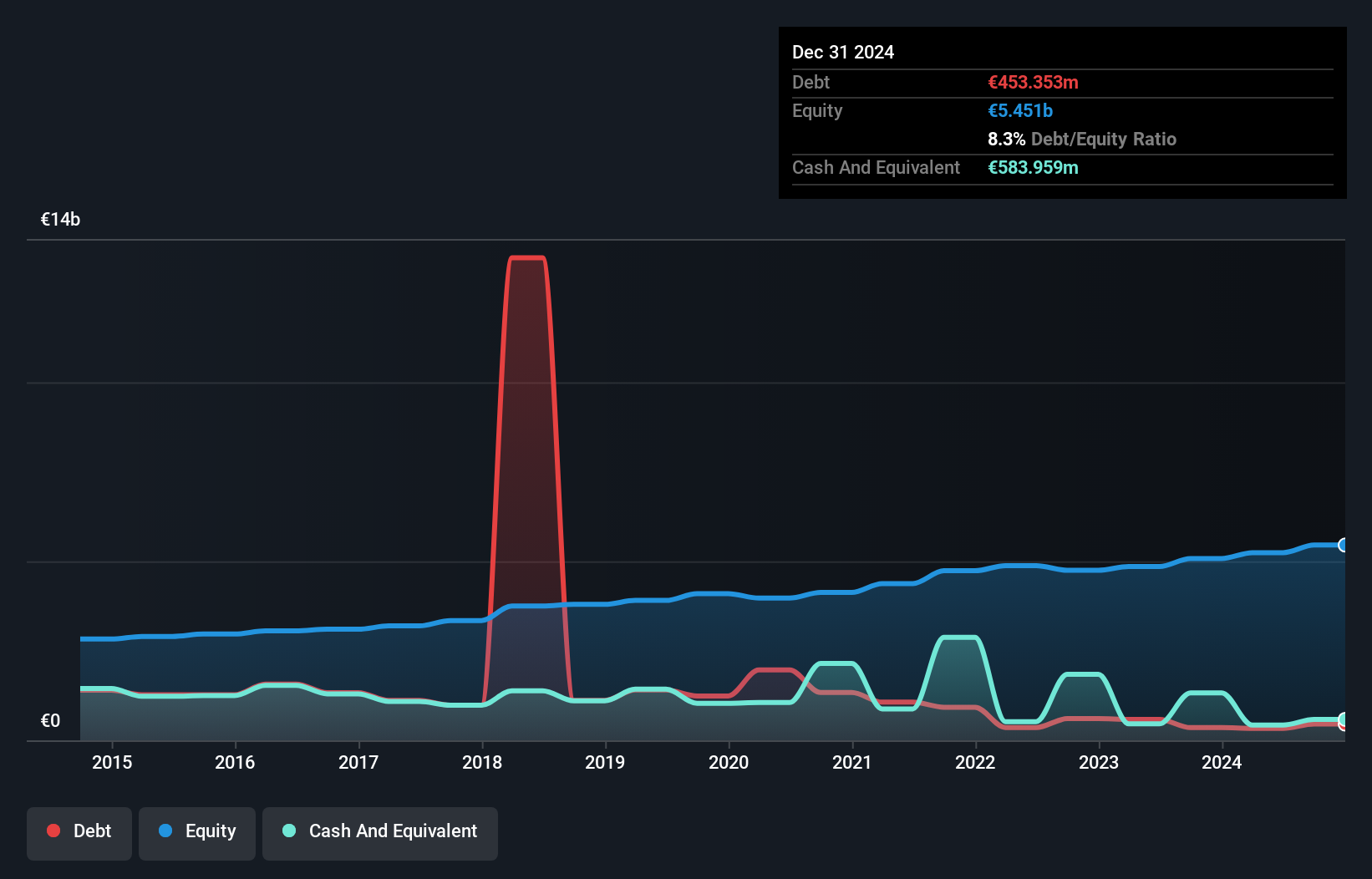

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative, with total assets of €35.3B and equity of €5.2B, has shown resilience in a challenging market. Total deposits are €28.2B, while total loans stand at €29.0B. The company has an appropriate level of bad loans (1.4%) and a sufficient allowance for bad loans (133%). Earnings growth over the past year was 1.3%, outperforming the industry average (-4.9%). Additionally, 94% of its liabilities come from low-risk funding sources like customer deposits, providing stability in uncertain times.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France with a market cap of €407.55 million.

Operations: The company's revenue is primarily derived from its Proximity Bank segment (€253.67 million) and Management for Own Account and Miscellaneous activities (€92.57 million).

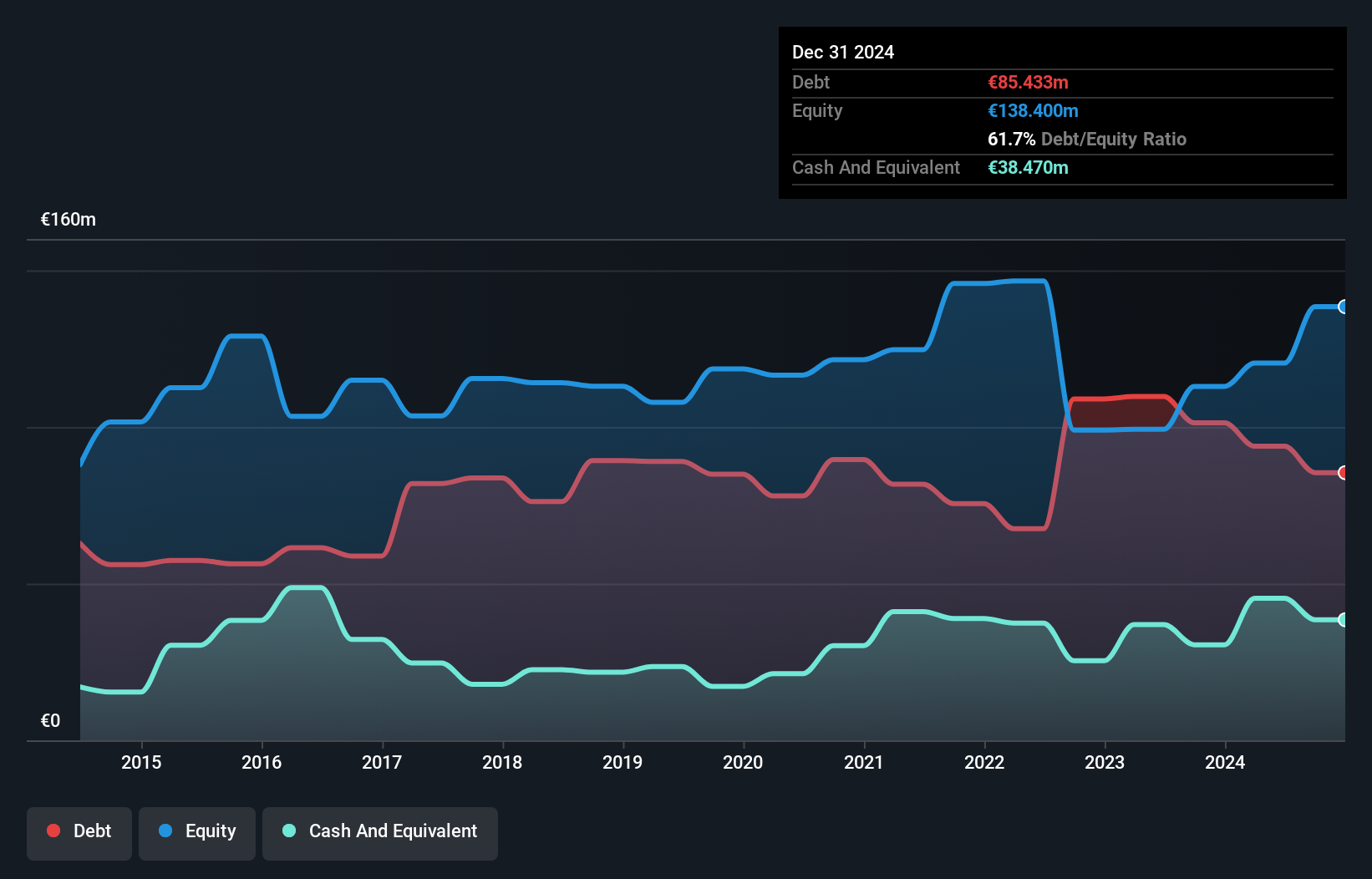

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative, with total assets of €16.9B and equity of €2.7B, stands out for its robust financial health. Deposits total €13.5B against loans of €14.1B, supported by a sufficient allowance for bad loans at 134%. Impressively, earnings grew by 19.5% over the past year, outperforming the industry average of -4.9%. Trading at 61.9% below estimated fair value suggests potential undervaluation for investors seeking growth opportunities in France's banking sector.

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linedata Services S.A. develops, publishes, and distributes financial software across Southern Europe, Northern Europe, North America, and Asia with a market cap of €379.81 million.

Operations: Linedata Services generates revenue through the development, publication, and distribution of financial software across various regions. The company's market cap stands at €379.81 million.

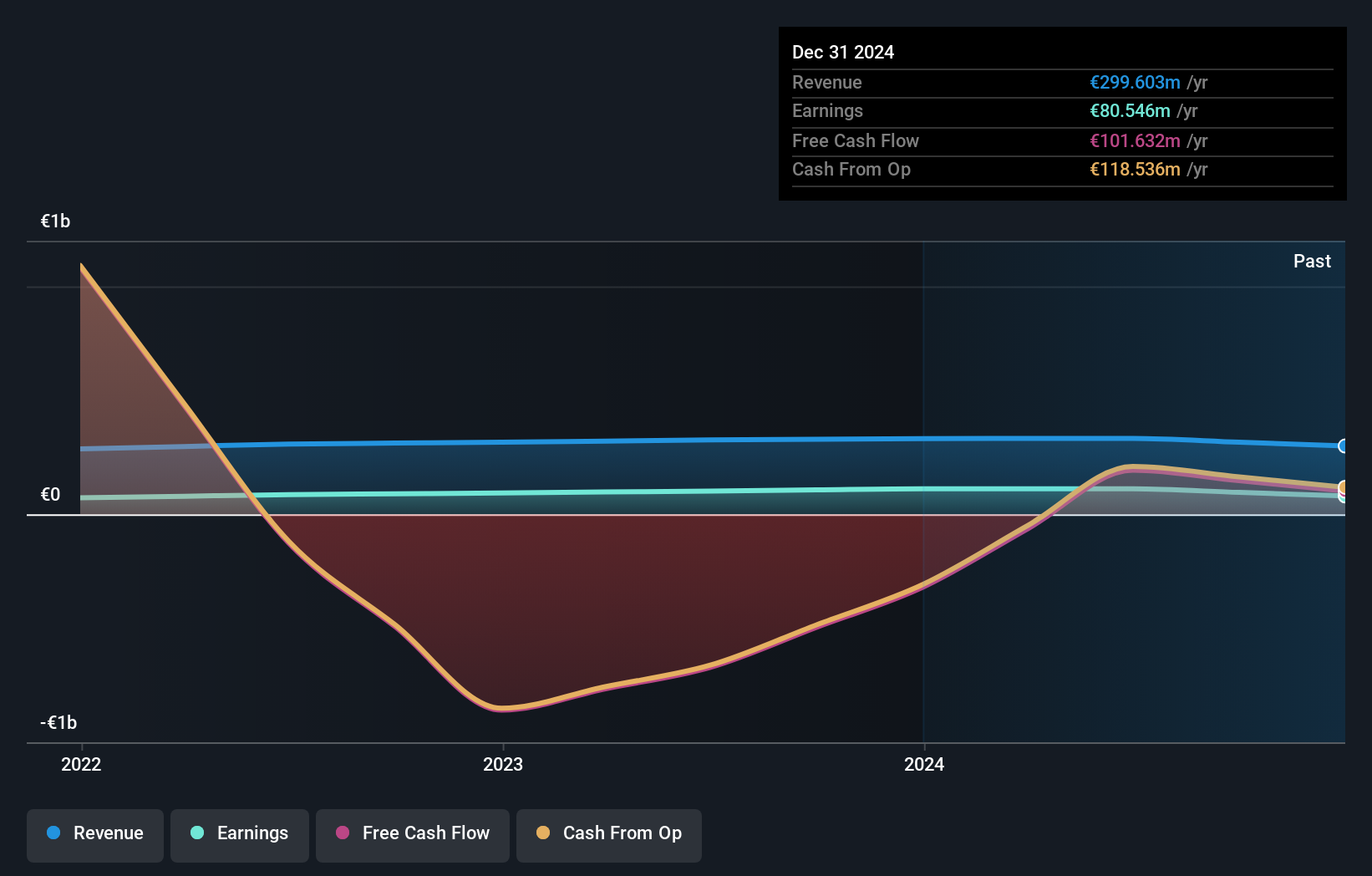

Linedata Services has demonstrated solid financial performance with earnings growing 22% over the past year, outpacing the software industry’s 10.6%. The company reported net income of €10.55 million for H1 2024, up from €8.48 million a year ago, and basic EPS rose to €2.13 from €1.71. Despite a high net debt to equity ratio of 40.3%, interest payments are well covered by EBIT at 9.6x coverage, reflecting robust operational efficiency and profitability

- Click here and access our complete health analysis report to understand the dynamics of Linedata Services.

Assess Linedata Services' past performance with our detailed historical performance reports.

Taking Advantage

- Unlock more gems! Our Euronext Paris Undiscovered Gems With Strong Fundamentals screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Euronext Paris Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LIN

Linedata Services

Develops, publishes, and distributes financial software in Southern Europe, Northern Europe, North America, and Asia.

Outstanding track record, undervalued and pays a dividend.