What Recent 8% Rally Means for Dassault Systèmes Amid AI Sector Momentum

Reviewed by Bailey Pemberton

Thinking about what to do with your Dassault Systèmes shares, or considering buying in? You are definitely not alone. Over the past month, this well-known software company has bounced back with an 8.4% price gain, topping off a smaller 1.9% increase over the last week. However, if you zoom out, the picture changes, with the stock still down 12.2% year-to-date and having lost nearly 15% over the last twelve months. Clearly, perceptions around Dassault Systèmes' risk and growth potential are shifting, and investors are watching closely as the broader tech sector faces uncertainty while innovation trends continue to evolve.

Some of these ups and downs may reflect recent optimism around digital transformation and renewed investor interest in European tech. Dassault Systèmes’ longer-term returns are a reminder of how quickly sentiment can change. Is the stock undervalued at its current price of €29.05? If we look strictly at a valuation score, which adds 1 point for each of 6 key checks a company passes for being undervalued, Dassault Systèmes receives a score of 0 out of 6. At first glance, that may not sound appealing, but as any seasoned investor knows, headline scores rarely tell the full story.

Let’s break down the main valuation approaches and see where Dassault Systèmes lands. Keep in mind there is a smarter, more nuanced view on valuation waiting for us at the end of this piece.

Dassault Systèmes scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dassault Systèmes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s value. This approach aims to capture the real worth of a business by considering all the cash it is expected to generate in the years ahead, rather than focusing solely on short-term profits or earnings multiples.

For Dassault Systèmes, the most recent reported Free Cash Flow stands at €1.50 Billion. Analysts have forecasted steady growth, projecting this figure to reach around €2.28 Billion by 2029. While analyst estimates only extend for five years, further cash flow projections after 2029 have been extrapolated to offer a longer-term perspective.

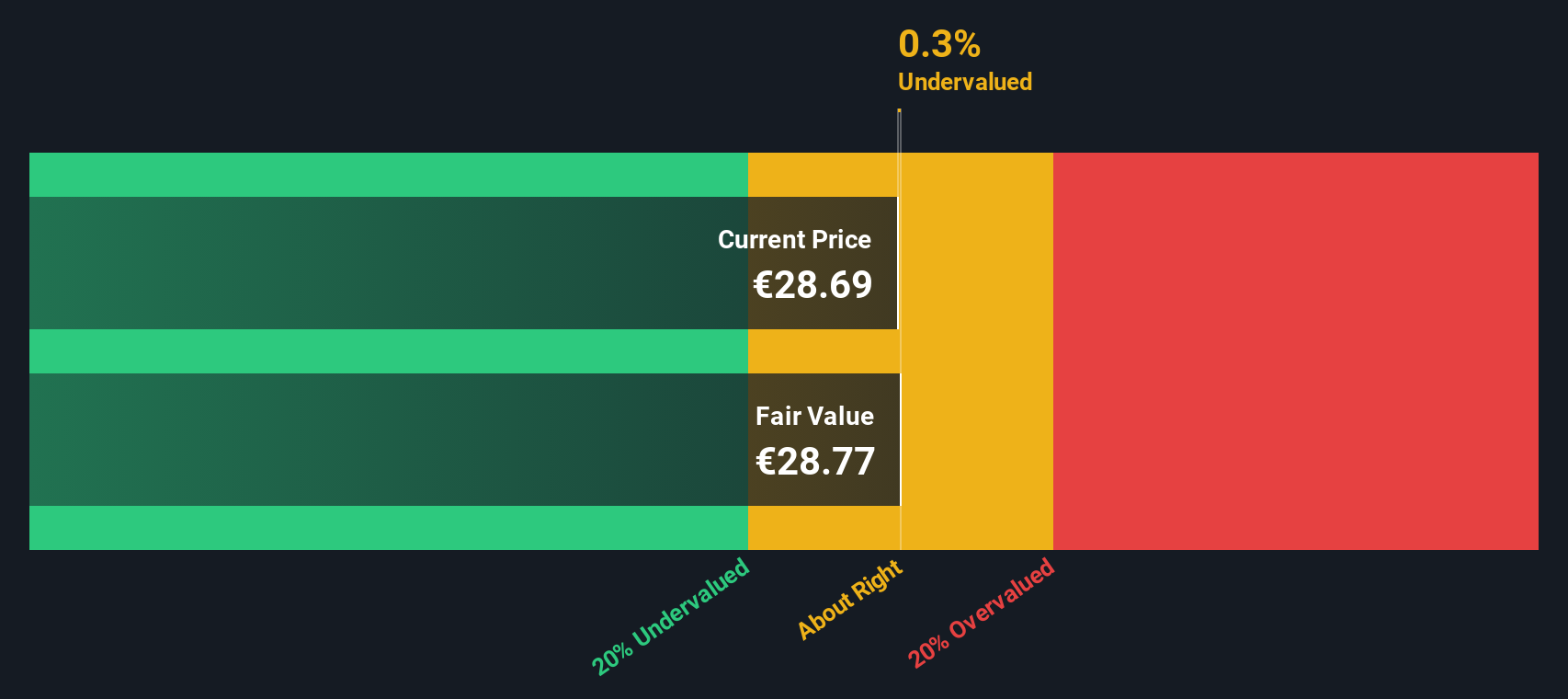

By consolidating all these projections, the DCF model estimates the company’s intrinsic fair value at €28.81 per share. With the current share price at €29.05, Dassault Systèmes appears to be trading just 0.8% above its estimated fair value. In other words, according to this approach, the company’s shares are priced close to where they should be based on future cash flow expectations.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Dassault Systèmes's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Dassault Systèmes Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like Dassault Systèmes, as it shows what investors are willing to pay today for a euro of current earnings. For companies with stable profits, the PE ratio helps investors quickly gauge if shares are expensive or cheap relative to peers and the broader sector.

Growth expectations and risk both play a major role in what counts as a “normal” or “fair” PE ratio. Higher projected growth or greater profitability can justify a higher PE ratio, while riskier or slower-growing companies typically trade at lower multiples.

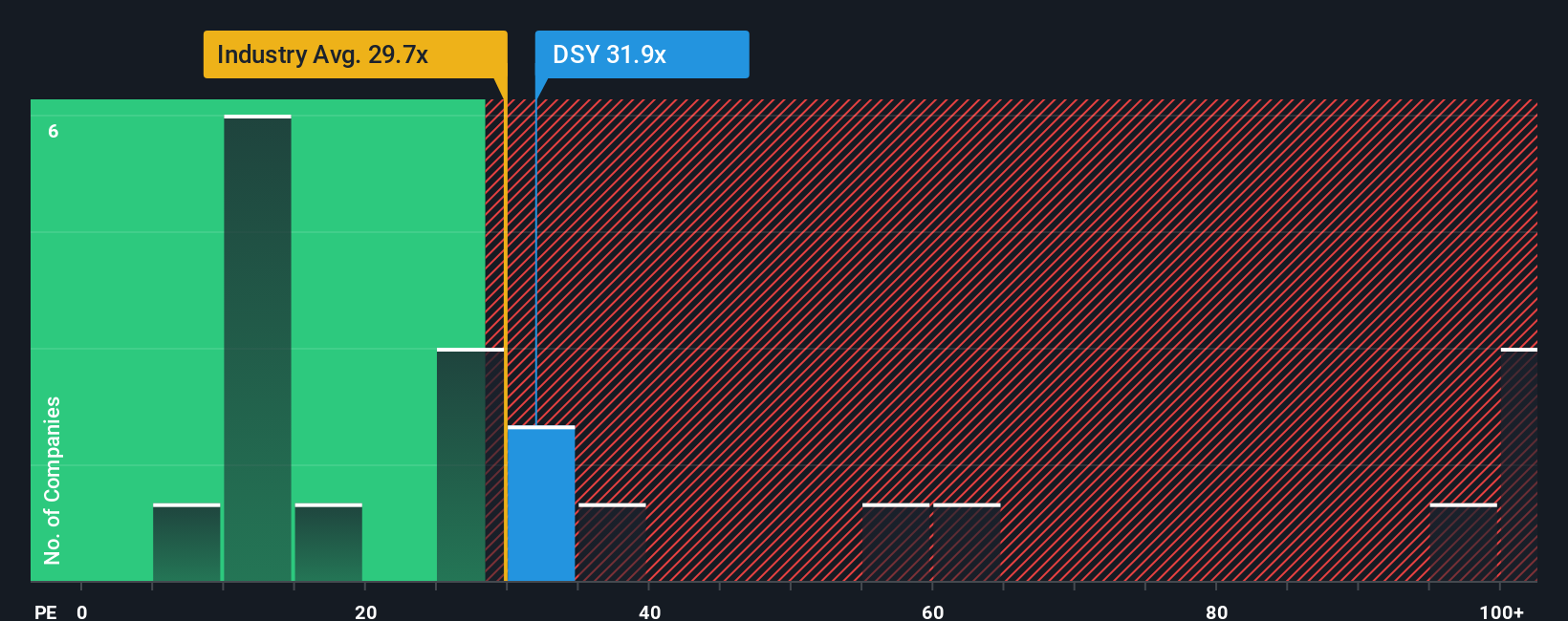

Dassault Systèmes’ current PE ratio is 33.6x, which is notably above the software industry average of 30.3x and above its peer group average of 23.9x. Put simply, the market is currently paying a premium for Dassault Systèmes compared to much of the sector.

But just comparing with peers does not capture the whole story. This is where Simply Wall St’s “Fair Ratio” comes in, a proprietary metric that estimates a justifiable PE multiple based on a company’s earnings growth, profit margins, business risks, industry, and even market cap. This metric provides a more tailored and nuanced view than just looking at averages, because it weighs multiple company-specific factors rather than relying on blunt yardsticks.

For Dassault Systèmes, the Fair Ratio stands at 29.1x. With the company trading at 33.6x, that is a premium of about 4.5x over what the Fair Ratio suggests. This means the market price reflects a higher level of optimism or perhaps lower perceived risk than Simply Wall St’s model would suggest is justified.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dassault Systèmes Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, including the reasons you believe in (or doubt) its future, clearly linked to your own assumptions for fair value, future revenue, earnings, and profit margins.

By connecting the company’s unique story to a financial forecast and an estimated fair value, Narratives help you cut through the noise and make sense of the numbers in the context of what really matters to you. This is exactly what Simply Wall St’s Narratives, available on the Community page and used by millions of investors, are designed to do. They enable you to map your investment perspective against real-time data and share it with others.

Narratives make it easier to decide when to buy or sell by letting you instantly compare your Fair Value to the current price, and they update automatically whenever new information, like breaking news or updated earnings, is released. For example, some investors see Dassault Systèmes as a long-term winner in digitalization and AI, expecting double-digit earnings growth and a fair value as high as €46.0, while others are more cautious on new product risks, giving a lowest fair value of €26.0. Every Narrative tells a different, personalized story of what makes the company a buy, hold, or sell right now.

Do you think there's more to the story for Dassault Systèmes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DSY

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion