In October 2024, the French market has been navigating a complex landscape marked by geopolitical tensions in the Middle East and cautious investor sentiment, as evidenced by a notable decline of 3.21% in France's CAC 40 Index. Amid these challenges, small-cap stocks often present unique opportunities for growth and resilience due to their potential for innovation and agility in adapting to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

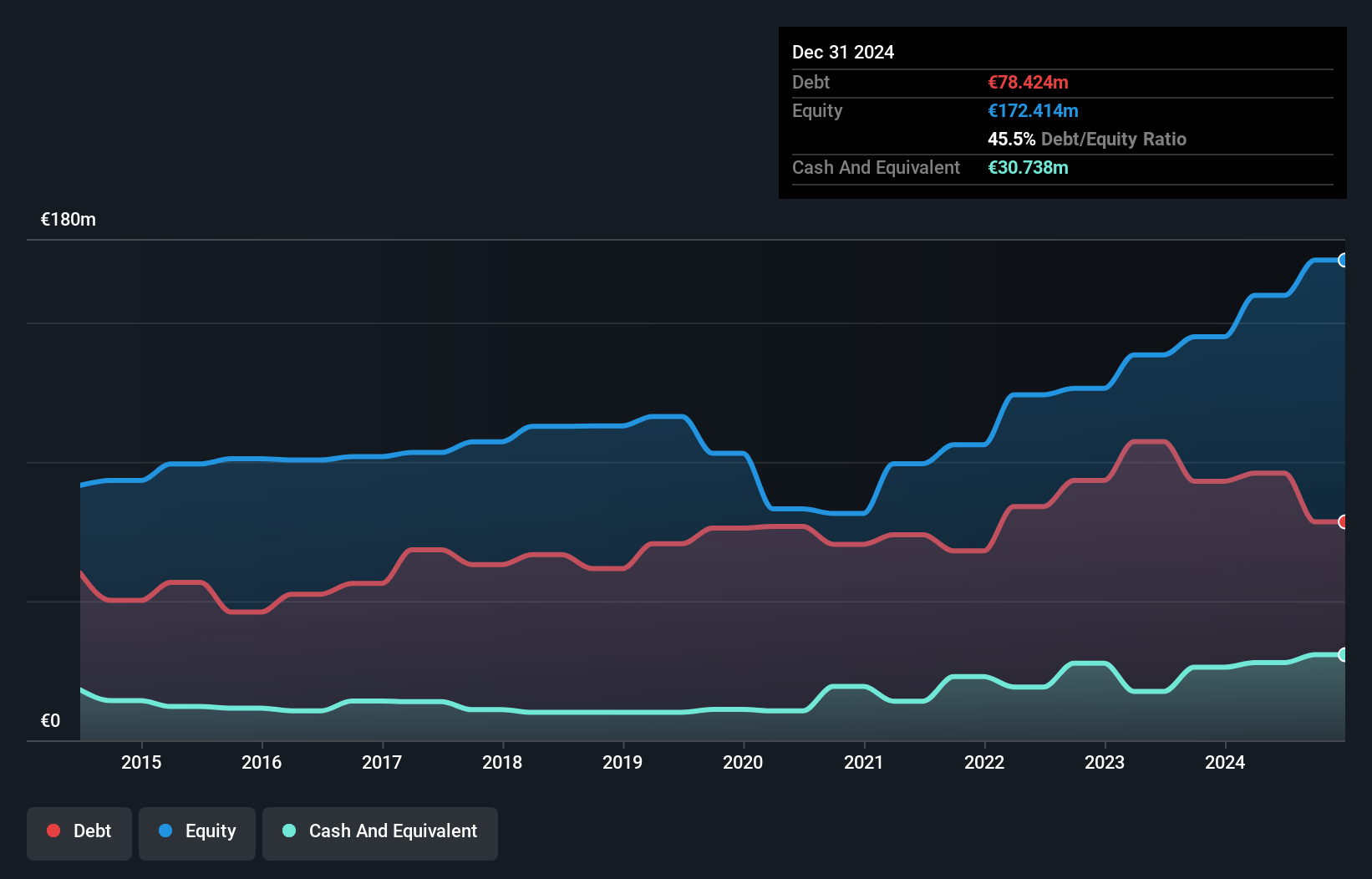

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher operating in France, the rest of Europe, the Americas, and the Asia Pacific with a market cap of €723.26 million.

Operations: Axway Software SA generates revenue primarily through its Subscription segment, which accounts for €201.19 million, followed by Maintenance at €77.04 million. The company also earns from Services (Excl. Subscription) and License segments, contributing €35.49 million and €8.46 million respectively to the total revenue stream.

Axway Software, a nimble player in the tech space, has shown promising financial metrics. With a price-to-earnings ratio of 20.7x, it stands below the industry average of 28.1x, indicating potential value for investors. The company’s interest payments are well-covered by EBIT at 10.1 times, suggesting robust earnings quality and debt management despite an increase in its debt-to-equity ratio from 12.5% to 24.6% over five years. Recent equity offerings amounting to €130 million might have caused some dilution but also bolster its growth strategy through acquisitions like Sopra Banking Software integration expected to impact revenues positively in the coming months.

- Get an in-depth perspective on Axway Software's performance by reading our health report here.

Evaluate Axway Software's historical performance by accessing our past performance report.

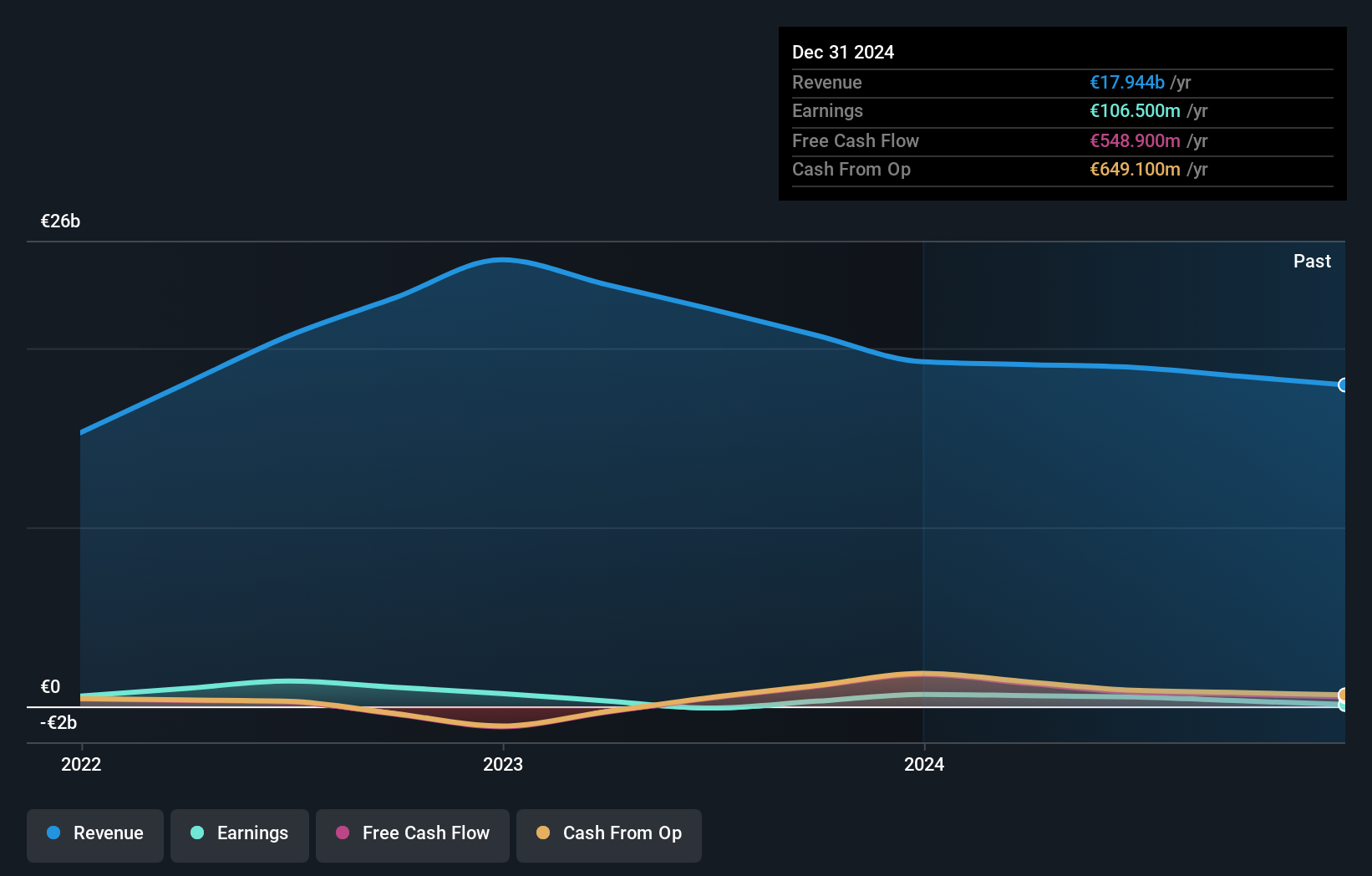

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. is involved in refining, distributing, and marketing refined petroleum products both in France and internationally, with a market capitalization of approximately €1.69 billion.

Operations: EssoF generates revenue primarily from its refining and distribution segment, which amounted to €18.93 billion. The company's financial performance is influenced by its gross profit margin trends, with notable fluctuations observed over recent periods.

EssoF, a smaller player in the oil and gas sector, has seen its net income dip to €116 million for the first half of 2024 from €265.6 million a year earlier, with sales also slightly down at €9 billion. Despite this, it boasts a strong financial footing with more cash than total debt and has reduced its debt-to-equity ratio from 5.8 to 1.2 over five years. The company trades significantly below estimated fair value and remains free cash flow positive at €790 million as of June 2024.

- Click here to discover the nuances of EssoF with our detailed analytical health report.

Understand EssoF's track record by examining our Past report.

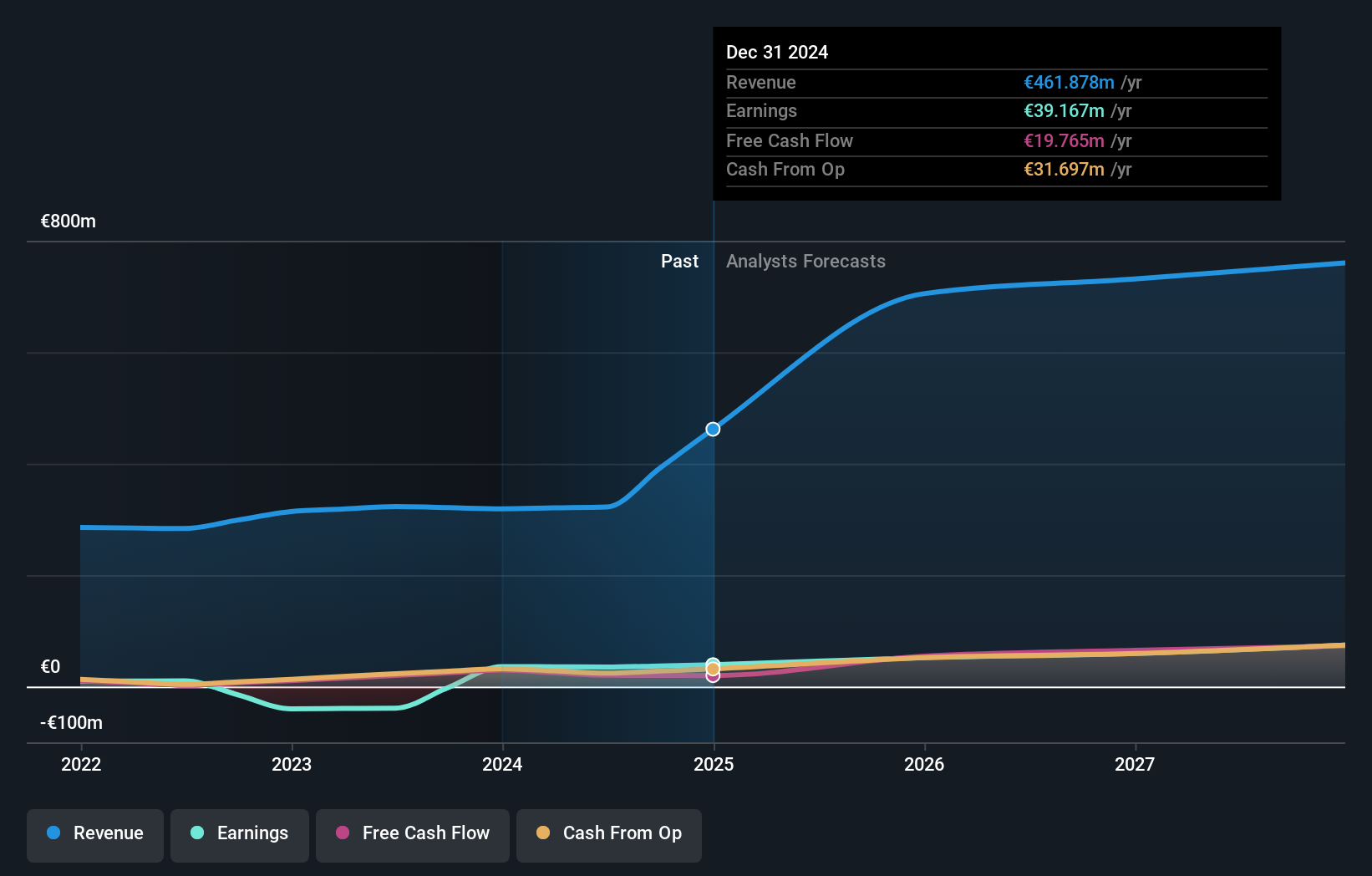

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market cap of €393.33 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €487.56 million.

EPC Groupe, a small player in its industry, showcases a blend of strengths and challenges. The company reported half-year sales of €242.42 million and net income of €12.52 million, almost mirroring last year's figures. Despite trading at 54% below estimated fair value, its net debt to equity ratio is high at 42.6%, indicating financial leverage concerns. Earnings grew by 17% over the past year but interest payments are not well covered with EBIT only providing 2.9x coverage.

- Click to explore a detailed breakdown of our findings in EPC Groupe's health report.

Examine EPC Groupe's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click this link to deep-dive into the 37 companies within our Euronext Paris Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AXW

Axway Software

Operates as an infrastructure software publisher in France, rest of Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with acceptable track record.