Major EU Cybersecurity Contract Could Be a Game Changer for Atos (ENXTPA:ATO)

Reviewed by Sasha Jovanovic

- In September 2025, Atos announced it was awarded a major cybersecurity contract worth up to €326 million to lead delivery of services for European Union institutions under the European Commission's CLOUD II Dynamic Purchasing System, in partnership with Leonardo.

- This agreement positions Atos as a primary cybersecurity provider to the EU public sector, highlighting its increased presence and influence within the European cybersecurity market.

- We’ll explore how this major EU cybersecurity contract could reshape Atos’ investment narrative amid its ongoing restructuring and sector headwinds.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Atos Investment Narrative Recap

The central thesis for Atos hinges on its capacity to execute turnaround efforts while capturing growth in cybersecurity, a segment underscored by its recent €326 million EU contract. While this win boosts near-term visibility and positions Atos as a key supplier to the public sector, it does not materially reduce the most immediate risk: persistently high debt levels and constrained balance sheet flexibility as the company restructures.

Among recent announcements, the integration of Cosmian's key management technology into Eviden, Atos’ cybersecurity brand, directly reinforces its credentials in securing sensitive European data. This development could help strengthen Atos’ market credibility, complementing the EU contract and buoying its efforts to restore client confidence despite ongoing headwinds.

Yet, against these gains, investors should be aware that Atos’ elevated debt and negative equity position remain unresolved...

Read the full narrative on Atos (it's free!)

Atos' outlook anticipates €8.5 billion in revenue and €527.4 million in earnings by 2028. This is based on a 0.4% annual revenue decline and a €972.6 million decrease in earnings from the current €1.5 billion.

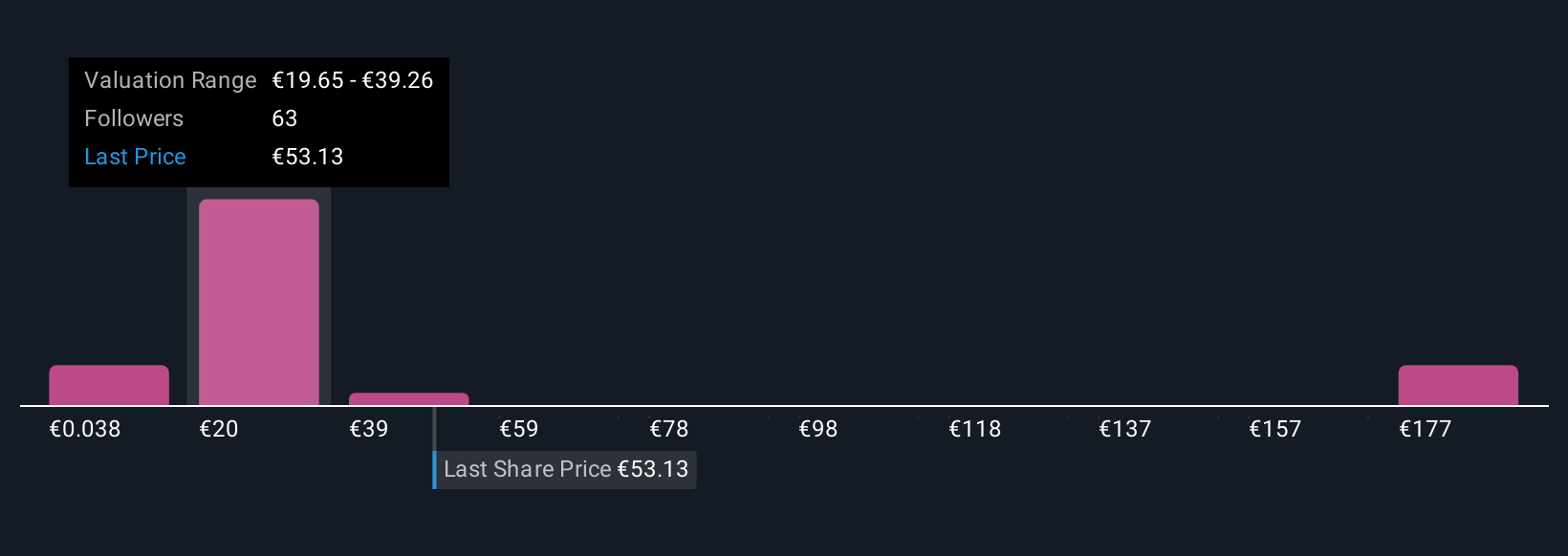

Uncover how Atos' forecasts yield a €37.15 fair value, a 32% downside to its current price.

Exploring Other Perspectives

Fair value estimates for Atos from the Simply Wall St Community range widely, from €0.04 up to €196.14 across 21 contributors. While many see opportunity, the ongoing risk from high debt and operational restructuring continues to weigh on the company's medium-term outlook, consider how these differing perspectives could impact your view.

Explore 21 other fair value estimates on Atos - why the stock might be worth over 3x more than the current price!

Build Your Own Atos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Atos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atos' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives