- France

- /

- Semiconductors

- /

- ENXTPA:ALRIB

A Piece Of The Puzzle Missing From Riber S.A.'s (EPA:ALRIB) 27% Share Price Climb

The Riber S.A. (EPA:ALRIB) share price has done very well over the last month, posting an excellent gain of 27%. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

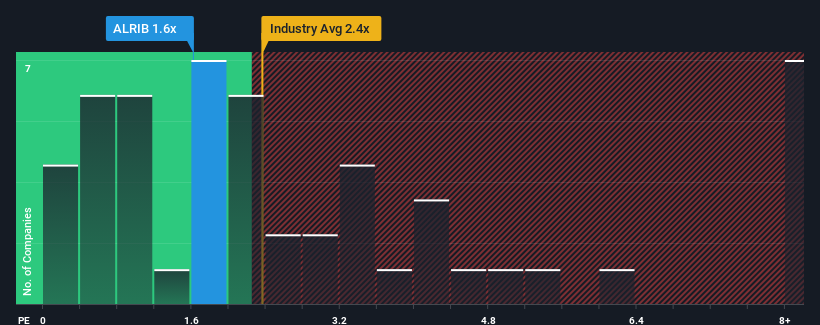

In spite of the firm bounce in price, when close to half the companies operating in France's Semiconductor industry have price-to-sales ratios (or "P/S") above 3.3x, you may still consider Riber as an enticing stock to check out with its 1.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Riber

What Does Riber's P/S Mean For Shareholders?

Riber could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Riber's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Riber's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.0%. The last three years don't look nice either as the company has shrunk revenue by 1.2% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 29% as estimated by the only analyst watching the company. With the rest of the industry predicted to shrink by 2.4%, that would be a fantastic result.

With this information, we find it very odd that Riber is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Riber's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Riber's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Riber that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALRIB

Riber

Provides molecular beam epitaxy (MBE) products and related services for the compound semiconductor research and industrial field.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives