- France

- /

- Retail Distributors

- /

- ENXTPA:GRVO

Graines Voltz S.A.'s (EPA:GRVO) P/S Still Appears To Be Reasonable

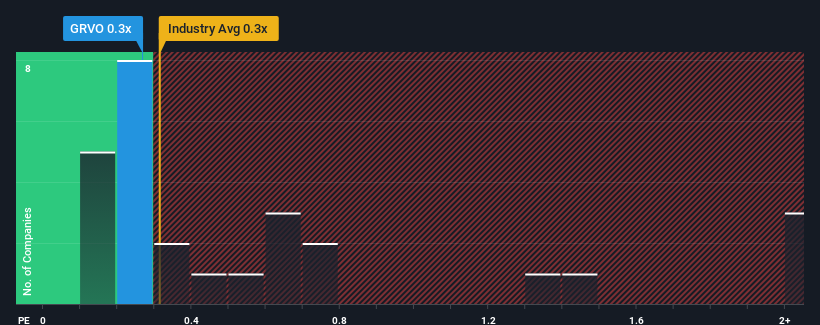

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Retail Distributors industry in France, you could be forgiven for feeling indifferent about Graines Voltz S.A.'s (EPA:GRVO) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Graines Voltz

What Does Graines Voltz's P/S Mean For Shareholders?

Graines Voltz could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Graines Voltz will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Graines Voltz?

The only time you'd be comfortable seeing a P/S like Graines Voltz's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 53% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 1.0% over the next year. Meanwhile, the rest of the industry is forecast to expand by 1.0%, which is not materially different.

In light of this, it's understandable that Graines Voltz's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Graines Voltz's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Graines Voltz (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Graines Voltz, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Graines Voltz, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GRVO

Graines Voltz

Distributes flower and vegetable seeds in France and internationally.

Moderate growth potential and slightly overvalued.