- France

- /

- Specialty Stores

- /

- ENXTPA:FNAC

The Market Lifts Fnac Darty SA (EPA:FNAC) Shares 25% But It Can Do More

Fnac Darty SA (EPA:FNAC) shares have had a really impressive month, gaining 25% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

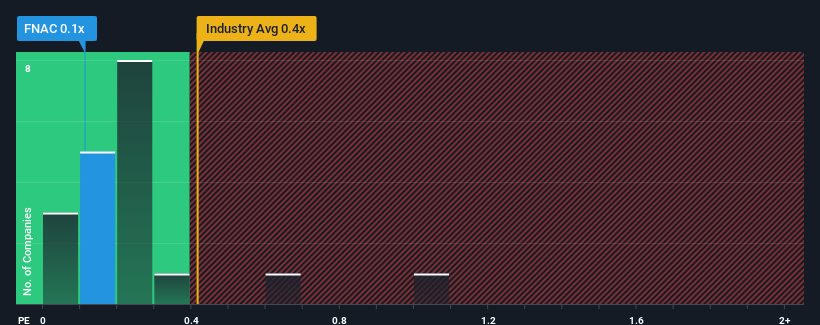

In spite of the firm bounce in price, there still wouldn't be many who think Fnac Darty's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in France's Specialty Retail industry is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 2 warning signs about Fnac Darty. View them for free.See our latest analysis for Fnac Darty

How Has Fnac Darty Performed Recently?

Fnac Darty's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Fnac Darty will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fnac Darty.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Fnac Darty's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 9.9% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.8% each year, which is noticeably less attractive.

In light of this, it's curious that Fnac Darty's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Fnac Darty's P/S

Fnac Darty appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Fnac Darty's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Fnac Darty.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FNAC

Fnac Darty

Engages in the retail of entertainment and leisure products, consumer electronics, and domestic appliances in France, Switzerland, Belgium, Luxembourg, and the Iberian Peninsula.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives