- France

- /

- Retail REITs

- /

- ENXTPA:MERY

Mercialys (ENXTPA:MERY): Assessing Valuation Following Upgraded 2025 Earnings Guidance and Executive Leadership Update

Reviewed by Kshitija Bhandaru

Mercialys (ENXTPA:MERY) caught investor attention after raising its full-year earnings per share guidance for 2025. This signals stronger-than-expected financial performance. This update came as the company shared news of a leadership transition.

See our latest analysis for Mercialys.

While Mercialys' upgraded earnings outlook and leadership transition made headlines, the 2025 share price has been steady but not without short-term turbulence, with a recent dip of just under 1% this week. However, the long-term story is far more compelling. The company’s five-year total shareholder return stands at a remarkable 273%, highlighting strong momentum and investor confidence despite modest 12-month gains.

If this kind of enduring performance has you wondering where else growth and insider alignment meet, it’s the perfect moment to discover fast growing stocks with high insider ownership.

With earnings forecasts moving higher and management showing confidence, the real question for investors is whether Mercialys’ current share price reflects all this upside, or if there is still genuine value to be unlocked.

Most Popular Narrative: 19.1% Undervalued

The leading narrative suggests Mercialys shares may have more room to run, setting fair value roughly 19% higher than the latest closing price of €10.68. The market may be underestimating both the pace and quality of the company's transformation, according to this view.

Mercialys' investment in hybrid "shopping park" assets, designed to integrate physical retail strengths with digital conveniences and omnichannel offerings (for example, click & collect, AI-driven marketing), strengthens their relevance in a retail landscape where physical locations play a resilient and evolving role. This supports both revenue growth and reduced vacancy risk.

Curious about the bold predictions that set this price target? This narrative hinges on a future dominated by smart investments, rising margins, and an earnings surge that could surprise even veteran investors. What numbers unlock this edge? Only the full story reveals the calculations behind the headline valuation.

Result: Fair Value of €13.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure from e-commerce and shifting consumer patterns, particularly in key French regions, could challenge Mercialys’ long-term portfolio growth and rental stability.

Find out about the key risks to this Mercialys narrative.

Another View: What Do Profit Multiples Say?

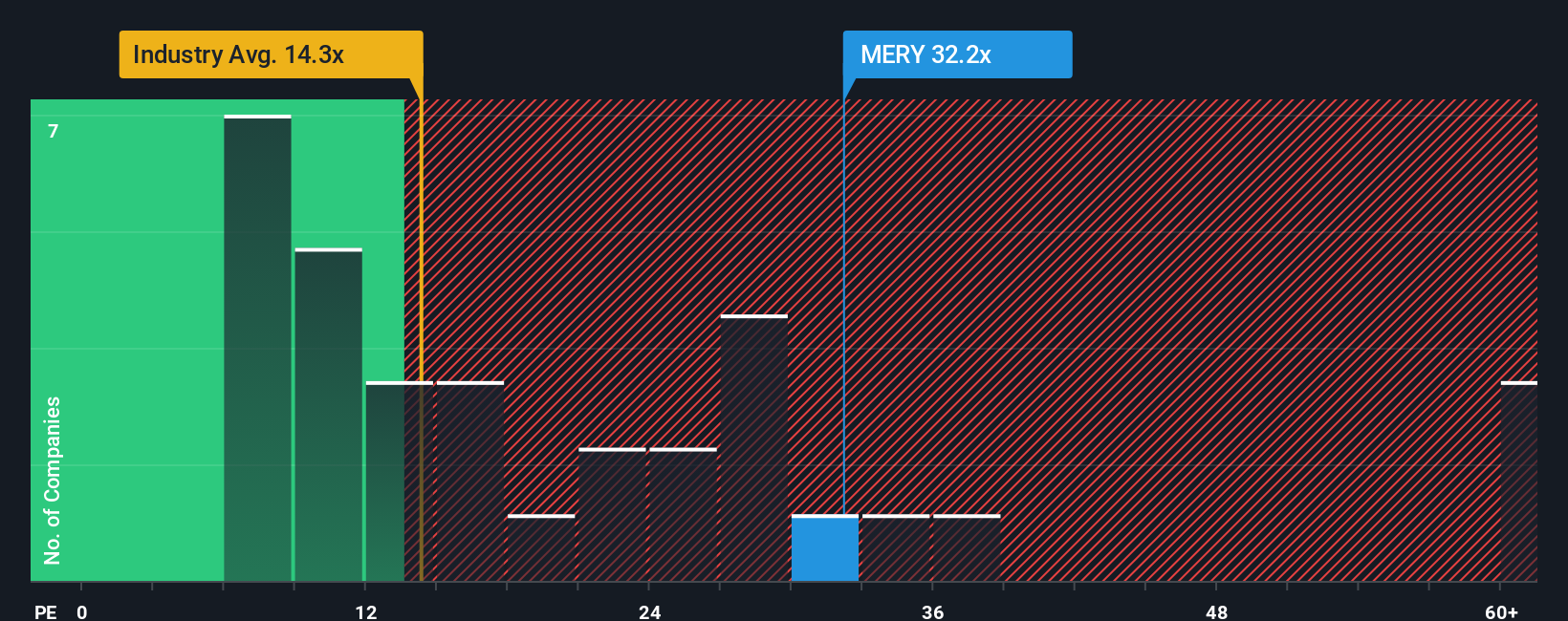

Looking at things from a different angle, Mercialys trades at a price-to-earnings ratio of 31.7 times, which stands out as expensive compared to the industry average of 14.3 times and a peer average of 42.7 times. The market's fair ratio could be closer to 17.9. This suggests investors are paying a premium today. Does the current price fully reward future growth, or could expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mercialys Narrative

If these conclusions do not reflect your own view or you want to dig deeper yourself, you can craft your personal take on Mercialys in just a few minutes with Do it your way.

A great starting point for your Mercialys research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investment horizons by tapping into breakthrough areas other investors are missing. Take action today on untapped opportunities. These strategies set future leaders apart.

- Uncover income potential and secure steady payouts by checking out these 18 dividend stocks with yields > 3% boasting attractive yields above 3%.

- Get ahead of tomorrow’s tech trends by targeting innovation through these 24 AI penny stocks with massive upside in artificial intelligence.

- Amplify your portfolio’s value with these 868 undervalued stocks based on cash flows signalling companies that the market hasn’t fully recognized. Catch them before the crowd does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MERY

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives