- France

- /

- Office REITs

- /

- ENXTPA:GFC

Gecina (ENXTPA:GFC) Valuation in Focus as New Executive Director Ushers in Leadership Transition

Reviewed by Simply Wall St

Gecina (ENXTPA:GFC) just announced Marie Caniac as the new Executive Director for its Office Division, effective this November. She will oversee 116 office properties valued at nearly €14 billion and steps in at a pivotal moment, succeeding Valérie Britay. Britay’s tenure was marked by the company’s largest lease transaction and numerous innovations in Paris’s prime office real estate. Investors wondering what’s next for Gecina now have a fresh face, bringing experience from Klépierre and a mandate to generate both financial and non-financial value in a rapidly evolving market.

This type of high-profile appointment is drawing scrutiny, particularly as Gecina’s stock has experienced volatility recently. Over the past year, shares have fallen around 15%. Short-term performance has not offered much relief, with a nearly 9% decline in the past three months, reflecting the market’s concerns and possibly recalibrating expectations for the future. Meanwhile, longer-term holders have seen modest returns, and the leadership change follows a series of strategic moves aimed at solidifying Gecina’s position in competitive office real estate.

With the company preparing for this new era and market sentiment still cautious, some market participants may be evaluating whether this is a key moment of change, or if all potential gains have already been factored into current prices.

Price-to-Earnings of 12.3x: Is it justified?

Based on its price-to-earnings (P/E) ratio of 12.3x, Gecina’s shares currently appear undervalued compared to both peer companies and the broader office real estate sector, where multiples tend to be significantly higher.

The price-to-earnings ratio measures the current share price relative to its per-share earnings. It is a fundamental tool for assessing if a stock is trading at a premium or discount compared to others in its industry. For office REITs, this multiple reflects both the company’s profitability and investor confidence in future earnings stability.

Gecina’s relatively low P/E ratio, especially in the context of high-profile leadership changes and evolving market conditions, suggests that the market may be underappreciating the company’s future earnings potential and stability. Investors could see room for upside if Gecina delivers on its growth forecasts.

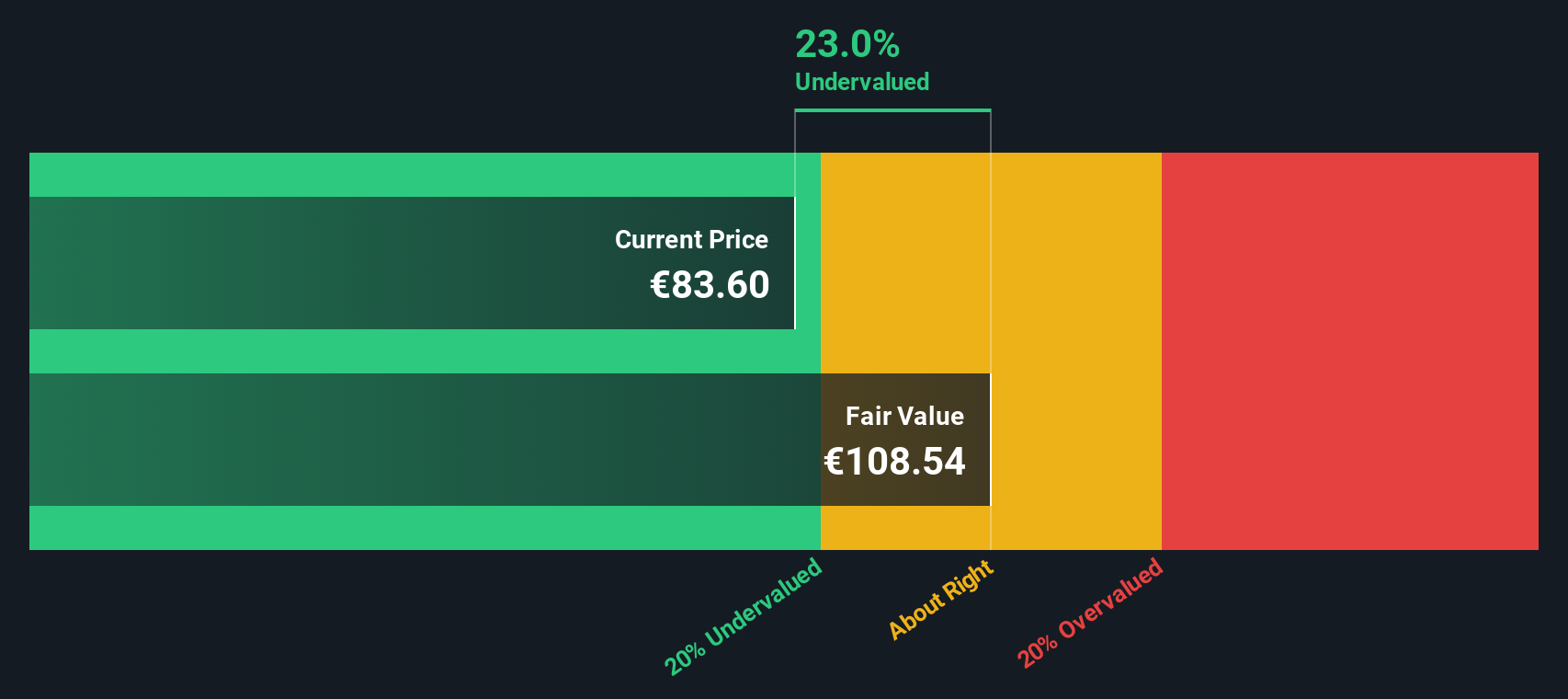

Result: Fair Value of €107.7 (UNDERVALUED)

See our latest analysis for Gecina.However, stagnant revenue growth and market volatility could challenge Gecina’s valuation narrative if these headwinds persist or intensify in the coming quarters.

Find out about the key risks to this Gecina narrative.Another View: What Does the SWS DCF Model Say?

Looking at Gecina through our DCF model presents a similar picture to the multiples-based valuation. This approach also suggests the company’s shares are trading below what the fundamentals might justify. Could these fair value signals prove too optimistic, or do they hint at an opportunity investors are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Gecina Narrative

For those who want to take a hands-on approach or feel differently about the outlook, you can quickly develop your own view using our tools in just a few minutes. Do it your way

A great starting point for your Gecina research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investment journey and zero in on opportunities you might be missing. Let the Simply Wall Street Screener point you toward stocks that match your ambitions and curiosity.

- Capture the momentum in fast-growing technology by checking out companies at the forefront of artificial intelligence with AI penny stocks paving the way for tomorrow’s breakthroughs.

- Secure your income with a curated list of reliable companies offering impressive yields by exploring dividend stocks with yields > 3% to help strengthen your portfolio’s cash flow potential.

- Spot market mispricings and seek value opportunities where others might overlook by leveraging undervalued stocks based on cash flows. These stocks are screened for standout fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GFC

Gecina

A leading operator, that fully integrates all real estate expertise, owning, managing, and developing a unique prime portfolio valued at 17.0bn Euro as at June 30, 2025.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives