- Spain

- /

- Real Estate

- /

- BME:LIB

Top European Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the European market navigates through recent economic challenges, including a disappointing trade deal framework with the U.S. and fluctuating stock indexes, investors are keenly observing potential opportunities. Penny stocks, though an older term, continue to hold interest for those looking beyond mainstream investments. These smaller or newer companies can offer unique value propositions and growth potential when backed by strong financials. In this article, we explore three European penny stocks that stand out for their financial resilience and potential to provide both stability and growth in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.97 | €14.41M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €307.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.93 | €18.43M | ✅ 2 ⚠️ 3 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.265 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.18 | €300.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.966 | €32.58M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 337 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Libertas 7 (BME:LIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Libertas 7, S.A. operates in the real estate and investment sectors in Spain with a market cap of €64.91 million.

Operations: The company's revenue is derived from three main segments: Investments (€2.82 million), Touristic Area (€1.93 million), and Real Estate Area (€7.22 million).

Market Cap: €64.91M

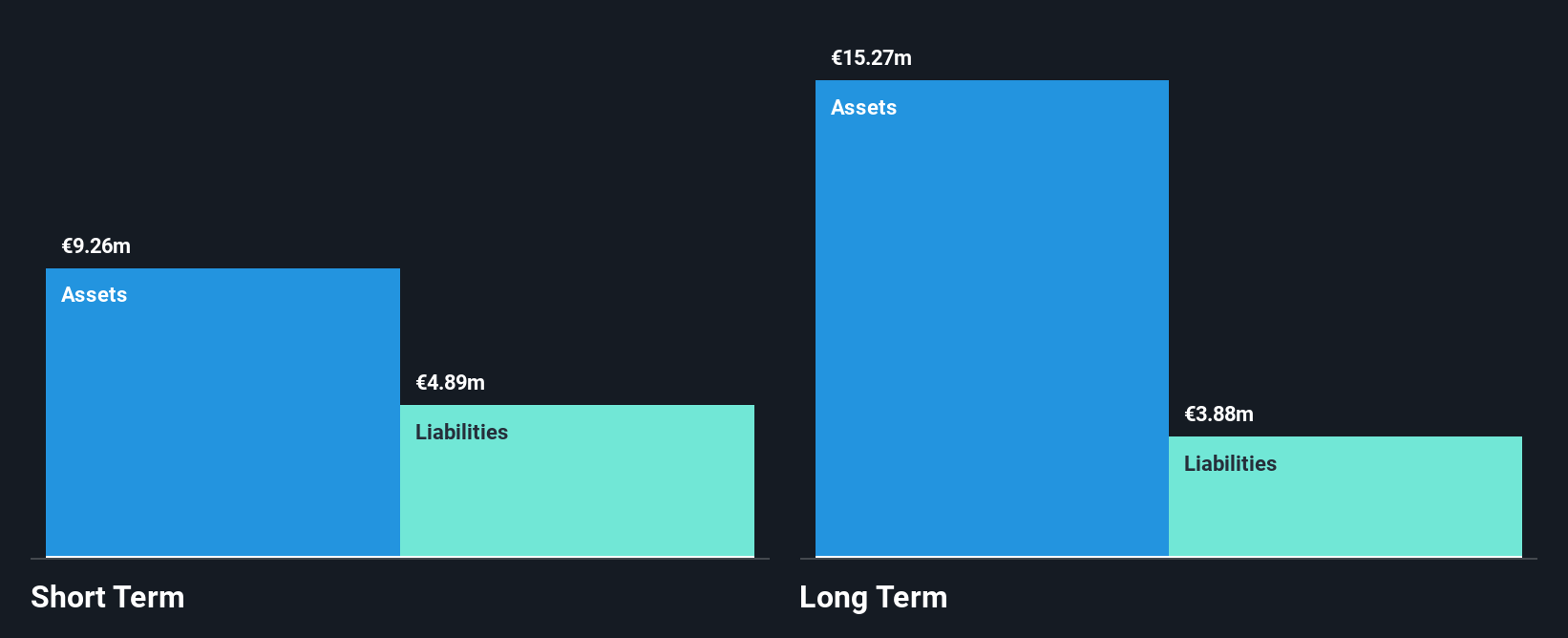

Libertas 7, S.A. has shown significant improvement in its financial performance, reporting a half-year revenue of €9.15 million and net income of €1.35 million as of June 30, 2025, compared to losses the previous year. The company has become profitable with a notable reduction in its debt-to-equity ratio over five years and maintains more cash than total debt. However, operating cash flow coverage for debt remains low at 11%. Despite high volatility in share price and low return on equity at 3.6%, the stock trades significantly below estimated fair value and benefits from experienced board oversight.

- Click here to discover the nuances of Libertas 7 with our detailed analytical financial health report.

- Explore Libertas 7's analyst forecasts in our growth report.

Crypto Blockchain Industries (ENXTPA:ALCBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Crypto Blockchain Industries focuses on investing in blockchain-based applications across various industries in France, with a market cap of €117.87 million.

Operations: The company generates revenue from its blockchain segment, amounting to €5.21 million.

Market Cap: €117.87M

Crypto Blockchain Industries, with a market cap of €117.87 million, focuses on blockchain investments in France and reported revenue of €5.21 million for the year ending March 31, 2025. Despite this revenue growth from €4.08 million the previous year, the company remains unprofitable with a net loss widening to €7.66 million from €0.4751 million last year. The company's cash reserves exceed its total debt and short-term assets cover both short- and long-term liabilities, yet negative operating cash flow indicates poor debt coverage. Share price volatility has increased significantly over the past year without meaningful shareholder dilution recently noted.

- Take a closer look at Crypto Blockchain Industries' potential here in our financial health report.

- Understand Crypto Blockchain Industries' track record by examining our performance history report.

Alliance Developpement Capital SIIC (ENXTPA:ALDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alliance Developpement Capital SIIC (ADC SIIC) is a publicly owned real estate investment firm with a market cap of €11.86 million.

Operations: The company generates revenue from its Hotels segment, which amounts to €1.12 billion.

Market Cap: €11.86M

Alliance Developpement Capital SIIC, with a market cap of €11.86 million, is currently pre-revenue and unprofitable, generating minimal revenue from its Hotels segment. The company holds no debt, eliminating concerns over interest coverage or cash flow for debt repayment. However, its short-term liabilities (€15.2M) surpass its short-term assets (€3.3M), indicating potential liquidity challenges. Despite a seasoned board with an average tenure of 11.4 years and stable weekly volatility relative to French stocks, the company's share price has been highly volatile recently and losses have increased significantly over the past five years by 60.3% annually without shareholder dilution in the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Alliance Developpement Capital SIIC.

- Assess Alliance Developpement Capital SIIC's previous results with our detailed historical performance reports.

Summing It All Up

- Explore the 337 names from our European Penny Stocks screener here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LIB

Libertas 7

Engages in the real estate and investment businesses in Spain.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives