- France

- /

- Real Estate

- /

- ENXTPA:SPEL

Foncière Volta (ENXTPA:SPEL) Net Income Lifted by €1.7M One-Off Gain, Underscoring Narrative Caution

Reviewed by Simply Wall St

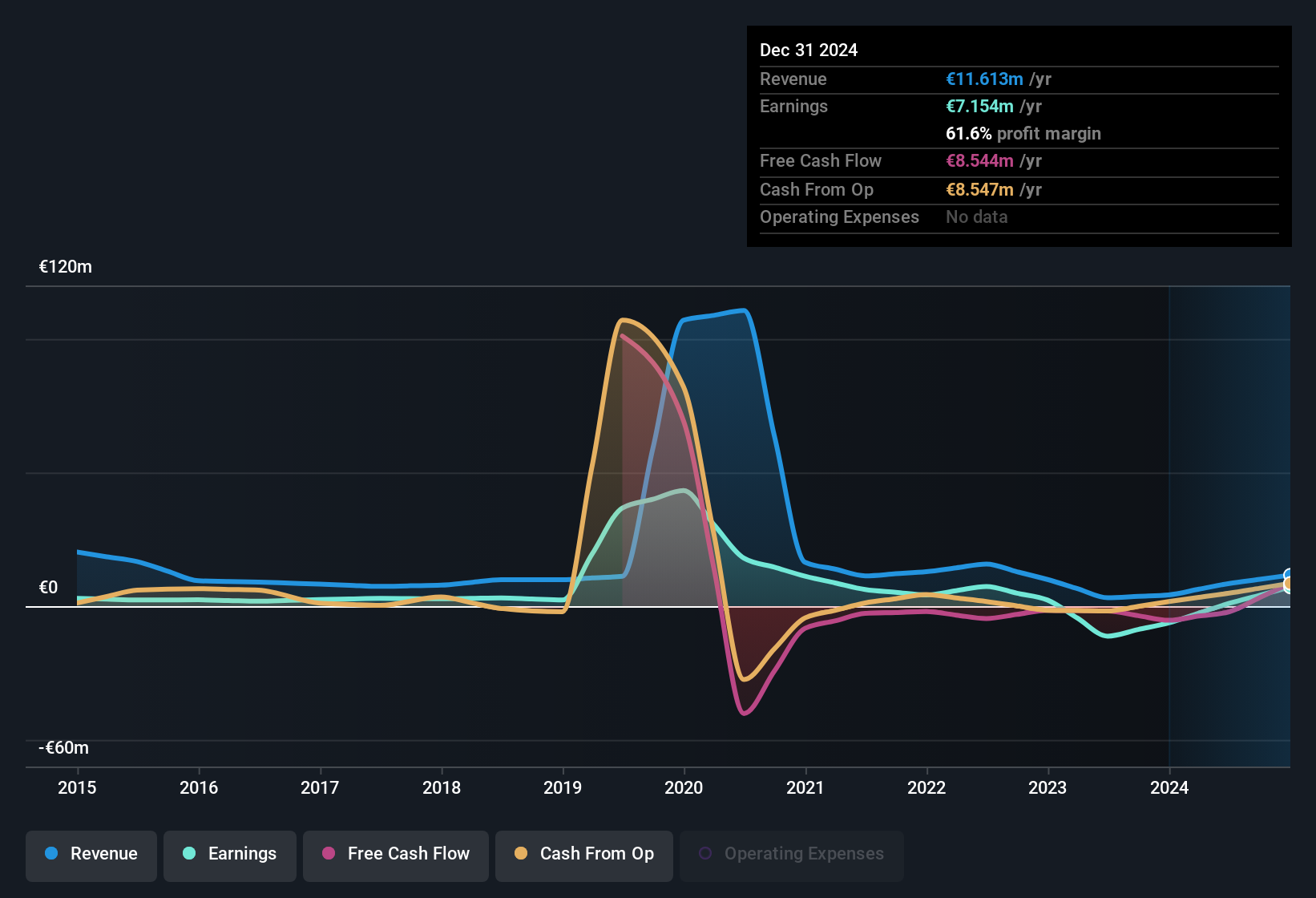

Foncière Volta (ENXTPA:SPEL) has just posted its H1 2025 results, reporting revenue of €5.45 million and basic EPS of €0.54 as headline numbers. For context, the company has seen revenue move from €2.33 million in H2 2023 to €6.16 million in H1 2024, and then to €5.45 million in the most recent half. Basic EPS tracked from -€0.03 to €0.13 and now €0.54 over the same periods. Margins showed clear improvement in the latest results, setting the stage for investors to weigh the sustainability of these gains.

See our full analysis for Foncière Volta.Next, we will compare the latest financial figures to the prevailing market narratives to see which trends are holding up and which stories might get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gains Boost Net Income

- Net income for H1 2025 surged to €5.74 million, significantly higher than prior semi-annual periods. Much of this uplift was driven by a €1.7 million one-off gain that affected the quality of underlying profit.

- Rather than signaling a sustained turnaround, the prevailing view notes this one-time event complicates the earnings picture and could mask ongoing challenges. Net income for the preceding period was just €1.41 million, highlighting a heavy reliance on nonrecurring items.

- While headline profitability finally turned positive over the last year, investors are urged to scrutinize the repeatability of these gains.

- The narrative highlights that excluding such gains, normalized profitability may be far more modest, suggesting a cautionary stance on underlying earnings strength.

Valuation Looks Cheap vs Peers

- Foncière Volta trades on a Price-to-Earnings ratio of 12.2x, well below both the French real estate sector average (14.5x) and direct peers (25.4x). This positions the stock in value territory based on conventional multiples.

- Bulls see this discount as a potential opportunity, arguing that improving margins and newly positive trailing twelve month earnings could attract value-focused investors, especially with the share price at €8.30 compared to sector averages.

- The lower P/E, coupled with recent profitability, lends support to the bullish case that the stock is undervalued relative to peers.

- However, market caution may be justified by the company’s inconsistent earnings history and the impact of nonrecurring items, which can reduce investor conviction even at discounted valuations.

Margin Trends Outpace Revenue Swings

- While total revenue declined from €6.16 million to €5.45 million sequentially, net income surged and basic EPS jumped to €0.54 from just €0.13. This indicates that improved margins, rather than topline growth, drove better bottom-line performance.

- The prevailing market view points out that this margin expansion, especially given the long-term net income decline of 50.7% annually over five years, signals cost management progress, but also underscores risk since interest payments are still not well covered by earnings.

- Margin improvement stands out as real, but questions linger over its durability in light of historic earnings contraction.

- Persistent financial stability risks, like thin interest coverage and high share price volatility, temper enthusiasm about short-term profitability gains.

To see how these trends might influence the bigger story for Foncière Volta, don’t miss our full consensus narrative for a grounded, balanced perspective. 📊 Read the full Foncière Volta Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Foncière Volta's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Foncière Volta’s reliance on one-off gains and its ongoing struggles with financial stability and thin interest coverage point to underlying balance sheet vulnerabilities.

If dependable financial strength matters to you, compare with companies that are better positioned for resilience through our solid balance sheet and fundamentals stocks screener (1933 results) for healthy balance sheets and fundamentals built to last.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SPEL

Foncière Volta

Acquires, constructs, holds, and rents real estate properties in France and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.