- France

- /

- Real Estate

- /

- ENXTPA:BASS

The Market Lifts BASSAC Société anonyme (EPA:BASS) Shares 25% But It Can Do More

BASSAC Société anonyme (EPA:BASS) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 7.7% isn't as attractive.

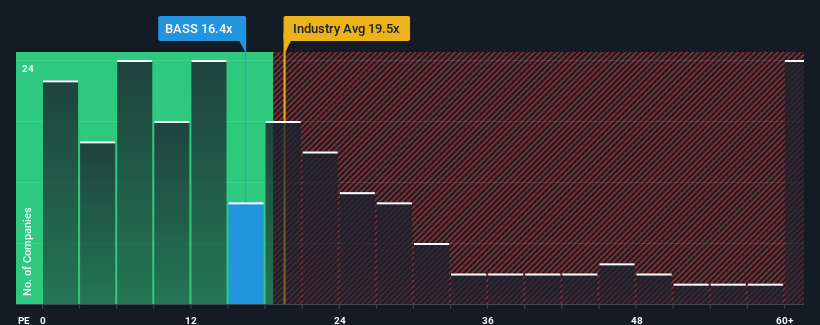

Even after such a large jump in price, it's still not a stretch to say that BASSAC Société anonyme's price-to-earnings (or "P/E") ratio of 16.4x right now seems quite "middle-of-the-road" compared to the market in France, where the median P/E ratio is around 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, BASSAC Société anonyme has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for BASSAC Société anonyme

How Is BASSAC Société anonyme's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like BASSAC Société anonyme's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 56% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 26% each year over the next three years. That's shaping up to be materially higher than the 14% per year growth forecast for the broader market.

With this information, we find it interesting that BASSAC Société anonyme is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BASSAC Société anonyme's P/E?

BASSAC Société anonyme appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that BASSAC Société anonyme currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for BASSAC Société anonyme (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than BASSAC Société anonyme. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BASSAC Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BASS

BASSAC Société anonyme

Operates as a real estate development company primarily in France, Belgium, Germany, and Spain.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives