Réalités S.A. (EPA:ALREA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

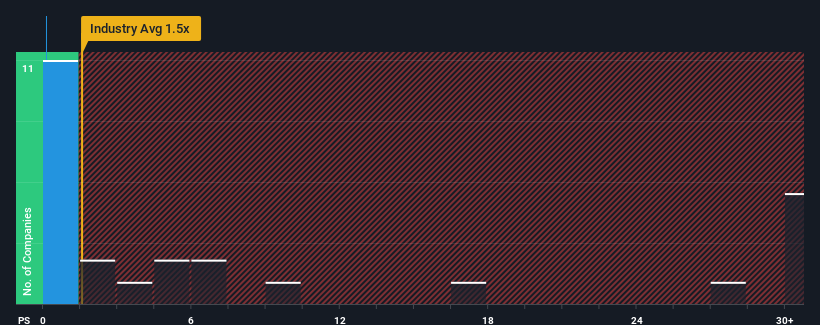

Following the heavy fall in price, Réalités may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Real Estate industry in France have P/S ratios greater than 1.5x and even P/S higher than 14x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Réalités

What Does Réalités' Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Réalités has been doing quite well of late. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Réalités will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Réalités will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Réalités?

In order to justify its P/S ratio, Réalités would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 5.0% during the coming year according to the sole analyst following the company. Meanwhile, the industry is forecast to moderate by 7.5%, which indicates the company should perform better regardless.

In light of this, the fact Réalités' P/S sits below the majority of other companies is peculiar but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

What We Can Learn From Réalités' P/S?

The southerly movements of Réalités' shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In our view, Réalités' P/S ratio appears to be lower than anticipated, considering that its revenue projections are not as dismal as the rest of the struggling industry. The P/S ratio may not align with the more favourable outlook due to the market pricing in potential revenue risks. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. So, given the low P/S, risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Réalités (1 shouldn't be ignored!) that you should be aware of.

If you're unsure about the strength of Réalités' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALREA

Low and slightly overvalued.

Market Insights

Community Narratives