Subdued Growth No Barrier To Valneva SE (EPA:VLA) With Shares Advancing 29%

Despite an already strong run, Valneva SE (EPA:VLA) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 90% in the last year.

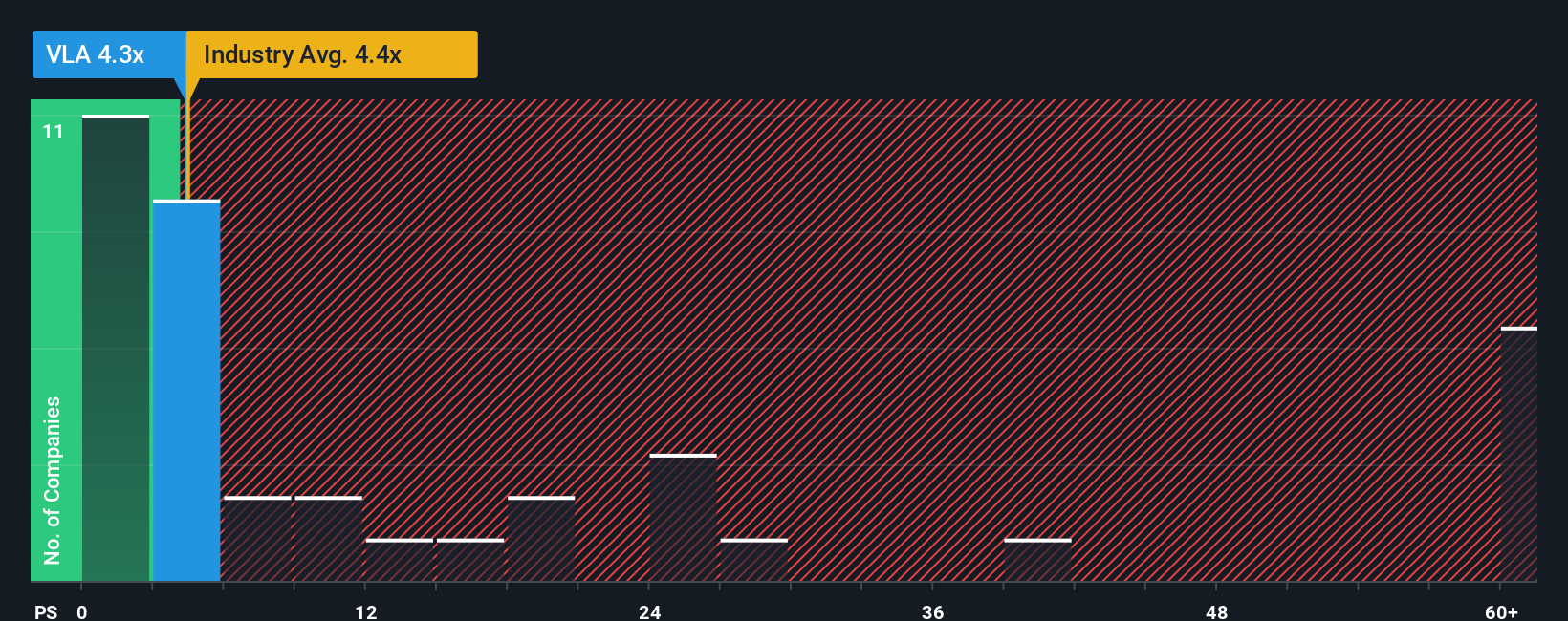

Even after such a large jump in price, there still wouldn't be many who think Valneva's price-to-sales (or "P/S") ratio of 4.3x is worth a mention when the median P/S in France's Biotechs industry is similar at about 4.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Valneva

How Has Valneva Performed Recently?

With revenue growth that's inferior to most other companies of late, Valneva has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Valneva will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Valneva?

The only time you'd be comfortable seeing a P/S like Valneva's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 36% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the eight analysts watching the company. With the industry predicted to deliver 84% growth per year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Valneva's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Valneva's P/S Mean For Investors?

Its shares have lifted substantially and now Valneva's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Valneva's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Valneva you should know about.

If you're unsure about the strength of Valneva's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VLA

Valneva

A specialty vaccine company, develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success