Does Positive AlphaMedix Phase II Data Reinforce the Bull Case for Sanofi (ENXTPA:SAN)?

Reviewed by Sasha Jovanovic

- Sanofi recently reported that its investigational therapy AlphaMedix™ (212Pb-DOTAMTATE) met all primary efficacy endpoints in a Phase II trial for patients with unresectable or metastatic SSTR-positive gastroenteropancreatic neuroendocrine tumors, demonstrating clinically meaningful response rates and prolonged clinical benefits in both PRRT-naive and PRRT-exposed groups.

- This therapy, which leverages targeted alpha radiation for greater tumor selectivity and was granted US FDA Breakthrough Therapy Designation in February 2024, may offer an innovative treatment option where limited alternatives exist.

- We’ll review how AlphaMedix’s positive Phase II results could influence Sanofi’s investment narrative and future outlook in high-value therapeutics.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sanofi Investment Narrative Recap

To be a Sanofi shareholder, you need confidence in the company’s ability to advance its innovative pipeline and deliver on R&D-driven growth while navigating structural pricing pressure, especially in vaccines. The recent positive Phase II results for AlphaMedix strengthen Sanofi’s position in high-value specialty therapeutics, potentially bolstering short-term investor sentiment, but they do not meaningfully reduce the near-term risk tied to ongoing competition and pricing headwinds in core vaccine markets.

Among the recent announcements, the expansion of Sanofi’s Insulins Valyou Savings Program is particularly relevant, as it reflects management’s continued efforts to boost patient access and protect market share in established franchises. This focus on affordability could help offset future volume declines from pricing pressures, which remain a primary risk for Sanofi’s consistent margin performance and reinvestment capacity.

However, investors should also be aware that despite new pipeline successes, the persistent risk of vaccine pricing headwinds remains a key challenge for Sanofi in the near term...

Read the full narrative on Sanofi (it's free!)

Sanofi's outlook anticipates €51.8 billion in revenue and €9.6 billion in earnings by 2028. This is based on a 4.2% annual revenue growth rate and a €3.2 billion increase in earnings from the current €6.4 billion.

Uncover how Sanofi's forecasts yield a €108.31 fair value, a 28% upside to its current price.

Exploring Other Perspectives

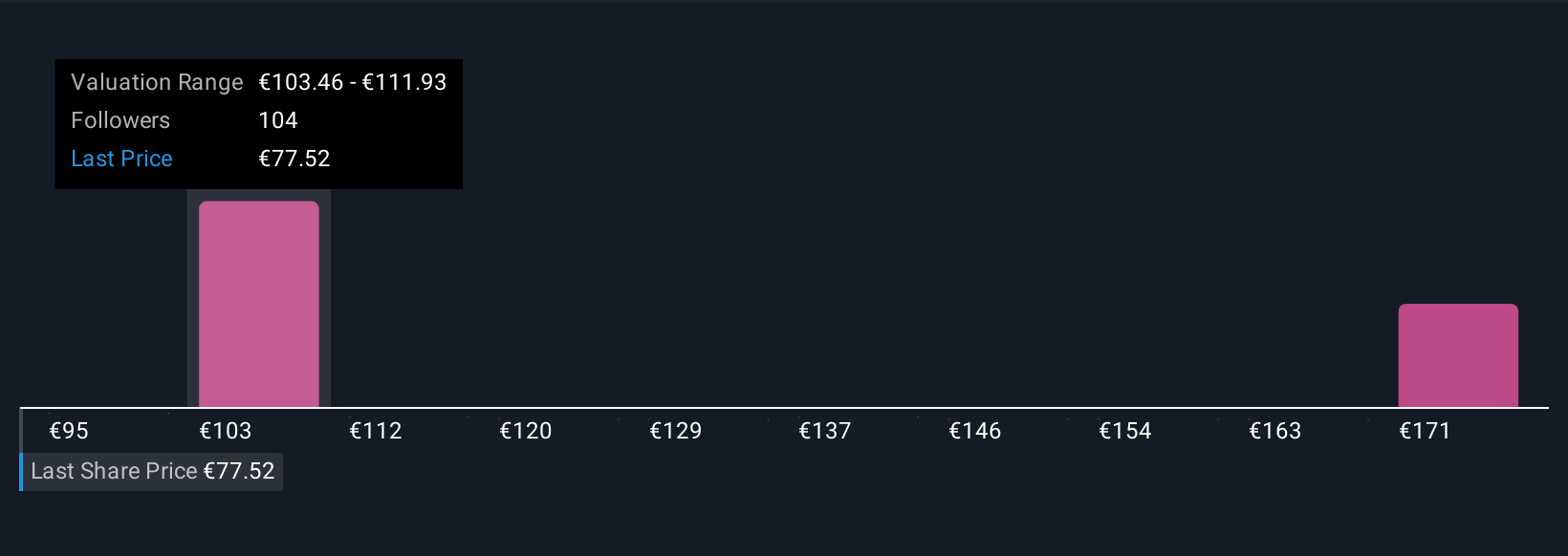

Simply Wall St Community members have published nine fair value estimates for Sanofi, with a wide spread from €95 to €179.63 per share. Despite excitement around innovations like AlphaMedix, ongoing competitive pricing pressure in vaccines remains a central issue affecting the company’s future performance.

Explore 9 other fair value estimates on Sanofi - why the stock might be worth just €95.00!

Build Your Own Sanofi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sanofi research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free Sanofi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sanofi's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives