Do Early NBTXR3 Data Reveal a Shift in Nanobiotix’s (ENXTPA:NANO) Competitive Positioning?

Reviewed by Sasha Jovanovic

- Nanobiotix recently announced updated results from phase 1 trials of its radiotherapy-activated candidate NBTXR3 in esophageal adenocarcinoma and recurrent or metastatic head and neck squamous cell carcinoma, presented at the 2025 ASTRO Annual Meeting by clinical investigators from MD Anderson Cancer Center and University of North Carolina.

- These early-stage clinical findings suggest potential for NBTXR3 across multiple solid tumor types, bolstered by continued regulatory Fast Track designation for head and neck cancer indications.

- We’ll examine how the emerging data on NBTXR3’s use with chemoradiation and immunotherapy advances Nanobiotix’s investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Nanobiotix's Investment Narrative?

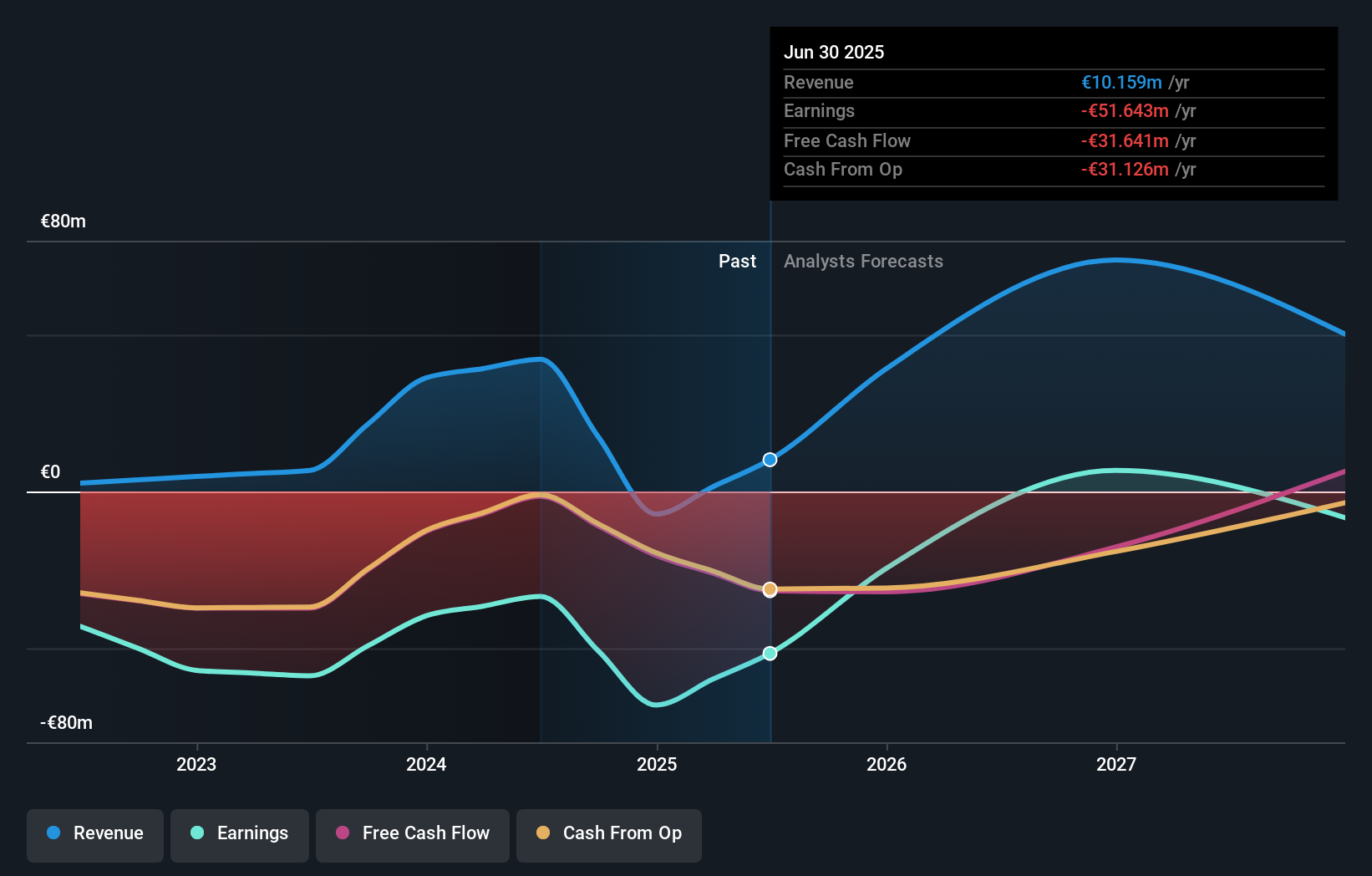

If you’re interested in Nanobiotix, the big picture is about belief in radiotherapy-activated nanomedicine's potential to transform cancer care, and whether early-stage clinical momentum can translate into broader commercial success. The updated phase 1 data, presented at ASTRO, reinforces hopes that NBTXR3 can impact challenging tumors like esophageal adenocarcinoma and recurrent/metastatic head and neck cancers, but these are still early signals. Recent price moves have been dramatic, reflecting excitement but also magnifying execution risk. The most important short-term catalyst remains progression in late-stage trials, especially the global phase 3 NANORAY-312 study, as regulatory Fast Track status offers a route to accelerate development timelines. Yet, funding risk remains acute: Nanobiotix has less than a year of cash runway, and even with recent safety/efficacy updates, this pressure hasn’t meaningfully eased. The new data supports the clinical story, but the main risks, cash burn and dilution, remain front and center for current and prospective shareholders.

But importantly, that cash runway concern still stands as something investors should watch closely. Nanobiotix's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nanobiotix - why the stock might be worth less than half the current price!

Build Your Own Nanobiotix Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nanobiotix research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Nanobiotix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nanobiotix's overall financial health at a glance.

No Opportunity In Nanobiotix?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanobiotix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NANO

Nanobiotix

Operates as a clinical-stage biotechnology that focuses on developing product candidates for the treatment of cancer and other unmet medical needs.

Slight risk with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion