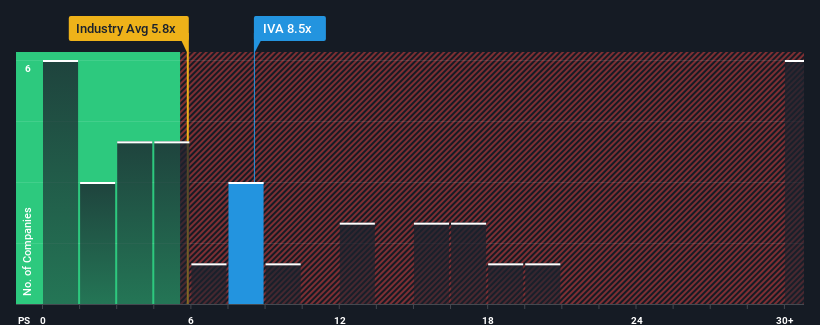

When close to half the companies in the Biotechs industry in France have price-to-sales ratios (or "P/S") below 5.8x, you may consider Inventiva S.A. (EPA:IVA) as a stock to potentially avoid with its 8.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Inventiva

How Inventiva Has Been Performing

Inventiva certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Inventiva's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Inventiva?

In order to justify its P/S ratio, Inventiva would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 126% last year. Pleasingly, revenue has also lifted 131% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 14% each year as estimated by the eight analysts watching the company. That's not great when the rest of the industry is expected to grow by 278% each year.

In light of this, it's alarming that Inventiva's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Inventiva's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Inventiva's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Inventiva (2 don't sit too well with us!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IVA

Inventiva

A clinical-stage biopharmaceutical company, focuses on the development of oral small molecule therapies for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) and other diseases in France and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives