Optimistic Investors Push Inventiva S.A. (EPA:IVA) Shares Up 27% But Growth Is Lacking

Those holding Inventiva S.A. (EPA:IVA) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

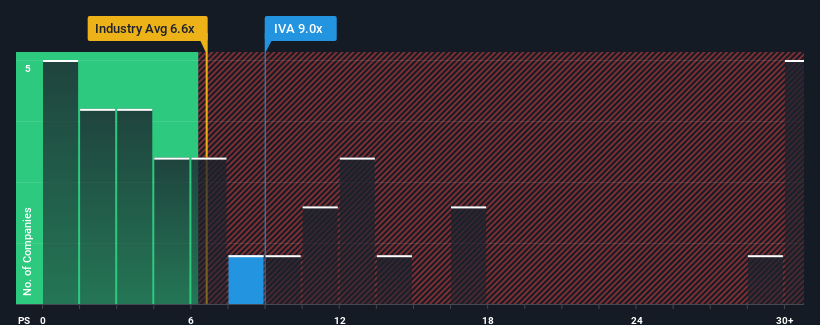

Since its price has surged higher, Inventiva may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 9x, when you consider almost half of the companies in the Biotechs industry in France have P/S ratios under 6.6x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Inventiva

How Inventiva Has Been Performing

Inventiva certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inventiva.Is There Enough Revenue Growth Forecasted For Inventiva?

The only time you'd be truly comfortable seeing a P/S as high as Inventiva's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 126%. Pleasingly, revenue has also lifted 131% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 14% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 408% each year, which paints a poor picture.

With this information, we find it concerning that Inventiva is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Inventiva's P/S Mean For Investors?

Inventiva shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Inventiva currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Inventiva (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IVA

Inventiva

A clinical-stage biopharmaceutical company, focuses on the development of oral small molecule therapies for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) and other diseases in France and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives