More Unpleasant Surprises Could Be In Store For Inventiva S.A.'s (EPA:IVA) Shares After Tumbling 28%

Inventiva S.A. (EPA:IVA) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

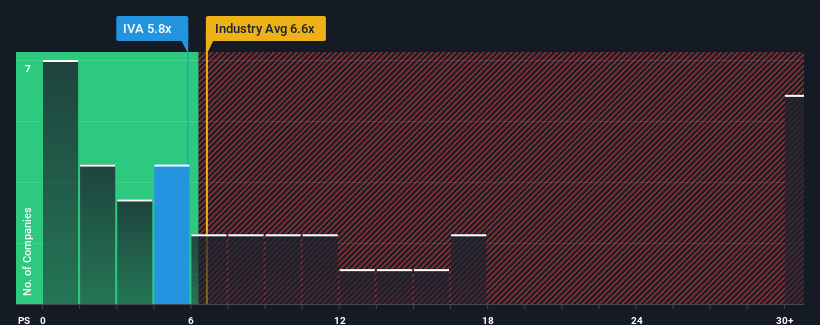

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Inventiva's P/S ratio of 5.8x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in France is also close to 6.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Inventiva

What Does Inventiva's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Inventiva has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Inventiva's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Inventiva would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 0.3% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 61% per year growth forecast for the broader industry.

In light of this, it's curious that Inventiva's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Inventiva's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Inventiva looks to be in line with the rest of the Biotechs industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Inventiva's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 5 warning signs for Inventiva (2 make us uncomfortable!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IVA

Inventiva

A clinical-stage biopharmaceutical company, focuses on the development of oral small molecule therapies for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) and other diseases in France and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives