Inventiva S.A. (EPA:IVA) Shares May Have Slumped 28% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Inventiva S.A. (EPA:IVA) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

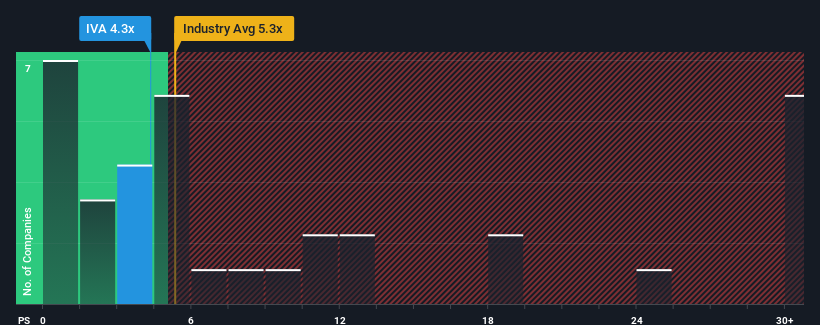

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Inventiva's P/S ratio of 4.3x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in France is also close to 5.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Inventiva

What Does Inventiva's P/S Mean For Shareholders?

Inventiva could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Inventiva will help you uncover what's on the horizon.How Is Inventiva's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Inventiva's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. Even so, admirably revenue has lifted 242% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 42% per year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 69% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that Inventiva's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Inventiva's P/S?

With its share price dropping off a cliff, the P/S for Inventiva looks to be in line with the rest of the Biotechs industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Inventiva's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You need to take note of risks, for example - Inventiva has 5 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IVA

Inventiva

A clinical-stage biopharmaceutical company, focuses on the development of oral small molecule therapies for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) and other diseases in France and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives