Ipsen (ENXTPA:IPN) Valuation: Is Recent Momentum Backed by Strong Fundamentals?

Reviewed by Kshitija Bhandaru

See our latest analysis for Ipsen.

Looking at the bigger picture, Ipsen’s recent momentum adds to a solid track record, with a 12% share price return over the past three months and a strong one-year total shareholder return of 3.4%. Momentum appears to be building for the stock, reflecting broader optimism in the sector alongside renewed focus on pipeline progress and profitability.

If news of Ipsen’s steady gains has you watching the sector, this could be a great time to discover other leaders with our See the full list for free.

But with shares now trading near recent highs, investors may wonder if Ipsen remains undervalued based on its fundamentals or if the market has already priced in the company’s future growth and prospects for the year ahead.

Most Popular Narrative: 9.5% Undervalued

With Ipsen's fair value pegged at €128.43 and the last close price at €116.20, the narrative points to a meaningful upside. Market watchers are sizing up the drivers supporting this bullish view.

Significant available cash and financial flexibility (€3B firepower, net cash balance) position the company to accelerate external innovation via targeted M&A or licensing. This strengthens both pipeline depth and long-term earnings growth potential.

Curious what assumptions turn this pipeline strength into a higher price target? The narrative’s math bakes in not just revenue growth, but a major margin boost. Want to know which future milestones could really make these projections a reality? Read the full breakdown to see the flagship forecasts that anchor this bullish perspective.

Result: Fair Value of €128.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in late-stage pipeline trials or increased generic competition could quickly challenge the bullish narrative and affect Ipsen’s growth outlook.

Find out about the key risks to this Ipsen narrative.

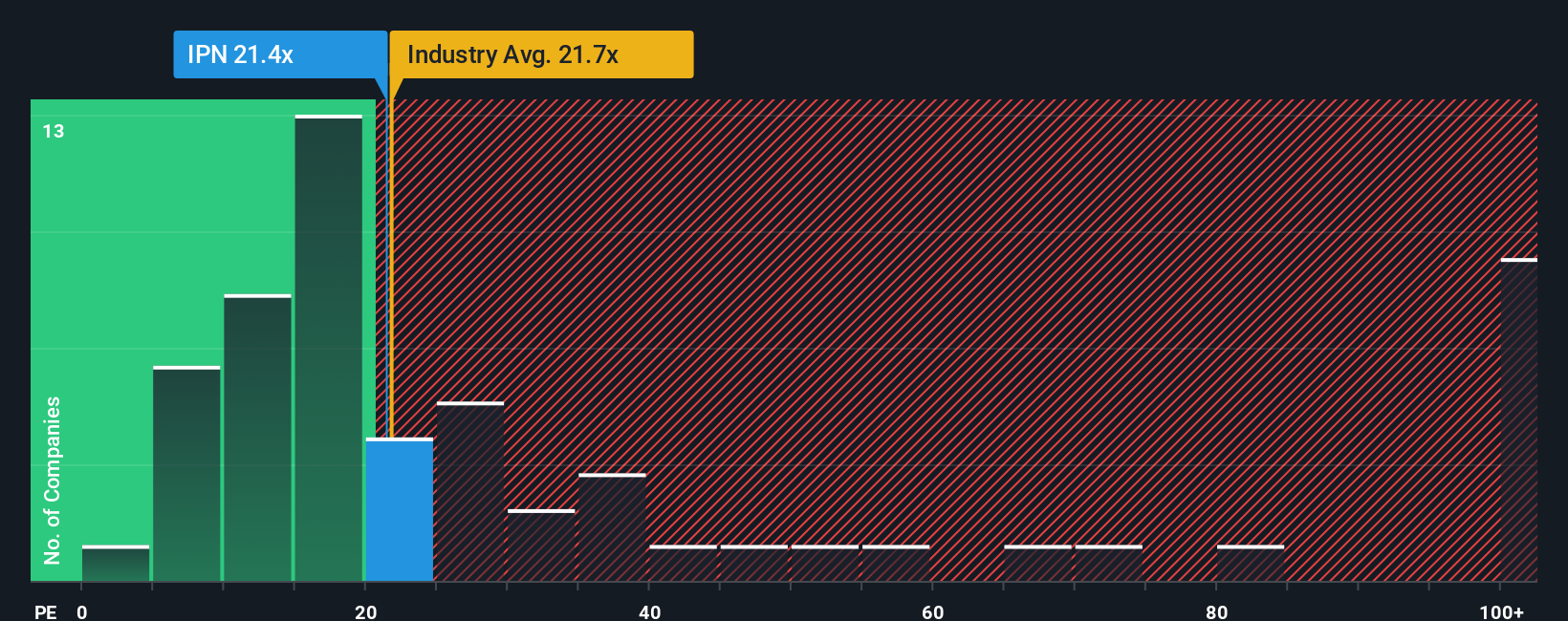

Another View: Multiples Raise a Red Flag

While the previous valuation paints Ipsen as undervalued, looking at its price-to-earnings ratio raises some caution. Ipsen trades at 21.3x, which is higher than the industry average of 21.1x and the peer average of 19x. It also sits above its fair ratio of 16.6x. This suggests the market might be overvaluing Ipsen based on earnings relative to its sector and what investors have historically paid. Could this premium price signal risk, or is it justified by future growth expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ipsen Narrative

If you see the numbers differently or want to dig into the details yourself, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Ipsen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Opportunity?

If you want your portfolio to stay ahead in a changing market, don’t wait on the sidelines. Your next great investment could be just a click away with Simply Wall Street’s screening tools.

- Unlock high growth prospects by tapping into these 24 AI penny stocks, which are powering advancements in artificial intelligence and transforming industries worldwide.

- Boost your passive income with these 19 dividend stocks with yields > 3%, offering yields above 3 percent and suitable for investors seeking stable, consistent returns.

- Catch the next big breakthrough by scanning these 26 quantum computing stocks, where innovation in quantum computing is creating exciting new possibilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives