- France

- /

- Life Sciences

- /

- ENXTPA:ERF

We Discuss Why Eurofins Scientific SE's (EPA:ERF) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

Key Insights

- Eurofins Scientific's Annual General Meeting to take place on 25th of April

- CEO Gilles Martin's total compensation includes salary of €1.32m

- The overall pay is 81% below the industry average

- Eurofins Scientific's three-year loss to shareholders was 28% while its EPS was down 21% over the past three years

Performance at Eurofins Scientific SE (EPA:ERF) has not been particularly rosy recently and shareholders will likely be holding CEO Gilles Martin and the board accountable for this. At the upcoming AGM on 25th of April, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

See our latest analysis for Eurofins Scientific

Comparing Eurofins Scientific SE's CEO Compensation With The Industry

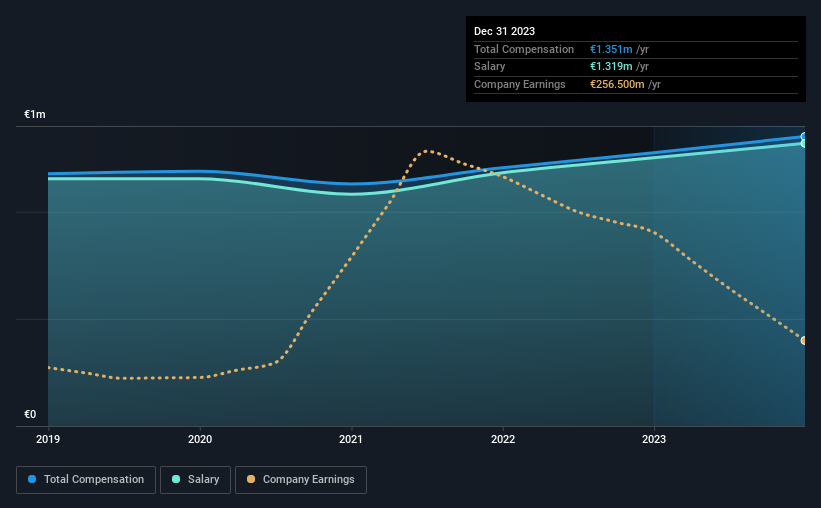

According to our data, Eurofins Scientific SE has a market capitalization of €12b, and paid its CEO total annual compensation worth €1.4m over the year to December 2023. That's a modest increase of 5.9% on the prior year. Notably, the salary which is €1.32m, represents most of the total compensation being paid.

For comparison, other companies in the France Life Sciences industry with market capitalizations above €7.5b, reported a median total CEO compensation of €7.0m. This suggests that Gilles Martin is paid below the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.3m | €1.3m | 98% |

| Other | €32k | €23k | 2% |

| Total Compensation | €1.4m | €1.3m | 100% |

Speaking on an industry level, nearly 52% of total compensation represents salary, while the remainder of 48% is other remuneration. Eurofins Scientific is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Eurofins Scientific SE's Growth Numbers

Over the last three years, Eurofins Scientific SE has shrunk its earnings per share by 21% per year. It saw its revenue drop 2.9% over the last year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Eurofins Scientific SE Been A Good Investment?

Since shareholders would have lost about 28% over three years, some Eurofins Scientific SE investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Gilles receives almost all of their compensation through a salary. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for Eurofins Scientific that investors should be aware of in a dynamic business environment.

Important note: Eurofins Scientific is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Eurofins Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ERF

Eurofins Scientific

Provides various analytical testing and laboratory services worldwide.

Good value with reasonable growth potential.