Did The Underlying Business Drive Sensorion's (EPA:ALSEN) Lovely 310% Share Price Gain?

Sensorion SA (EPA:ALSEN) shareholders have seen the share price descend 19% over the month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Few could complain about the impressive 310% rise, throughout the period. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Sensorion

We don't think Sensorion's revenue of €2,421,267 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Sensorion has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Sensorion has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

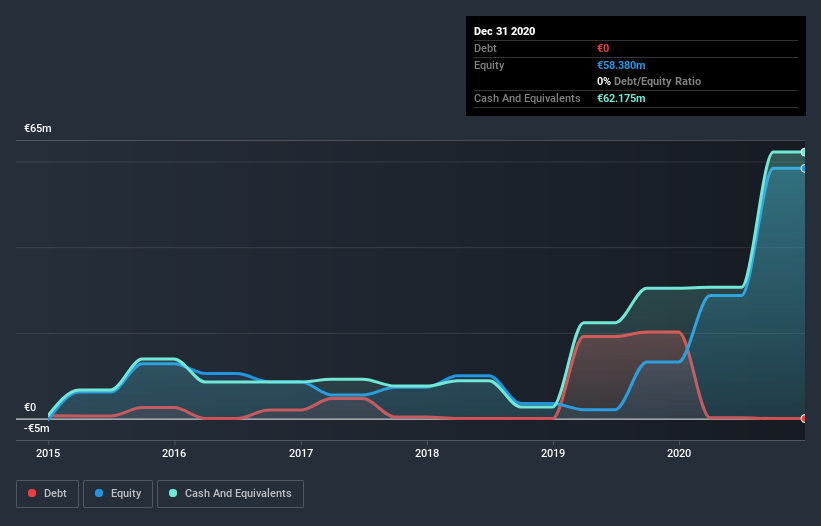

When it last reported its balance sheet in December 2020, Sensorion could boast a strong position, with cash in excess of all liabilities of €53m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. And given that the share price has shot up 58% in the last year , it's fair to say investors are liking management's vision for the future. You can click on the image below to see (in greater detail) how Sensorion's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's good to see that Sensorion has rewarded shareholders with a total shareholder return of 310% in the last twelve months. That certainly beats the loss of about 11% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Sensorion better, we need to consider many other factors. Even so, be aware that Sensorion is showing 5 warning signs in our investment analysis , and 1 of those is concerning...

But note: Sensorion may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Sensorion, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALSEN

Sensorion

A biotechnology company, develops drug candidates for the treatment of inner ear disorders in France.

Flawless balance sheet low.

Market Insights

Community Narratives