Pharnext's (EPA:ALPHA) Stock Price Has Reduced 66% In The Past Three Years

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Pharnext SA (EPA:ALPHA) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 66% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 51% lower in that time. There was little comfort for shareholders in the last week as the price declined a further 4.5%.

See our latest analysis for Pharnext

Given that Pharnext didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Pharnext saw its revenue shrink by 7.9% per year. That is not a good result. The share price decline of 18% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

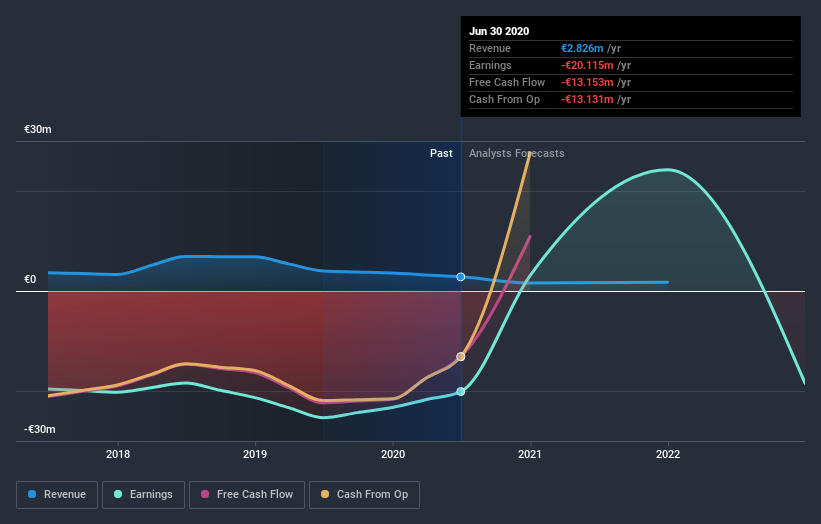

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Pharnext's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Pharnext shares, which performed worse than the market, costing holders 51%. Meanwhile, the broader market slid about 1.7%, likely weighing on the stock. The three-year loss of 18% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Pharnext has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Pharnext, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALPHA

Pharnext S.C.A

A clinical-stage biopharmaceutical company, engages in developing novel therapies for neurodegenerative diseases.

Moderate and slightly overvalued.