Investors push Novacyt (EPA:ALNOV) 12% lower this week, company's increasing losses might be to blame

It might be of some concern to shareholders to see the Novacyt S.A. (EPA:ALNOV) share price down 26% in the last month. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 992%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 77% in the last three years. We love happy stories like this one. The company should be really proud of that performance!

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Novacyt

Novacyt wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Novacyt saw its revenue shrink by 23% per year. This is in stark contrast to the strong share price growth of 61%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. I think it's fair to say there is probably a fair bit of excitement in the price.

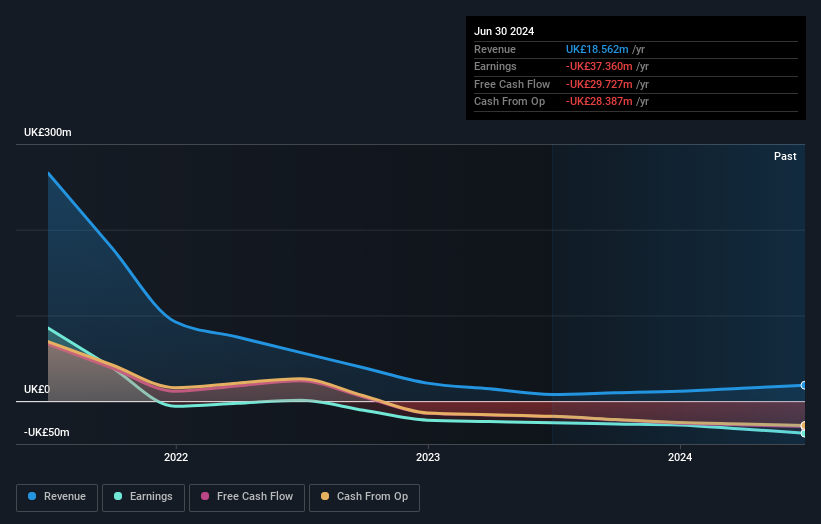

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Novacyt shareholders have received a total shareholder return of 10% over the last year. Having said that, the five-year TSR of 61% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Novacyt better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Novacyt (including 2 which can't be ignored) .

We will like Novacyt better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Novacyt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNOV

Novacyt

Provides in vitro and molecular diagnostic tests for a range of infectious diseases in the United Kingdom, rest of Europe, France, the United States, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet low.